The economics of foreign exchange market, a dynamic and ever-evolving landscape, plays a pivotal role in international trade and finance. It’s a complex system where currencies are bought, sold, and traded, affecting economies, businesses, and individuals worldwide.

This intricate market involves a diverse range of participants, including central banks, commercial banks, corporations, and individual investors. The interplay of economic, political, and psychological factors influences exchange rates, shaping the global financial landscape.

The Nature and Structure of the Foreign Exchange Market

The foreign exchange market, also known as the forex market, is a global decentralized market where currencies are traded. It is the largest and most liquid financial market in the world, with an estimated daily trading volume of over $5 trillion.

Types of Participants in the Forex Market

The participants in the forex market can be classified into three main groups:

- Commercial Participants: These are businesses that engage in international trade and need to exchange currencies to facilitate their transactions.

- Financial Institutions: These are banks, investment banks, and other financial institutions that trade currencies for their own accounts or on behalf of their clients.

- Speculators: These are individuals or institutions that trade currencies with the aim of making a profit from exchange rate fluctuations.

Factors Influencing Exchange Rates

Exchange rates are determined by a complex interplay of economic, political, and psychological factors.

Economic Factors

- Interest rates: Interest rate differentials between countries can influence the demand for currencies, as investors seek higher returns.

- Inflation: Inflation rates can affect the purchasing power of currencies, making them more or less attractive to investors.

- Economic growth: Strong economic growth can increase demand for a country’s currency, while weak growth can lead to depreciation.

Political Factors

- Political stability: Political instability can lead to currency depreciation, as investors become more risk-averse.

- Government policies: Government policies, such as fiscal and monetary policies, can influence exchange rates.

Psychological Factors

- Market sentiment: Market sentiment can drive exchange rates, as traders react to news and events.

- Speculation: Speculation can amplify exchange rate movements, as traders buy or sell currencies based on expectations of future changes.

The Economics of Exchange Rate Determination: The Economics Of Foreign Exchange Market

