Foreign exchange market currency of – Embark on a journey into the dynamic world of foreign exchange market currency, where global finance takes center stage. From understanding the intricacies of currency exchange rates to exploring diverse trading strategies, this comprehensive guide delves into the complexities of this ever-evolving market.

In this realm, a myriad of participants converge, from central banks and multinational corporations to individual traders. The interplay of their actions shapes the ebb and flow of currency values, creating a fascinating landscape of opportunities and challenges.

Foreign Exchange Market Overview

The foreign exchange market, also known as forex or currency market, is a global decentralized market where currencies are traded. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion.

The forex market plays a vital role in global finance by facilitating international trade and investment. It allows businesses to exchange currencies to settle cross-border transactions, and investors to diversify their portfolios by investing in foreign assets.

Types of Participants in the Forex Market

The forex market involves a wide range of participants, including:

- Banks: Commercial banks are the largest participants in the forex market, acting as intermediaries between buyers and sellers of currencies.

- Institutional investors: Hedge funds, pension funds, and other institutional investors trade currencies to manage risk and enhance returns.

- Retail traders: Individual traders participate in the forex market through online platforms, speculating on currency movements.

- Central banks: Central banks intervene in the forex market to influence exchange rates and manage their countries’ monetary policies.

Factors Influencing Currency Exchange Rates

Currency exchange rates are determined by a complex interplay of economic, political, and psychological factors. Some of the key factors that influence exchange rates include:

- Interest rates: Differences in interest rates between countries can attract or repel foreign capital, affecting currency demand and supply.

- Inflation: Inflationary pressures can erode the value of a currency, making it less attractive to hold.

- Economic growth: Strong economic growth can increase demand for a country’s currency, leading to appreciation.

- Political stability: Political instability or uncertainty can weaken a currency’s value.

- Central bank intervention: Central banks can intervene in the forex market to influence exchange rates and stabilize their economies.

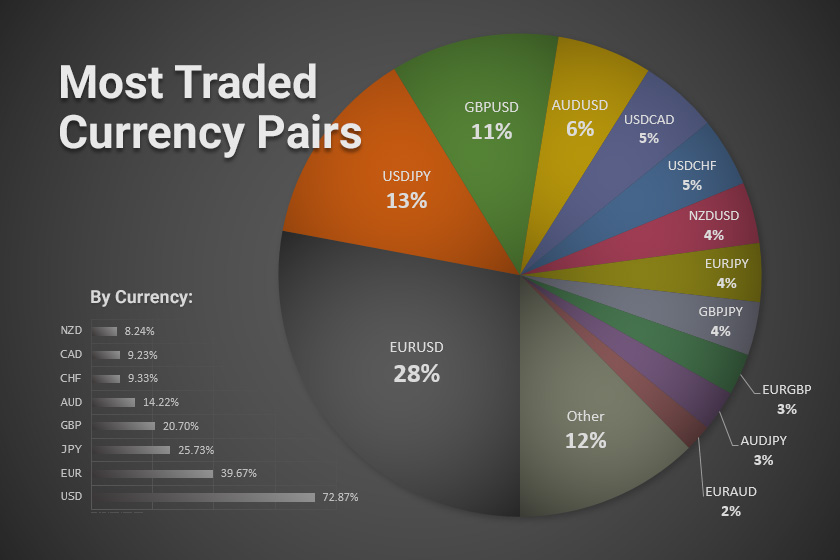

Major Currency Pairs

In the vast foreign exchange market, a handful of currency pairs dominate trading volumes, accounting for the bulk of transactions. These major currency pairs are highly liquid, meaning they can be bought and sold quickly and easily, making them attractive to traders seeking efficient execution of their orders.

The popularity of these currency pairs stems from several factors. First, they represent the currencies of the world’s largest and most developed economies, including the United States, the Eurozone, Japan, and the United Kingdom. These economies are characterized by stable political and economic conditions, making their currencies less prone to extreme fluctuations.

