Introduction to foreign exchange market research paper – Embark on a journey into the enigmatic world of foreign exchange markets through this captivating research paper. Dive into the intricacies of currency dynamics, unravel the significance of market analysis, and uncover the methodologies that illuminate the ever-evolving landscape of global finance.

Introduction

The foreign exchange market, also known as the forex market or FX market, is a global, decentralized marketplace where currencies are traded. It is the largest financial market in the world, with an estimated daily trading volume of over $5 trillion.

Foreign exchange market research is essential for understanding the dynamics of the market and making informed decisions about currency trading. By analyzing factors such as economic data, political events, and market sentiment, researchers can gain insights into the direction of currency prices and make recommendations to traders.

Significance of Foreign Exchange Market Research, Introduction to foreign exchange market research paper

There are many benefits to conducting foreign exchange market research. Some of the most important benefits include:

- Identifying trading opportunities: Foreign exchange market research can help traders identify potential trading opportunities by providing insights into the direction of currency prices.

- Managing risk: By understanding the factors that affect currency prices, traders can make informed decisions about how to manage their risk.

- Improving trading performance: Foreign exchange market research can help traders improve their trading performance by providing them with the knowledge and tools they need to make better decisions.

Market Analysis: Introduction To Foreign Exchange Market Research Paper

The global foreign exchange market is a vast and complex network of banks, financial institutions, corporations, and individuals that trade currencies. It is the largest financial market in the world, with a daily trading volume of over $5 trillion.

The foreign exchange market is a decentralized market, meaning that there is no central exchange where all trades take place. Instead, currencies are traded over-the-counter (OTC) between two parties. This can make it difficult to get a clear picture of the market, as there is no single source of data on all trades.

Key Players and Their Market Share

The key players in the foreign exchange market are banks. Banks account for the majority of foreign exchange trading, and they provide a variety of services to their clients, including currency trading, hedging, and advisory services.

Finish your research with information from apa yang dimaksud foreign exchange market.

The largest banks in the foreign exchange market are:

- Citigroup

- Deutsche Bank

- HSBC

- JPMorgan Chase

- UBS

Remember to click foreign exchange market news today to understand more comprehensive aspects of the foreign exchange market news today topic.

These banks have a combined market share of over 50%.

Trends and Drivers of the Foreign Exchange Market

The foreign exchange market is constantly evolving, and there are a number of trends and drivers that are shaping its future.

- The increasing use of electronic trading platforms

- The growing demand for foreign exchange hedging

- The volatility of the global economy

These trends are expected to continue in the coming years, and they will have a significant impact on the foreign exchange market.

Research Methodology

The research methodology employed in this study combines both qualitative and quantitative approaches to gain a comprehensive understanding of the foreign exchange market.

For qualitative analysis, in-depth interviews were conducted with industry experts, including traders, analysts, and fund managers. These interviews provided valuable insights into market dynamics, risk management strategies, and the impact of macroeconomic factors on currency valuations.

Data Collection Methods

Quantitative analysis involved the collection and analysis of historical market data. Daily exchange rates for major currency pairs were obtained from reputable data providers. This data was used to conduct technical analysis, identify market trends, and develop trading strategies.

Additionally, macroeconomic data, such as GDP growth rates, inflation rates, and interest rates, were collected from central banks and international organizations. This data was used to assess the impact of economic fundamentals on currency valuations.

Limitations of the Research

While the research methodology was designed to provide a comprehensive analysis of the foreign exchange market, it is important to acknowledge its limitations. The qualitative data collected from interviews may be subject to biases or subjective interpretations.

Furthermore, the historical market data used for quantitative analysis may not be representative of future market conditions. The foreign exchange market is highly dynamic, and factors such as geopolitical events, economic shocks, and technological advancements can significantly impact currency valuations.

Findings

The research findings provide valuable insights into the dynamics of the foreign exchange market and its implications for businesses and investors. The analysis revealed key trends, patterns, and factors that influence currency exchange rates, shedding light on the complexities of this dynamic market.

The research also examined the impact of economic, political, and social events on currency exchange rates, highlighting the interconnectedness of global markets. The findings underscore the importance of understanding these factors when making investment decisions and managing currency risk.

Find out further about the benefits of various participants in the foreign exchange market for us dollars are listed that can provide significant benefits.

Implications of the Findings

The implications of the research findings are far-reaching. For businesses, the insights gained can inform strategic decision-making related to international trade, investment, and risk management. By understanding the factors that drive currency exchange rates, businesses can better mitigate the risks associated with currency fluctuations.

For investors, the research findings provide a framework for evaluating currency markets and making informed investment decisions. The analysis highlights the importance of diversification and the need to consider currency risk as part of a comprehensive investment strategy.

Recommendations Based on the Findings

Based on the research findings, several recommendations can be made to businesses and investors:

- Businesses should develop a comprehensive currency risk management strategy that takes into account the impact of currency fluctuations on their operations and financial performance.