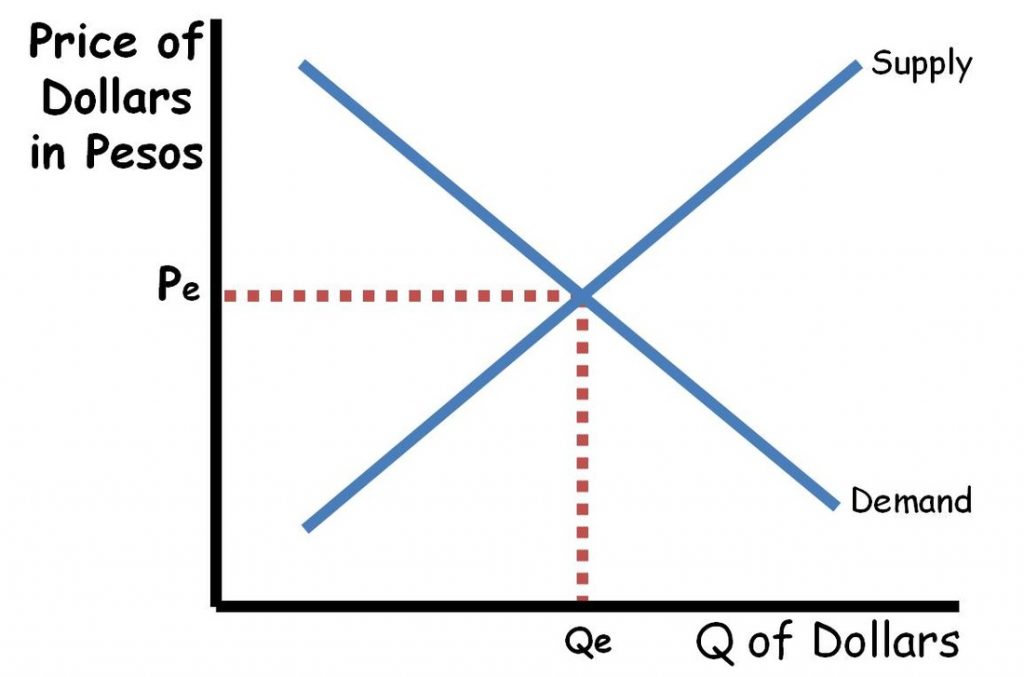

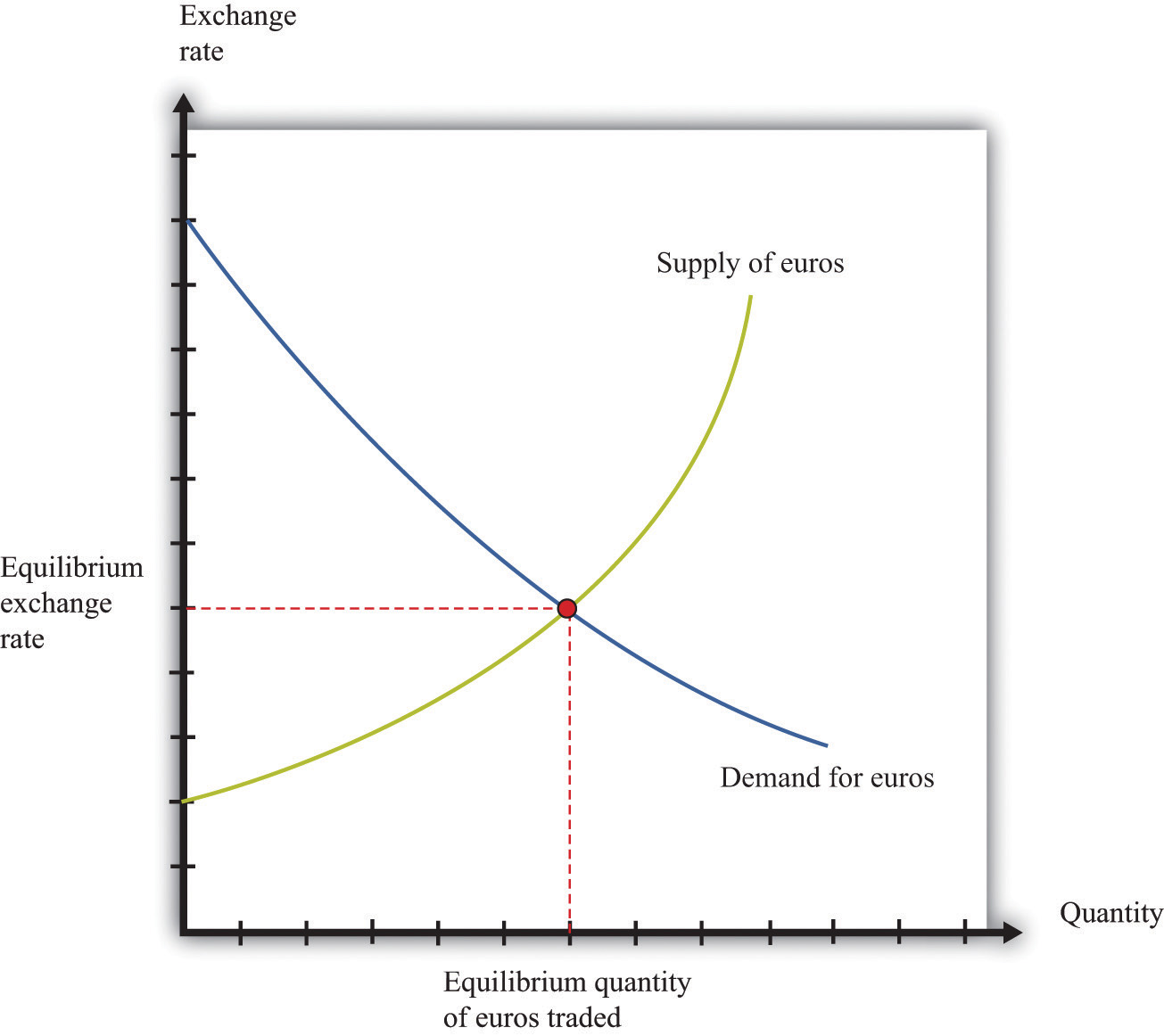

Exchange rates, the prices of one currency in terms of another, are determined by a complex interplay of economic factors. Purchasing power parity (PPP), interest rates, trade imbalances, and capital flows all play a significant role in shaping exchange rate dynamics.

Purchasing Power Parity (PPP)

PPP is a theory that states that the exchange rate between two currencies should be equal to the ratio of their purchasing power. In other words, a dollar should buy the same amount of goods and services in both countries. If the exchange rate deviates from PPP, it suggests that one currency is overvalued or undervalued.

Interest Rates

Interest rates are another key determinant of exchange rates. The interest rate parity (IRP) condition states that the difference in interest rates between two countries should be equal to the expected change in the exchange rate. This implies that investors will seek to invest in countries with higher interest rates, leading to an appreciation of the currency in that country.