Enhance your insight with the methods and methods of primary participants of the foreign exchange market.

Moreover, major currency pairs are often used as a proxy for global economic trends. For example, the EUR/USD pair is closely watched as an indicator of the relative strength of the European and US economies. This makes them valuable tools for traders seeking to gauge the direction of the global economy and make informed trading decisions.

USD/JPY

- The USD/JPY pair, also known as “Gopher” or “Ninja,” is one of the most heavily traded currency pairs in the forex market.

- The US dollar (USD) is the world’s reserve currency, while the Japanese yen (JPY) is the currency of Japan, the world’s third-largest economy.

- The USD/JPY pair is characterized by its high liquidity and relatively low volatility, making it popular among both retail and institutional traders.

- The pair is often used as a barometer of risk appetite in the market, with a strong USD/JPY indicating a flight to safety and a weak USD/JPY indicating a risk-on sentiment.

EUR/USD

- The EUR/USD pair, also known as “Euro,” is another highly traded currency pair, accounting for a significant portion of global forex volume.

- The euro (EUR) is the currency of the Eurozone, a group of 19 European countries, while the US dollar (USD) is the world’s reserve currency.

- The EUR/USD pair is known for its high liquidity and moderate volatility, making it suitable for both short-term and long-term trading strategies.

- The pair is often used as an indicator of the relative strength of the European and US economies, with a strong EUR/USD indicating a stronger European economy and a weak EUR/USD indicating a stronger US economy.

GBP/USD

- The GBP/USD pair, also known as “Cable,” is a popular currency pair that reflects the exchange rate between the British pound sterling (GBP) and the US dollar (USD).

- The British pound is the currency of the United Kingdom, a major developed economy, while the US dollar is the world’s reserve currency.

- The GBP/USD pair is known for its relatively high volatility, making it a popular choice for short-term traders seeking to capitalize on price fluctuations.

- The pair is often used as an indicator of the relative strength of the UK and US economies, with a strong GBP/USD indicating a stronger UK economy and a weak GBP/USD indicating a stronger US economy.

Currency Trading Strategies: Foreign Exchange Market Currency Of

The foreign exchange market offers various trading strategies to capitalize on currency fluctuations. These strategies involve diverse techniques and risk management approaches.

You also can investigate more thoroughly about foreign exchange market economics definition to enhance your awareness in the field of foreign exchange market economics definition.

Understanding these strategies is crucial for successful currency trading, as they provide a framework for making informed decisions and managing potential risks.

Spot Trading

Spot trading involves the immediate buying and selling of currencies at the current market price. It is the most common type of currency trading and is typically executed within two business days.

Spot trading is suitable for short-term traders seeking to profit from immediate price movements.

Forward Contracts

Forward contracts are agreements to buy or sell a specific amount of currency at a predetermined price on a future date. They are used to hedge against currency risk or speculate on future price movements.

Forward contracts offer more flexibility than spot trading, allowing traders to lock in exchange rates for future transactions.

Options

Currency options provide the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined price within a specified period. They offer flexibility and risk management benefits.

Options can be used to hedge against potential losses or speculate on currency movements.

Investigate the pros of accepting forex trading pdf in your business strategies.

Risk Management Techniques

Effective currency trading involves employing risk management techniques to mitigate potential losses. These techniques include:

- Stop-loss orders: Automatically close trades when prices reach a predetermined level to limit losses.

- Take-profit orders: Automatically close trades when prices reach a predetermined level to secure profits.

- Hedging: Using forward contracts or options to offset potential losses from currency fluctuations.

- Diversification: Trading in multiple currency pairs to reduce exposure to a single currency.

Market Analysis

Market analysis is the process of evaluating economic data, charts, and indicators to forecast currency movements. It helps traders make informed decisions and develop effective trading strategies.

