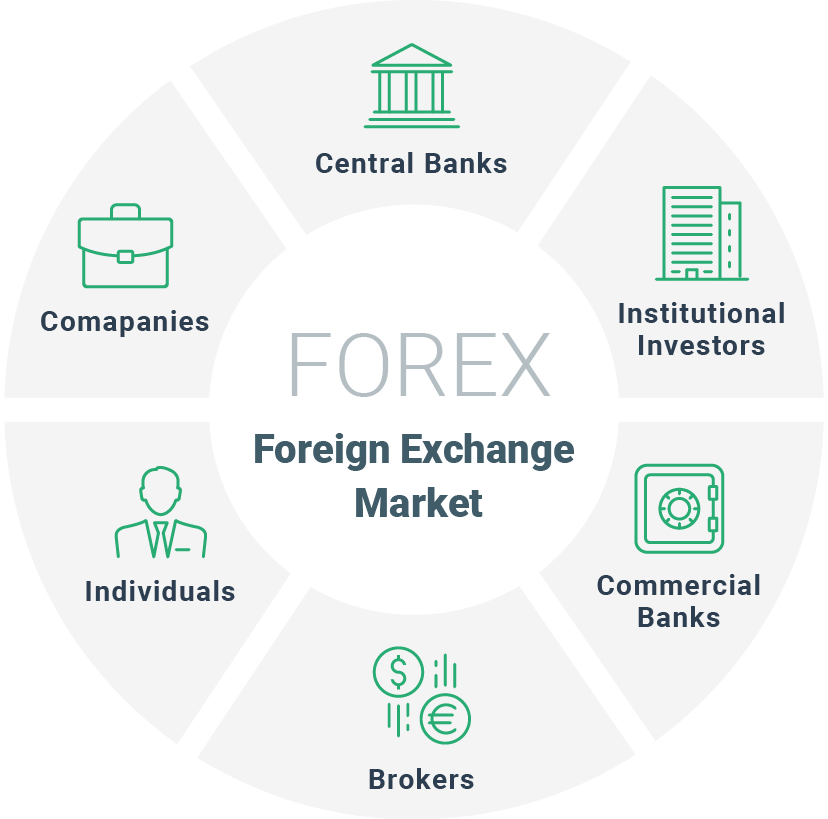

Major participants of foreign exchange market, a diverse group of entities, play pivotal roles in shaping the global financial landscape. From commercial banks facilitating international trade to central banks managing monetary policies, each participant contributes uniquely to the dynamics of this trillion-dollar market.

Delving into the intricacies of this market, we will explore the functions, motivations, and impact of these major players, unraveling the complex web of interactions that drive currency exchange rates and influence global economic outcomes.

Major Participants of the Foreign Exchange Market

Commercial Banks

Commercial banks play a crucial role in the foreign exchange market by facilitating transactions between individuals, businesses, and other financial institutions. They offer a wide range of foreign exchange services, including currency exchange, wire transfers, and hedging instruments. Commercial banks act as intermediaries, connecting buyers and sellers of foreign currencies and ensuring the smooth flow of funds across borders.

Do not overlook explore the latest data about foreign exchange market operations.

Central Banks

Central banks are responsible for managing the monetary policy of their respective countries. They participate in the foreign exchange market to influence the value of their currencies, maintain economic stability, and manage their international reserves. Central banks intervene in the market by buying or selling foreign currencies, which can affect the exchange rates and influence the flow of capital.

Investment Banks

Investment banks are active participants in the foreign exchange market, providing a range of services to institutional clients, such as corporations, hedge funds, and pension funds. They facilitate large-scale foreign exchange transactions, offer advisory services, and engage in proprietary trading. Investment banks also play a significant role in the development of new foreign exchange products and strategies.

Market Dynamics and Structures: Major Participants Of Foreign Exchange Market

The foreign exchange market is a complex and dynamic system that operates on a global scale. It is a decentralized market, meaning that there is no central exchange or clearinghouse where all transactions take place. Instead, trades are executed over-the-counter (OTC) between banks, corporations, and other financial institutions.

Finish your research with information from foreign exchange market frq.

The market is divided into two main segments: the spot market and the forward market. The spot market is where currencies are traded for immediate delivery, while the forward market is where currencies are traded for delivery at a future date.

Factors Influencing Exchange Rates, Major participants of foreign exchange market

The value of a currency is determined by a variety of factors, including economic data, political events, and market sentiment. Economic data, such as GDP growth, inflation, and unemployment, can have a significant impact on exchange rates. Political events, such as elections, wars, and terrorist attacks, can also cause exchange rates to fluctuate.

Impact of Market Participants

The participants in the foreign exchange market can have a significant impact on exchange rate fluctuations. Large banks and corporations can move the market by buying or selling large amounts of currency. Hedge funds and other speculative traders can also contribute to market volatility.

In this topic, you find that foreign exchange market topics for project is very useful.

Trading Instruments and Practices

The foreign exchange market facilitates various types of transactions, including spot, forward, and swap contracts. Spot contracts involve the immediate exchange of currencies at the prevailing market rate. Forward contracts, on the other hand, allow participants to lock in an exchange rate for a future date, mitigating currency fluctuations. Swap contracts involve the exchange of currencies with an agreement to reverse the transaction at a later date.

The settlement process in the foreign exchange market is typically conducted through a network of correspondent banks, which act as intermediaries between the transacting parties. The settlement date, known as the “value date,” is usually two business days after the trade date. This allows for the verification of funds and the completion of necessary administrative processes.

To manage risks associated with foreign exchange transactions, market participants employ various strategies. These include hedging, which involves offsetting exposure to currency fluctuations by taking opposite positions in the market, and diversification, which involves investing in a range of currencies to reduce overall risk. Additionally, market participants may use stop-loss orders to limit potential losses or take-profit orders to secure gains.

Technology and Market Infrastructure

Technology has played a pivotal role in transforming the foreign exchange market, facilitating seamless transactions and enhancing market efficiency. Electronic trading platforms have emerged as central hubs for foreign exchange trading, offering real-time pricing, increased liquidity, and reduced transaction costs.

Electronic Trading Platforms

- Provide real-time access to market data and liquidity, allowing traders to execute trades quickly and efficiently.

- Offer a wide range of trading tools and analytics, empowering traders with sophisticated market insights.

- Enable algorithmic trading, which automates trading strategies based on predefined parameters, improving accuracy and speed.

Clearing and Settlement Systems

Clearing and settlement systems are essential components of the foreign exchange market, ensuring the secure and timely completion of transactions. They:

- Verify and match trades between counterparties.

- Clear trades by netting out offsetting positions, reducing settlement risk.

- Settle trades by facilitating the exchange of currencies between counterparties, ensuring finality and reducing settlement delays.

Closing Notes

In conclusion, the major participants of foreign exchange market, namely commercial banks, central banks, and investment banks, form a symbiotic ecosystem that drives global currency exchange. Their diverse roles and motivations create a dynamic and ever-evolving market, shaping international trade, investment flows, and economic policies worldwide.

Understanding the intricacies of this market and the key players involved empowers us to navigate its complexities, mitigate risks, and harness opportunities in the ever-changing world of foreign exchange.