Trade Imbalances

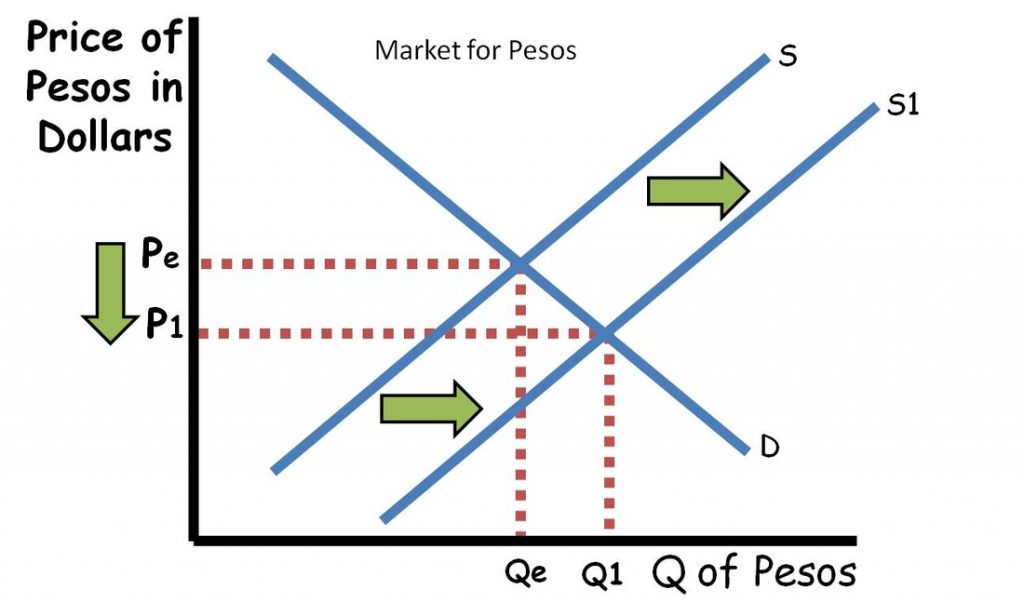

Trade imbalances occur when one country imports more goods and services than it exports. This can lead to a depreciation of the currency of the deficit country, as foreign demand for its goods and services falls. Conversely, a trade surplus can lead to an appreciation of the currency of the surplus country.

Capital Flows

Capital flows refer to the movement of funds across borders. Foreign direct investment (FDI) and portfolio investment can significantly impact exchange rates. FDI, which involves long-term investments in businesses, tends to lead to an appreciation of the currency in the recipient country. Portfolio investment, which involves short-term investments in financial assets, can lead to exchange rate fluctuations depending on the direction and magnitude of the flows.

