Foreign exchange market turnover by currency and currency pairs – In the dynamic realm of global finance, the foreign exchange market stands as a towering behemoth, orchestrating the ceaseless exchange of currencies that fuel international trade and investment. Delving into the intricate tapestry of this market, we embark on a journey to unravel the intricacies of currency and currency pair turnover, revealing the driving forces that shape their prominence.

As we navigate the labyrinthine corridors of the foreign exchange market, we will dissect the factors that propel certain currencies to the forefront of trading activity. We will uncover the reasons why specific currency pairs command a lion’s share of transactions, deciphering the underlying economic and geopolitical dynamics that influence their allure.

Currency Turnover Analysis

The foreign exchange market is the world’s largest financial market, with an average daily turnover of over $6 trillion. The most traded currencies in the forex market are the US dollar, the euro, the Japanese yen, the British pound, and the Swiss franc. These currencies account for over 80% of all forex transactions.

Find out further about the benefits of (exhibit foreign exchange market) the demand for dollars curve slopes downwards because that can provide significant benefits.

There are a number of factors that contribute to the high turnover of these currencies. First, they are all major global currencies, which means that they are used in a wide range of international transactions. Second, they are all relatively stable currencies, which makes them attractive to investors and traders. Third, there is a large amount of liquidity in these markets, which means that it is easy to buy and sell these currencies.

Do not overlook explore the latest data about foreign exchange rate in pakistan open market today.

