Foreign exchange market and its efficiency – In the dynamic realm of global finance, the foreign exchange market stands as a testament to the intricate interplay between currencies, economies, and market efficiency. This vibrant marketplace, where currencies are traded in colossal volumes, offers a fascinating lens through which to examine the forces that shape market behavior and influence the strategies of its participants.

Delving into the foreign exchange market and its efficiency, we uncover the diverse cast of market participants, the mechanics of currency trading, and the factors that influence exchange rate fluctuations. We explore the concept of market efficiency, its varying degrees, and how it impacts the accuracy of exchange rates and the profitability of trades.

Market Overview

The foreign exchange market, also known as Forex or FX, is the largest financial market in the world, with a daily trading volume of over $5 trillion. It involves the exchange of currencies between countries, businesses, and individuals.

Participants in the foreign exchange market include banks, investment firms, hedge funds, and individual traders. The market operates 24 hours a day, 5 days a week, with trading centers located in major financial hubs around the world.

Types of Foreign Exchange Transactions

There are two main types of foreign exchange transactions:

- Spot transactions: These are transactions that are settled within two business days.

- Forward transactions: These are transactions that are settled at a future date, typically ranging from one month to one year.

Major Currency Pairs

The most commonly traded currency pairs in the foreign exchange market are:

- EUR/USD (euro/US dollar)

- USD/JPY (US dollar/Japanese yen)

- GBP/USD (British pound/US dollar)

- USD/CHF (US dollar/Swiss franc)

- AUD/USD (Australian dollar/US dollar)

Market Efficiency: Foreign Exchange Market And Its Efficiency

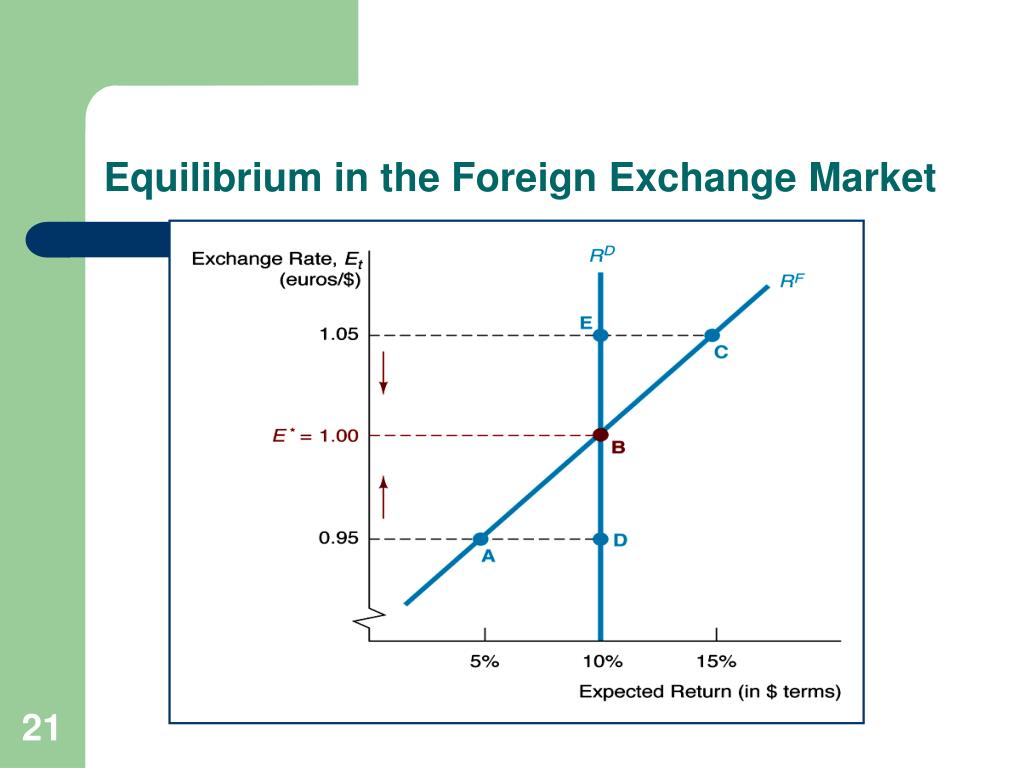

Market efficiency is the degree to which the prices of assets reflect all available information. It is an important concept in the foreign exchange market, as it affects the ability of traders to make profitable trades.

Check what professionals state about foreign exchange market today in nigeria and its benefits for the industry.

There are three main types of market efficiency: weak, semi-strong, and strong. Weak efficiency means that the current prices of assets reflect all past information. Semi-strong efficiency means that the current prices of assets reflect all publicly available information. Strong efficiency means that the current prices of assets reflect all information, including private information.