The Impact of Exchange Rate Fluctuations

Exchange rate fluctuations can have significant impacts on trade, investment, and economic growth. They can also affect businesses and individuals in various ways.

Discover how foreign exchange market trading has transformed methods in RELATED FIELD.

When the value of a currency appreciates, it becomes more expensive for domestic firms to export goods and services, making them less competitive in the international market. This can lead to a decline in exports and a slowdown in economic growth. Conversely, a depreciation in the currency makes exports cheaper, boosting exports and economic growth.

Impact on Businesses and Individuals

Exchange rate fluctuations can impact businesses and individuals in several ways:

- Businesses that import goods may face higher costs if the value of their domestic currency depreciates against the currency of the exporting country.

- Businesses that export goods may benefit from a depreciation in the value of their domestic currency, as it makes their products cheaper in foreign markets.

- Individuals who travel abroad may find that their purchasing power changes depending on the exchange rate between their home currency and the currency of the country they are visiting.

Government and Central Bank Policies

Governments and central banks can use monetary and fiscal policies to manage exchange rates. Monetary policy involves adjusting interest rates to influence the flow of capital into and out of a country. Fiscal policy involves adjusting government spending and taxation to affect the demand for domestic goods and services.

By influencing the supply and demand for a currency, governments and central banks can stabilize exchange rates and mitigate the negative effects of exchange rate fluctuations.

The Role of Speculation in the Foreign Exchange Market

Speculation plays a significant role in the foreign exchange market, influencing exchange rate determination and market dynamics. Speculators aim to profit from anticipated currency price movements by buying and selling currencies.

There are various speculative strategies, each with its own risks and rewards. Technical analysis involves studying historical price charts and patterns to predict future price movements. Fundamental analysis focuses on economic and political factors that may affect currency values.

You also can investigate more thoroughly about foreign exchange market example to enhance your awareness in the field of foreign exchange market example.

Types of Speculative Strategies

- Carry trade: Borrowing in a low-interest-rate currency and investing in a higher-interest-rate currency to profit from the interest rate differential.

- Momentum trading: Buying or selling currencies that are trending strongly in a particular direction.

- Arbitrage: Exploiting price discrepancies between different markets or currencies.

Role of Technical and Fundamental Analysis

Technical analysts use charts and indicators to identify trading opportunities based on historical price patterns. Fundamental analysts consider economic data, political events, and market sentiment to assess currency valuations.

The Regulation of the Foreign Exchange Market

The foreign exchange market, being the largest and most liquid financial market globally, demands proper regulation to ensure its stability, transparency, and fairness. Regulatory frameworks vary across jurisdictions, with central banks and other regulatory bodies playing crucial roles in overseeing the market.

Need for Regulation

Regulation is essential in the forex market for several reasons. Firstly, it helps prevent market manipulation and insider trading, protecting market participants from unfair practices. Secondly, regulation ensures transparency by requiring market participants to disclose relevant information, fostering trust and confidence among traders. Thirdly, it promotes stability by mitigating systemic risks that could destabilize the financial system.

Regulatory Frameworks

Regulatory frameworks for the forex market differ across countries. In the United States, the Commodity Futures Trading Commission (CFTC) is the primary regulator, while in the United Kingdom, the Financial Conduct Authority (FCA) oversees the market. Other major regulators include the European Securities and Markets Authority (ESMA) in the European Union and the Monetary Authority of Singapore (MAS) in Singapore.

In this topic, you find that foreign exchange market harborough is very useful.

Role of Central Banks

Central banks play a significant role in regulating the forex market. They intervene in the market to influence exchange rates, manage inflation, and maintain financial stability. Central banks also set monetary policy, which affects the value of currencies and influences forex market activity.

Impact of Regulation

Regulation has a significant impact on the stability and efficiency of the forex market. It helps maintain orderly market conditions, reduces volatility, and enhances transparency. However, excessive regulation can also stifle innovation and limit market participation. Therefore, regulators must strike a balance between ensuring market integrity and fostering market growth.