Technical Analysis

Technical analysis focuses on studying price charts and patterns to identify trading opportunities. It assumes that past price movements can provide insights into future price behavior. Common technical analysis tools include:

- Support and resistance levels: Identify areas where the price has historically found difficulty breaking through.

- Trendlines: Identify the overall direction of the price movement.

- Moving averages: Smooth out price fluctuations and identify trends.

- Oscillators: Measure the momentum and overbought/oversold conditions of a currency pair.

Fundamental Analysis

Fundamental analysis examines economic and political factors that can influence currency values. It considers data such as:

- Gross domestic product (GDP)

- Inflation rates

- Interest rates

- Political stability

By analyzing these factors, traders can assess the economic health of a country and its impact on its currency.

Successful Trading Strategies

Combining technical and fundamental analysis can lead to successful trading strategies. For example:

- Trend following: Buying currencies in uptrends and selling in downtrends, identified through technical analysis.

- Counter-trend trading: Trading against the prevailing trend, based on fundamental analysis that suggests a reversal.

- Range trading: Trading within a defined price range, using technical analysis to identify support and resistance levels.

Currency Derivatives

Currency derivatives are financial instruments that derive their value from the underlying value of a currency. They allow traders to speculate on currency movements, hedge against currency risk, and facilitate international trade.

Types of Currency Derivatives

There are three main types of currency derivatives:

- Futures Contracts: Legally binding agreements to buy or sell a specific amount of currency at a predetermined price on a future date.

- Options Contracts: Give the buyer the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined price on or before a future date.

- Swaps: Agreements to exchange one currency for another at a predetermined rate on a future date.

Uses and Benefits

Currency derivatives offer several uses and benefits:

- Risk Management: Hedging against currency fluctuations to protect against potential losses.

- Speculation: Trading on currency movements to profit from exchange rate changes.

- International Trade: Facilitating international trade by locking in exchange rates and reducing currency risk.

Examples in Practice

- A company importing goods from Europe may use a currency futures contract to lock in the euro exchange rate, protecting against potential fluctuations.

- A currency trader may use currency options to speculate on the movement of the Japanese yen against the US dollar.

- Two banks may enter into a currency swap to exchange currencies at a predetermined rate, facilitating international transactions.

Emerging Markets

Emerging markets play a significant role in the foreign exchange market due to their potential for high returns and their contribution to global economic growth. These markets offer unique opportunities for investors seeking diversification and the potential for above-average returns.

Challenges and Opportunities

Trading currencies in emerging markets comes with both challenges and opportunities. One challenge is the higher level of risk associated with these markets due to factors such as political instability, economic volatility, and currency fluctuations. However, these risks can also present opportunities for investors willing to take on more risk in exchange for potentially higher returns.

Investment Strategies, Foreign exchange market currency of

Successful investment strategies in emerging market currencies often involve a combination of fundamental analysis and technical analysis. Fundamental analysis focuses on economic indicators, political events, and market trends to assess the value of a currency. Technical analysis, on the other hand, uses historical price data to identify patterns and predict future price movements.

One common strategy is to invest in emerging market currencies that are undervalued relative to their fundamentals. This involves identifying currencies that are trading below their fair value based on economic indicators and market sentiment. Another strategy is to trade emerging market currencies using technical analysis to identify trends and profit from price fluctuations.

Examples of successful investment strategies in emerging market currencies include the carry trade, which involves borrowing in low-interest currencies and investing in high-interest emerging market currencies. Another strategy is the currency overlay, which involves hedging the currency risk of an investment portfolio by investing in a basket of emerging market currencies.

Conclusive Thoughts

As we conclude our exploration of foreign exchange market currency, it becomes evident that this arena presents a rich tapestry of possibilities. Whether you’re a seasoned trader or an aspiring investor, understanding the dynamics of this market can empower you to navigate its complexities and harness its potential.

From mastering trading strategies to leveraging market analysis tools, the foreign exchange market offers a gateway to global financial participation. As you continue your journey in this ever-evolving realm, may you find success and fulfillment in your financial endeavors.