The foreign exchange market exhibits different levels of efficiency depending on the currency pair being traded. The most heavily traded currency pairs, such as the EUR/USD, are generally considered to be more efficient than less heavily traded currency pairs.

Weak Efficiency

Weak efficiency means that the current prices of assets reflect all past information. This means that technical analysis, which is the study of past prices to predict future prices, can be used to make profitable trades in a weakly efficient market.

You also can understand valuable knowledge by exploring foreign exchange market bots.

Semi-Strong Efficiency

Semi-strong efficiency means that the current prices of assets reflect all publicly available information. This means that fundamental analysis, which is the study of economic data to predict future prices, can be used to make profitable trades in a semi-strong efficient market.

Strong Efficiency

Strong efficiency means that the current prices of assets reflect all information, including private information. This means that it is impossible to make profitable trades in a strong efficient market.

Factors Affecting Market Efficiency

The efficiency of the foreign exchange market can be influenced by a range of factors, both internal and external. These factors can impact the accuracy of exchange rates and the ability of traders to make profitable trades.

Market Depth

Market depth refers to the number of participants and the volume of orders in the market. A deep market provides more liquidity and tighter spreads, making it easier for traders to execute orders at fair prices. Conversely, a shallow market can lead to wider spreads and price volatility, which can increase transaction costs and reduce trading opportunities.

Understand how the union of bis the foreign exchange market can improve efficiency and productivity.

Information Asymmetry

Information asymmetry occurs when one party in a transaction has more information than the other. In the foreign exchange market, this can lead to price distortions and unfair advantages for those with access to privileged information. Insider trading, for example, can give traders an unfair advantage over those who are unaware of upcoming market-moving events.

Regulatory Environment

The regulatory environment can also affect market efficiency. Stringent regulations, such as those governing capital controls or anti-money laundering measures, can increase compliance costs and reduce market participation. Conversely, a lack of regulation can lead to market manipulation, fraud, and other abuses that undermine confidence in the market.

Technological Advancements

Technological advancements have significantly improved market efficiency. Electronic trading platforms, algorithmic trading, and high-frequency trading have increased market transparency, reduced transaction costs, and made it easier for traders to access real-time information. However, these advancements can also lead to increased volatility and algorithmic trading may create market distortions if not properly regulated.

Economic and Political Factors

Economic and political events can have a major impact on the foreign exchange market. Changes in interest rates, inflation, and economic growth can affect the value of currencies. Political instability, wars, and natural disasters can also lead to market volatility and currency fluctuations.

Example: Brexit

The decision of the United Kingdom to leave the European Union (Brexit) is an example of how external factors can affect market efficiency. The uncertainty surrounding the terms of the UK’s exit from the EU led to increased volatility in the pound sterling and made it difficult for traders to accurately predict exchange rates.

Implications for Market Participants

Market efficiency profoundly influences the strategies and decision-making processes of foreign exchange market participants. Understanding the implications of market efficiency can enhance traders’ profitability and risk management.

In an efficient market, prices reflect all available information, making it challenging for traders to consistently outperform the market. However, market efficiency also offers advantages and disadvantages.

Advantages of Trading in an Efficient Market, Foreign exchange market and its efficiency

- Fair Pricing: Prices in an efficient market are considered fair, as they incorporate all known information.

- Reduced Transaction Costs: Competition among market participants leads to lower transaction costs, benefiting traders.

- Market Liquidity: Efficient markets are typically liquid, providing traders with ample opportunities to execute trades.

Disadvantages of Trading in an Efficient Market

- Difficulty in Outperforming the Market: The efficient market hypothesis suggests that it is difficult to consistently outperform the market over the long term.

- Increased Volatility: Efficient markets can experience periods of high volatility, potentially leading to losses for traders.

- Information Overload: Traders must constantly monitor and analyze vast amounts of information to keep up with the fast-paced efficient market.

Recommendations for Adapting to Market Efficiency

Traders can adapt to different levels of market efficiency by:

- Adopting a Long-Term Perspective: Focus on long-term strategies rather than short-term gains.

- Utilizing Technical Analysis: Identify trading opportunities based on historical price patterns and technical indicators.

- Employing Risk Management Techniques: Implement stop-loss orders and position sizing strategies to manage risk.

- Seeking Professional Advice: Consult with experienced traders or financial advisors for guidance.

Last Recap

Our journey into the foreign exchange market and its efficiency culminates in a comprehensive understanding of the market’s dynamics and their implications for participants. We recognize the advantages and challenges of operating in an efficient market and equip ourselves with strategies to navigate different levels of market efficiency. Ultimately, this knowledge empowers us to make informed decisions and adapt to the ever-changing landscape of the global currency market.