The Future of the Foreign Exchange Market

The foreign exchange market is constantly evolving, and new technologies are emerging that have the potential to further transform the way it operates. Blockchain and artificial intelligence (AI) are two of the most promising technologies that could have a major impact on the forex market in the coming years.

Blockchain is a distributed ledger technology that allows for the secure and transparent recording of transactions. It has the potential to revolutionize the way that foreign exchange transactions are settled, making them faster, cheaper, and more secure. AI can be used to develop trading algorithms that can automatically execute trades based on predefined criteria. This can help traders to make more informed decisions and to trade more efficiently.

In addition to these new technologies, the forex market is also facing a number of challenges in the coming years. These challenges include:

* The increasing volatility of exchange rates

* The rise of protectionism

* The impact of climate change

The increasing volatility of exchange rates is making it more difficult for businesses and investors to manage their foreign exchange risk. The rise of protectionism is also creating uncertainty in the global economy, which could lead to further volatility in exchange rates. Climate change is also having a significant impact on the global economy, which could lead to changes in the demand for foreign exchange.

Despite these challenges, the future of the foreign exchange market is bright. The development of new technologies and the growing demand for foreign exchange services are expected to drive continued growth in the market. Businesses and investors should be aware of the challenges and opportunities facing the forex market in the coming years in order to make informed decisions about their foreign exchange strategies.

The Role of Blockchain in the Future of the Forex Market

Blockchain is a distributed ledger technology that allows for the secure and transparent recording of transactions. It has the potential to revolutionize the way that foreign exchange transactions are settled, making them faster, cheaper, and more secure.

One of the biggest challenges facing the forex market is the high cost of settlement. Blockchain can help to reduce these costs by eliminating the need for intermediaries, such as banks. Blockchain can also help to speed up settlement times, which can be critical for businesses that need to make payments quickly.

In addition to reducing costs and speeding up settlement times, blockchain can also help to improve the security of foreign exchange transactions. Blockchain is a secure and tamper-proof technology, which makes it very difficult for fraudsters to steal money or manipulate transactions.

The Role of AI in the Future of the Forex Market

AI can be used to develop trading algorithms that can automatically execute trades based on predefined criteria. This can help traders to make more informed decisions and to trade more efficiently.

One of the biggest challenges facing forex traders is the amount of data that they need to process in order to make informed decisions. AI can help traders to overcome this challenge by automating the process of data analysis. AI can also help traders to identify trading opportunities that they might otherwise have missed.

In addition to helping traders to make more informed decisions, AI can also help to improve the efficiency of forex trading. AI can be used to automate the execution of trades, which can free up traders to focus on other tasks. AI can also be used to develop risk management tools that can help traders to protect their profits.

The Challenges Facing the Forex Market in the Coming Years, The economics of foreign exchange market

The forex market is facing a number of challenges in the coming years, including:

* The increasing volatility of exchange rates

* The rise of protectionism

* The impact of climate change

The increasing volatility of exchange rates is making it more difficult for businesses and investors to manage their foreign exchange risk. The rise of protectionism is also creating uncertainty in the global economy, which could lead to further volatility in exchange rates. Climate change is also having a significant impact on the global economy, which could lead to changes in the demand for foreign exchange.

Despite these challenges, the future of the foreign exchange market is bright. The development of new technologies and the growing demand for foreign exchange services are expected to drive continued growth in the market. Businesses and investors should be aware of the challenges and opportunities facing the forex market in the coming years in order to make informed decisions about their foreign exchange strategies.

Ending Remarks

In conclusion, the economics of foreign exchange market is a fascinating and multifaceted field that continues to evolve with technological advancements and global economic dynamics. Understanding its intricacies provides valuable insights for businesses, investors, and policymakers alike, enabling them to navigate the complexities of the global financial system and make informed decisions.