As various participants in the foreign exchange market for us dollars are listed takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The foreign exchange market for US dollars is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion. Various participants in the foreign exchange market include banks, non-bank financial institutions, corporations, governments and central banks, and individuals.

Banks

Banks play a pivotal role in the foreign exchange market for US dollars, facilitating the exchange of currencies between individuals, businesses, and governments worldwide.

Banks engage in various activities within the foreign exchange market, including:

- Currency trading: Banks act as intermediaries, buying and selling currencies on behalf of their clients.

- Currency exchange: Banks provide currency exchange services for travelers and businesses, offering competitive rates and convenient access.

- Cross-border payments: Banks facilitate international payments, such as wire transfers and foreign currency drafts.

Bank Regulations

Bank regulations significantly impact banks’ participation in the foreign exchange market. These regulations include:

- Capital requirements: Banks are required to maintain a certain level of capital to mitigate financial risks.

- Liquidity regulations: Banks must maintain sufficient liquidity to meet their obligations and manage fluctuations in currency demand.

- Anti-money laundering and know-your-customer (AML/KYC) regulations: Banks must implement measures to prevent money laundering and other financial crimes.

Non-bank financial institutions: Various Participants In The Foreign Exchange Market For Us Dollars Are Listed

Non-bank financial institutions (NBFIs) play a significant role in the foreign exchange market for US dollars, contributing to its liquidity and efficiency.

NBFIs engage in various activities within the forex market, including:

- Currency trading: NBFIs buy and sell currencies for their own accounts or on behalf of clients, seeking to profit from exchange rate fluctuations.

- Hedging: NBFIs use forex transactions to manage currency risk associated with their cross-border operations or investments.

- Investment: NBFIs may invest in foreign exchange instruments, such as currency forwards or options, to enhance their portfolio returns.

Types of Non-bank financial institutions

Different types of NBFIs participate in the forex market, including:

- Hedge funds: Hedge funds use sophisticated trading strategies to generate returns for their investors, often involving currency trading.

- Mutual funds: Mutual funds offer diversified investment portfolios to retail investors, which may include foreign exchange instruments.

- Insurance companies: Insurance companies manage large portfolios of foreign currency assets and liabilities, requiring them to engage in forex transactions for hedging and investment purposes.

- Pension funds: Pension funds invest retirement savings on behalf of their members, often including foreign exchange investments.

- Corporations: Corporations with international operations or investments need to manage currency risk, which can involve participating in the forex market.

Factors influencing their participation

NBFIs’ participation in the forex market is influenced by several factors, such as:

- Market volatility: Increased currency volatility creates opportunities for NBFIs to generate profits through trading.

- Interest rate differentials: NBFIs may engage in carry trades, borrowing in currencies with low interest rates and investing in currencies with higher rates.

- Economic growth: NBFIs tend to increase their forex activities during periods of economic growth, when cross-border trade and investment increase.

- Regulatory environment: NBFIs’ forex activities are subject to regulations that can impact their participation.

Corporations

Corporations participate in the foreign exchange market for US dollars to facilitate their global operations and manage currency risks. They engage in international trade, investments, and financing activities that require currency conversions.

Corporate Activities Involving Foreign Exchange Transactions

– Import and Export: Corporations import goods and services from foreign countries, which requires them to purchase foreign currencies to pay suppliers. Similarly, they export goods and services to other countries, receiving foreign currencies that need to be converted back to their home currency.

– Foreign Direct Investment (FDI): Corporations invest in subsidiaries or operations in foreign countries. This involves converting home currency into the local currency of the host country and managing currency fluctuations related to dividends, profits, and capital repatriation.

– International Financing: Corporations may borrow or lend funds in foreign currencies to access lower interest rates or diversify their funding sources. This requires currency conversions and managing exchange rate risks associated with debt servicing and repayment.

Impact of Currency Fluctuations on Corporate Operations

Currency fluctuations can significantly impact corporate operations:

– Revenue and Expenses: Changes in exchange rates affect the value of foreign currency earnings and expenses. For example, a depreciation of the home currency against a foreign currency would increase the value of foreign earnings but also increase the cost of imported inputs.

– Profitability: Currency fluctuations can affect corporate profitability by altering the value of foreign currency earnings and expenses, leading to potential gains or losses.

– Financial Risk Management: Corporations need to manage currency risks associated with foreign exchange transactions. They may use hedging strategies, such as forward contracts or currency options, to mitigate the impact of unfavorable exchange rate movements.

Governments and central banks

Governments and central banks play a crucial role in the foreign exchange market for US dollars by implementing policies and interventions that influence the supply and demand dynamics of the currency.

Find out about how foreign exchange market.ppt can deliver the best answers for your issues.

Government policies, such as fiscal and monetary policies, can significantly impact the value of the US dollar. Fiscal policy, which involves government spending and taxation, can affect the demand for US dollars if it leads to changes in economic growth or inflation. Monetary policy, implemented by central banks, involves managing interest rates and the money supply, which can influence the attractiveness of the US dollar for investors and businesses.

Do not overlook explore the latest data about foreign exchange market london.