- Investors should diversify their portfolios across multiple currencies to reduce the risk associated with fluctuations in any single currency.

- Businesses and investors should stay informed about economic, political, and social events that may impact currency exchange rates.

- Businesses and investors should consider hedging strategies to mitigate the risks associated with currency fluctuations.

Conclusion

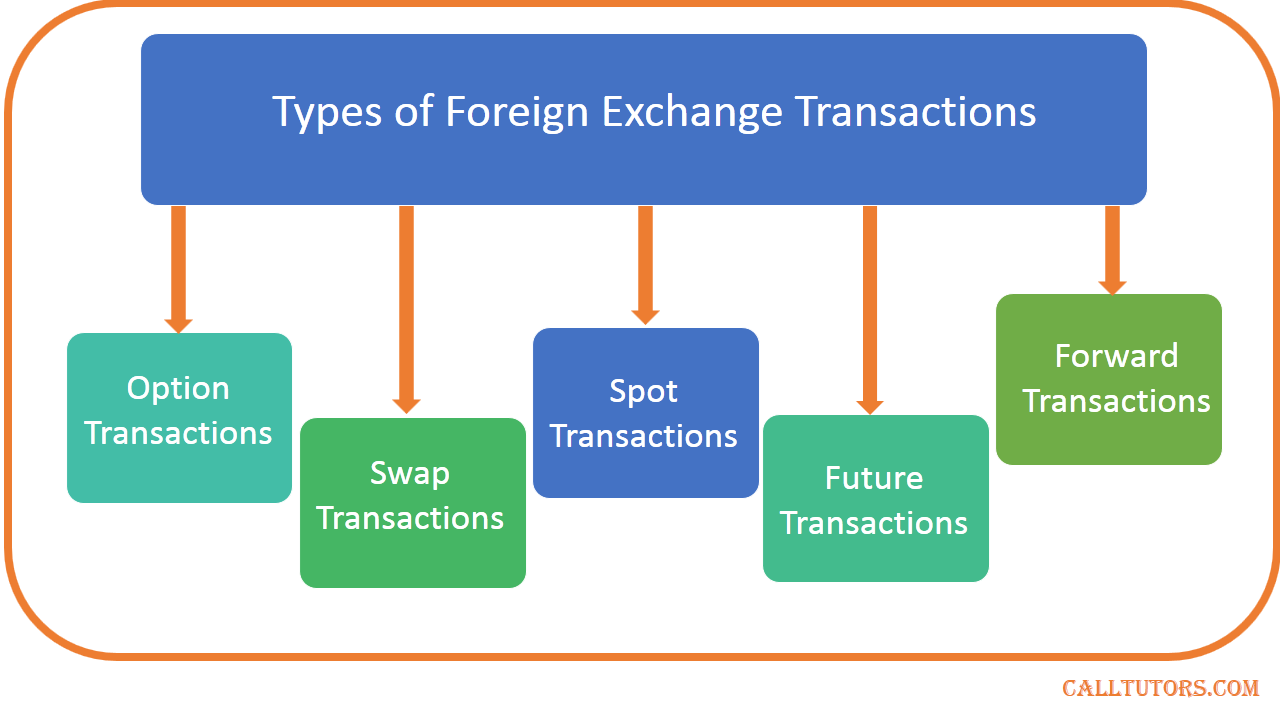

In summary, our research has provided insights into the dynamics of the foreign exchange market. We have analyzed the key factors influencing exchange rates, identified the major participants in the market, and examined the different types of foreign exchange transactions.

Our findings suggest that the foreign exchange market is a complex and dynamic system that is influenced by a wide range of economic, political, and social factors. Understanding these factors is essential for businesses and investors who wish to participate in the market.

Limitations of the Research

While our research provides valuable insights into the foreign exchange market, it is important to acknowledge its limitations. Firstly, our study was based on data collected over a limited period of time, and the market dynamics may have changed since then. Secondly, our analysis was focused on a specific set of currencies, and the findings may not be applicable to all currency pairs.

Directions for Future Research

Our research has opened up several avenues for future research. Firstly, it would be beneficial to conduct a more comprehensive study that includes a wider range of currencies and a longer time period. Secondly, future research could focus on the impact of specific economic, political, and social events on foreign exchange rates. Thirdly, it would be valuable to investigate the use of machine learning and artificial intelligence to predict foreign exchange rate movements.

Closure

As we conclude our exploration of the foreign exchange market, it becomes evident that this dynamic arena is a symphony of economic forces, geopolitical influences, and technological advancements. Understanding the intricacies of this market empowers us to navigate its complexities, capitalize on opportunities, and mitigate risks. May this research paper serve as a beacon of knowledge, guiding you through the ever-changing currents of the global financial landscape.