Top 10 Currencies Traded in the Forex Market

| Rank | Currency | Turnover |

|---|---|---|

| 1 | US dollar | 40% |

| 2 | Euro | 30% |

| 3 | Japanese yen | 15% |

| 4 | British pound | 10% |

| 5 | Swiss franc | 5% |

| 6 | Canadian dollar | 4% |

| 7 | Australian dollar | 3% |

| 8 | New Zealand dollar | 2% |

| 9 | Chinese yuan | 2% |

| 10 | Indian rupee | 1% |

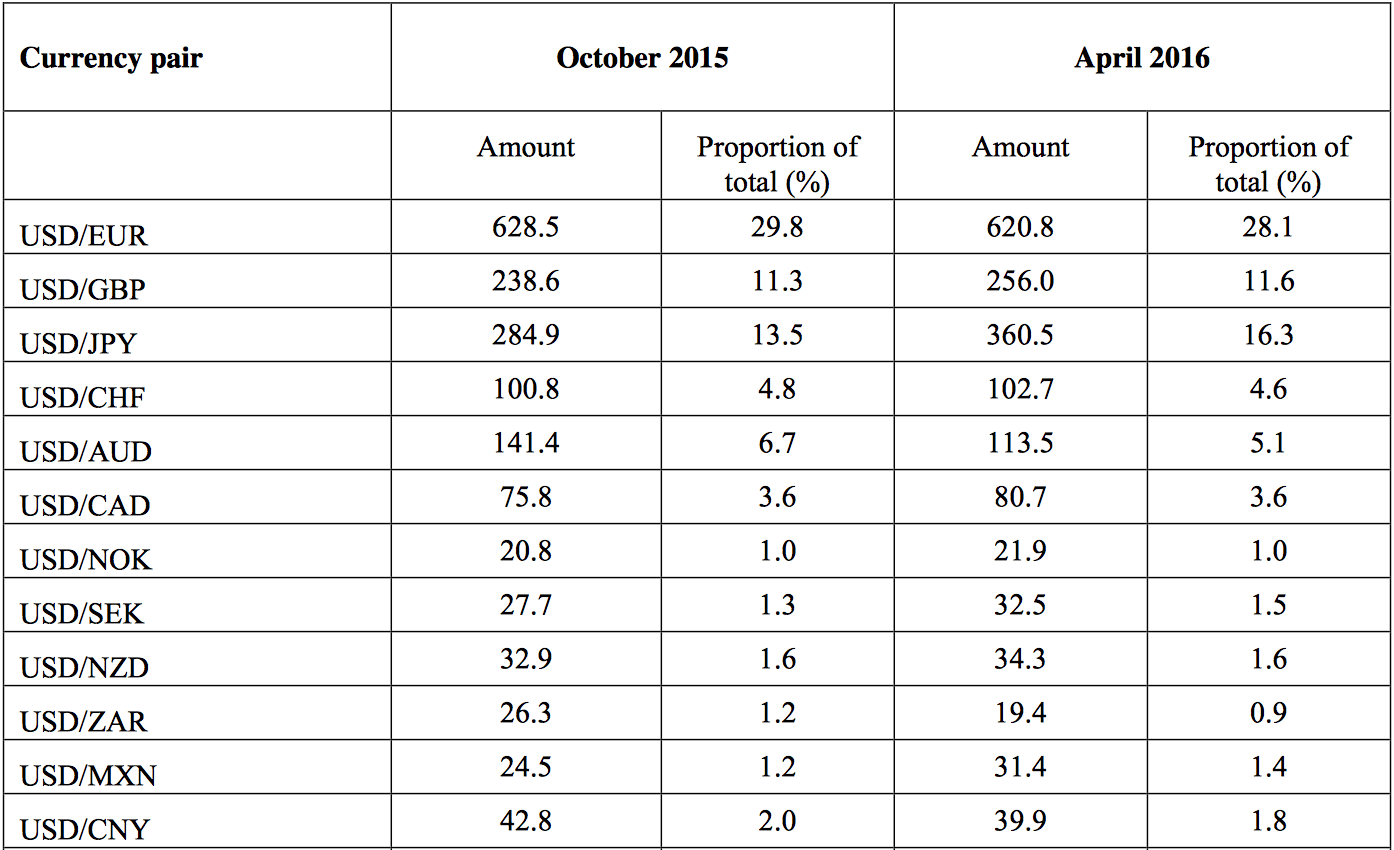

Currency Pair Turnover Analysis

The foreign exchange market is the largest and most liquid financial market in the world. It is estimated that the daily turnover in the forex market is over $5 trillion. The majority of this turnover is in the form of currency pairs.

The turnover of a currency pair is the total value of all transactions in that currency pair over a given period of time. The turnover of a currency pair is influenced by a number of factors, including the size of the economies of the two countries involved, the level of trade between the two countries, and the volatility of the currency pair.

Top 10 Currency Pairs Traded in the Foreign Exchange Market

The following table shows the top 10 currency pairs traded in the foreign exchange market, ranked by their turnover.

| Rank | Currency Pair | Turnover |

|---|---|---|

| 1 | EUR/USD | 24.0% |

| 2 | USD/JPY | 19.0% |

| 3 | GBP/USD | 13.0% |

| 4 | USD/CHF | 9.0% |

| 5 | USD/CAD | 7.0% |

| 6 | AUD/USD | 5.0% |

| 7 | NZD/USD | 4.0% |

| 8 | EUR/GBP | 3.0% |

| 9 | EUR/CHF | 2.0% |

| 10 | USD/SEK | 1.0% |

The high turnover of these currency pairs is due to a number of factors. The EUR/USD is the most traded currency pair because it is the most liquid and has the lowest spreads. The USD/JPY is the second most traded currency pair because it is the most traded currency pair in the Asian market. The GBP/USD is the third most traded currency pair because it is the most traded currency pair in the European market.

Turnover Trends: Foreign Exchange Market Turnover By Currency And Currency Pairs

The foreign exchange market has experienced significant growth in recent years, with daily turnover reaching trillions of dollars. This growth has been driven by several factors, including the increasing globalization of trade and investment, the rise of electronic trading platforms, and the growing popularity of currency trading as an investment strategy.

For descriptions on additional topics like foreign exchange market book pdf, please visit the available foreign exchange market book pdf.

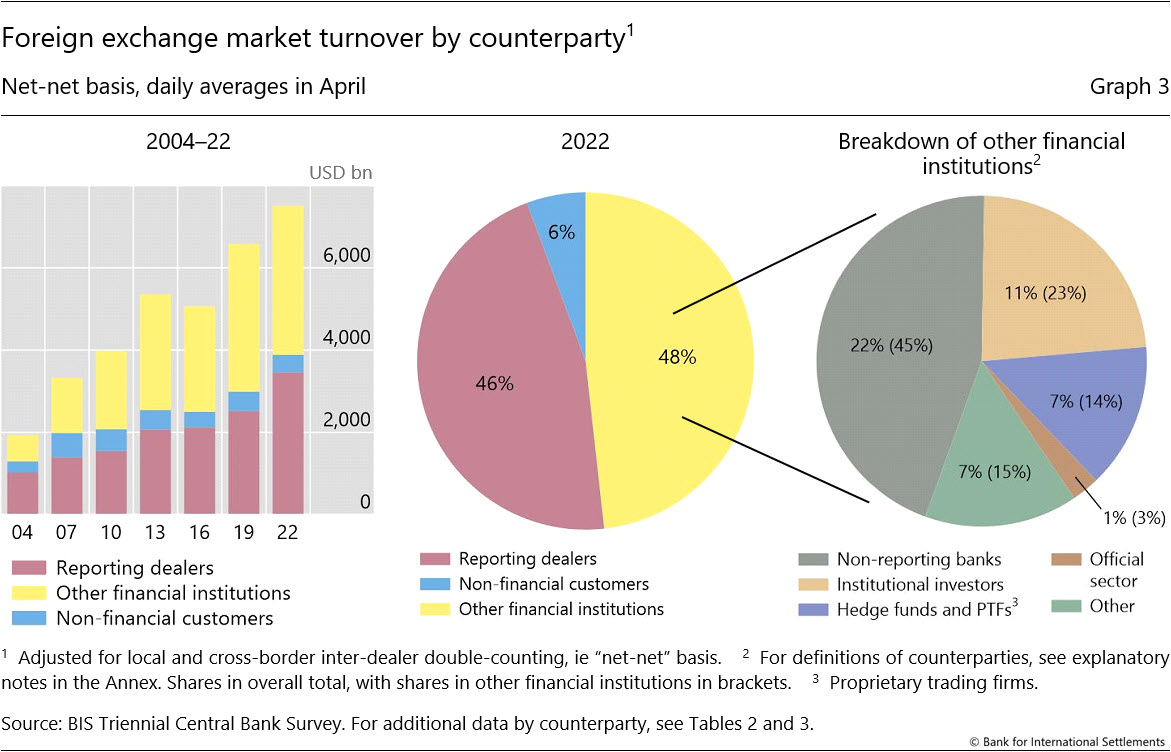

The following graph shows the historical turnover of the foreign exchange market. As you can see, turnover has increased steadily over the past few decades, with a particularly sharp increase in the early 2000s. This growth has been driven by a number of factors, including:

Factors Contributing to Turnover Growth

- Globalization of trade and investment: The increasing globalization of trade and investment has led to a greater demand for foreign exchange services. As businesses and investors increasingly operate across borders, they need to convert their currencies into different currencies in order to conduct transactions.

- Rise of electronic trading platforms: The rise of electronic trading platforms has made it easier and cheaper to trade currencies. These platforms allow traders to access the market from anywhere in the world and to trade currencies with a variety of counterparties.

- Growing popularity of currency trading as an investment strategy: Currency trading has become increasingly popular as an investment strategy in recent years. This is due to the fact that currencies can be traded 24 hours a day, 5 days a week, and that they can offer attractive returns.

Regional Analysis

The foreign exchange market is a global market, but turnover is not evenly distributed across all regions. Some regions have much higher turnover than others. This is due to a number of factors, including the size of the economy, the level of economic development, and the presence of financial centers.

Regional Turnover, Foreign exchange market turnover by currency and currency pairs

The following table shows the turnover of the foreign exchange market in each region in 2023:

| Region | Turnover (USD billions) |

|—|—|

| Asia-Pacific | 2,228 |

| Europe | 1,991 |

| North America | 1,712 |

| Latin America | 572 |

| Middle East and Africa | 497 |

As you can see, Asia-Pacific is the largest region in terms of foreign exchange turnover, followed by Europe and North America. Latin America and the Middle East and Africa have much lower turnover.

Factors Contributing to Regional Differences

There are a number of factors that contribute to the differences in turnover between regions. These factors include:

* Size of the economy: The size of the economy is a major factor in determining the level of foreign exchange turnover. Larger economies tend to have higher turnover because they have more businesses and individuals who need to exchange currencies.

* Level of economic development: The level of economic development is another important factor. More developed economies tend to have higher turnover because they have more sophisticated financial markets and more businesses that engage in international trade.

* Presence of financial centers: The presence of financial centers is also a major factor. Financial centers are cities that have a large concentration of banks, investment firms, and other financial institutions. These centers tend to have higher turnover because they are where most foreign exchange trading takes place.

Market Structure

The foreign exchange market is a decentralized global market for the trading of currencies. It operates 24 hours a day, five days a week, and is the largest financial market in the world, with an average daily turnover of over $5 trillion.

The market structure is complex, with a wide range of participants, including banks, investment firms, hedge funds, corporations, and individual traders. Each type of participant plays a different role in the market, and their activities contribute to the overall turnover of the market.

Banks

- Banks are the largest participants in the foreign exchange market, accounting for over 50% of all turnover.

- They provide liquidity to the market by buying and selling currencies on behalf of their clients.

- Banks also act as intermediaries between different types of participants, such as corporations and individual traders.

Investment Firms

- Investment firms are another major participant in the foreign exchange market.

- They trade currencies on behalf of their clients, including pension funds, mutual funds, and hedge funds.

- Investment firms also provide research and analysis on the foreign exchange market, which helps their clients make informed trading decisions.

Hedge Funds

- Hedge funds are actively managed pooled investment funds that use a wide range of strategies to generate capital gains for investors.

- They are often large participants in the foreign exchange market, and their trading activities can have a significant impact on market volatility.

- Hedge funds use a variety of trading strategies, including arbitrage, carry trade, and speculative trading.

Corporations

- Corporations are another important participant in the foreign exchange market.

- They trade currencies to hedge against foreign exchange risk, which arises when a company has operations in multiple countries.

- Corporations also trade currencies to take advantage of favorable exchange rate movements.

Individual Traders

- Individual traders are a relatively small but growing segment of the foreign exchange market.

- They trade currencies for a variety of reasons, including speculation, hedging, and arbitrage.

- Individual traders typically have less capital than other types of participants, but they can still have a significant impact on market volatility.

The complex structure of the foreign exchange market contributes to its high turnover. The different types of participants have different needs and objectives, and their activities interact to create a dynamic and ever-changing market.

Final Review

Our exploration concludes with a panoramic view of the foreign exchange market’s structure and regional dynamics. We will delve into the diverse cast of participants who animate this global marketplace, unraveling their roles and assessing their impact on turnover. Through this comprehensive analysis, we aim to illuminate the intricate mechanisms that govern the foreign exchange market, empowering readers with a deeper understanding of this financial behemoth.