Central bank interventions

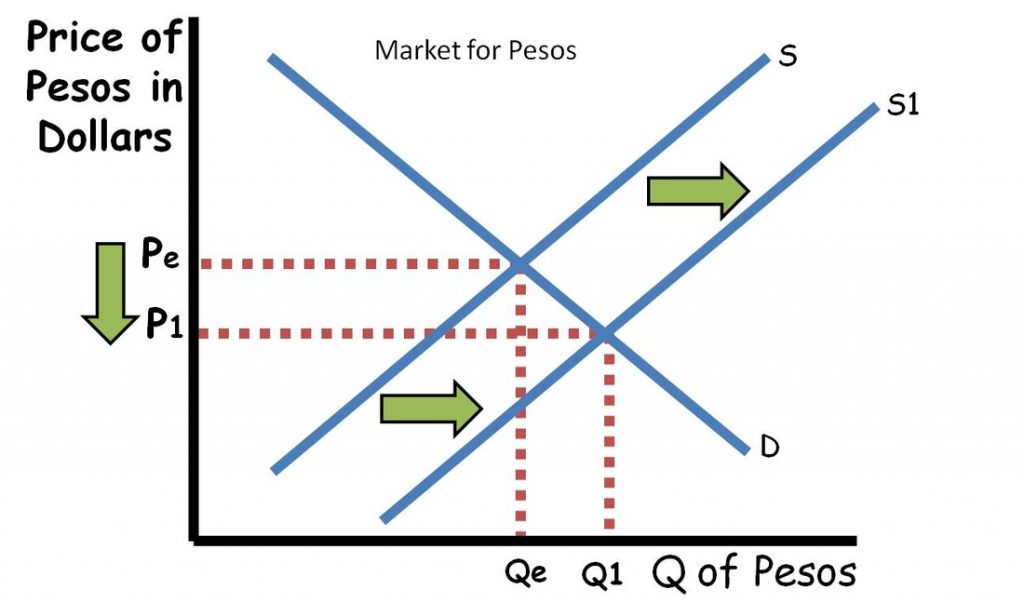

Central banks can intervene in the foreign exchange market to stabilize the value of the US dollar or to achieve specific economic objectives. Interventions can involve buying or selling US dollars in the market to influence its supply and demand. For example, if the US dollar is depreciating rapidly, the central bank may intervene by buying US dollars to increase demand and support its value.

Examples of government or central bank actions

In 2018, the US government implemented tax cuts that boosted economic growth and led to increased demand for US dollars, resulting in its appreciation against other currencies.

In 2020, the US Federal Reserve lowered interest rates to near zero in response to the COVID-19 pandemic. This made the US dollar less attractive to investors, leading to its depreciation.

Browse the implementation of meaning of arbitrage in foreign exchange market in real-world situations to understand its applications.

Individuals

Individuals participate in the foreign exchange market for US dollars for various reasons. One common reason is to facilitate international travel. When individuals travel abroad, they need to exchange their domestic currency into the local currency of the country they are visiting. This process is typically done through foreign exchange bureaus or banks.

Another reason why individuals participate in the foreign exchange market is to make international payments. For example, individuals may need to send money to family or friends living abroad, or they may need to make payments for goods or services purchased from foreign countries.

Finally, some individuals participate in the foreign exchange market for speculative purposes. They may buy and sell foreign currencies in the hope of making a profit from fluctuations in exchange rates.

Types of Foreign Exchange Transactions

There are several different types of foreign exchange transactions that individuals can engage in. The most common type of transaction is a spot transaction, which involves the immediate exchange of one currency for another. Forward transactions, on the other hand, involve the exchange of currencies at a future date.

Individuals can also participate in the foreign exchange market through the use of currency options. A currency option gives the holder the right, but not the obligation, to buy or sell a certain amount of currency at a specified exchange rate on or before a certain date.

Factors Influencing Individual Participation

There are a number of factors that can influence individual participation in the foreign exchange market. These factors include:

– The exchange rate between the individual’s domestic currency and the foreign currency they need.

– The individual’s need for foreign currency.

– The individual’s risk tolerance.

– The individual’s knowledge of the foreign exchange market.

Technology

Technology plays a pivotal role in the foreign exchange market for US dollars. The advent of electronic trading platforms and other technological advancements has revolutionized the market, enhancing its efficiency, transparency, and accessibility.

Electronic Trading Platforms

Electronic trading platforms have transformed the foreign exchange market by automating the trading process. These platforms allow participants to execute trades directly with each other, eliminating the need for intermediaries. This has significantly reduced transaction costs and increased market liquidity.

Algorithmic Trading

Algorithmic trading, also known as algo trading, is a type of automated trading that uses computer programs to execute trades based on predefined criteria. Algo trading has become increasingly popular in the foreign exchange market, as it allows traders to implement complex trading strategies and react quickly to market movements.

Blockchain Technology, Various participants in the foreign exchange market for us dollars are listed

Blockchain technology has the potential to further revolutionize the foreign exchange market. Blockchain is a distributed ledger system that can be used to record and track transactions securely and transparently. This could lead to increased transparency and reduced settlement times in the foreign exchange market.

Outcome Summary

In conclusion, the foreign exchange market for US dollars is a complex and dynamic market with a wide range of participants. These participants play a vital role in the global economy, facilitating international trade and investment. As the market continues to evolve, it is likely that we will see new participants enter the market and new technologies emerge that will further shape its landscape.