Participants in the foreign exchange market trade for all of the following reasons except one. This reason is not applicable to the market and does not justify participation. Read on to discover what this reason is and why it is excluded.

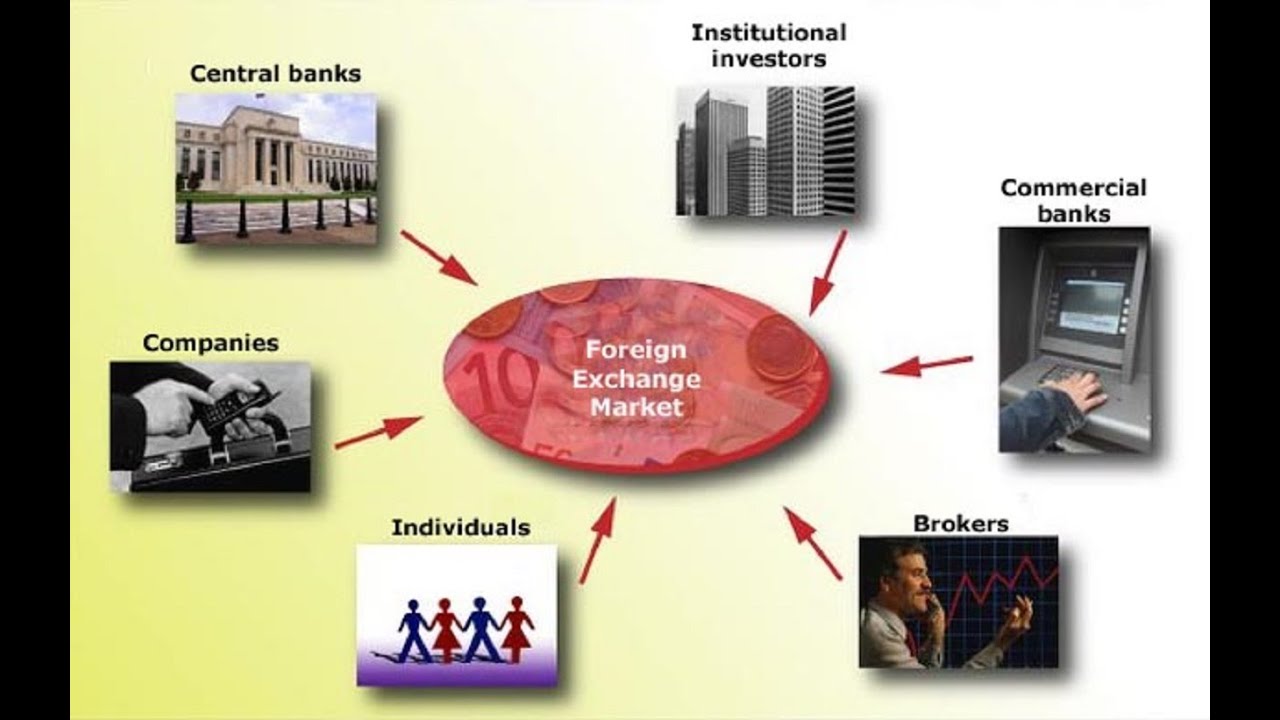

The foreign exchange market, also known as the forex market, is the largest financial market in the world, with a daily trading volume of over $5 trillion. It is a decentralized market where currencies are traded electronically. Participants in the forex market include banks, investment firms, hedge funds, and individual traders.

Reasons for Participation in the Foreign Exchange Market

The foreign exchange market is a global, decentralized marketplace where currencies are traded. Participants engage in this market for various reasons, including:

International Trade

Businesses involved in international trade need to exchange currencies to facilitate transactions. For example, an importer in the United States may need to convert U.S. dollars into euros to purchase goods from a supplier in Europe.

Understand how the union of apa yang dimaksud foreign exchange market can improve efficiency and productivity.

Investment

Investors may trade currencies to diversify their portfolios or to speculate on currency fluctuations. For instance, an investor may buy the Japanese yen if they expect it to appreciate in value against the U.S. dollar.

Hedging

Businesses and investors can use currency derivatives to hedge against foreign exchange risk. This involves entering into contracts that offset potential losses from currency fluctuations.

Central Bank Intervention

Central banks may intervene in the foreign exchange market to influence the value of their currency. They can buy or sell currencies to stabilize exchange rates or to achieve specific economic goals.

Remittances

Individuals and businesses may transfer funds across borders for various reasons, such as sending money to family members abroad or making international payments.

Tourism, Participants in the foreign exchange market trade for all of the following reasons except

Travelers need to exchange currencies when visiting foreign countries to purchase goods and services.

Discover how foreign exchange market limitations has transformed methods in RELATED FIELD.

Other Reasons

Other reasons for participating in the foreign exchange market include:

- Arbitraging price differences between different markets

- Providing liquidity to the market

- Facilitating cross-border transactions

Specific Exceptions to Participation Reasons: Participants In The Foreign Exchange Market Trade For All Of The Following Reasons Except

While the foreign exchange market presents numerous opportunities, certain reasons are not valid for participation. These reasons include:

Investment Returns

The foreign exchange market is not primarily designed for long-term investment returns. It’s a highly speculative market where currency values fluctuate rapidly. While short-term gains can be realized, it’s not a suitable avenue for long-term investment strategies.

Notice forex market time converter for recommendations and other broad suggestions.

Avoidance of Inflation

Foreign exchange trading does not offer a reliable hedge against inflation. Currency values are influenced by various factors, including economic conditions, interest rates, and political events. While currency fluctuations can sometimes offset inflationary pressures, they are not a guaranteed protection against inflation.

Capital Preservation

The foreign exchange market is inherently volatile. Currency values can fluctuate significantly in a short period, potentially resulting in substantial losses. It’s not a suitable market for preserving capital or minimizing risk.

Examples of Excluded Reasons

There are certain reasons that do not justify participation in the foreign exchange market. These reasons include:

- Speculation without a strategy: Engaging in forex trading without a well-defined strategy and risk management plan can lead to significant losses.

- Lack of understanding: Entering the forex market without a thorough understanding of the market dynamics, instruments, and risks involved can result in poor decision-making and potential financial losses.

- Emotional trading: Making trading decisions based on emotions, such as fear or greed, can lead to impulsive actions and irrational choices that can negatively impact trading outcomes.

- Unrealistic expectations: Expecting to generate quick and substantial profits in the forex market without putting in the necessary time and effort is unrealistic and can lead to disappointment and financial setbacks.

Implications of Excluded Reasons

Participating in the foreign exchange market for reasons that are not valid can have serious consequences. These reasons often involve speculation or other risky activities that can lead to financial losses.

One of the biggest risks of participating in the foreign exchange market for excluded reasons is that it can lead to excessive leverage. Leverage is a tool that allows traders to increase their potential profits, but it also increases their potential losses. When traders use leverage, they are essentially borrowing money to trade. If the market moves against them, they can lose more money than they originally invested.

Another risk of participating in the foreign exchange market for excluded reasons is that it can lead to emotional trading. When traders are motivated by speculation or other risky activities, they are more likely to make impulsive decisions. This can lead to poor trading decisions that can result in financial losses.

Consequences of Excluded Reasons

- Financial losses

- Excessive leverage

- Emotional trading

- Loss of reputation

- Legal consequences

Ending Remarks

In conclusion, participants in the foreign exchange market trade for a variety of reasons, including speculation, hedging, and investment. However, there is one reason that is not applicable to the market and does not justify participation. This reason is to earn a guaranteed profit. The forex market is a volatile market, and there is no guarantee of profit. In fact, traders can lose money just as easily as they can make money.