Foreign exchange market appreciation and depreciation, key concepts in global finance, present a captivating narrative of currency fluctuations and their profound impact on economies and businesses alike. This article delves into the intricacies of these phenomena, exploring their causes, consequences, and strategies for risk management.

Understanding the dynamics of foreign exchange market appreciation and depreciation is crucial for navigating the ever-changing landscape of international trade and investment.

Foreign Exchange Market

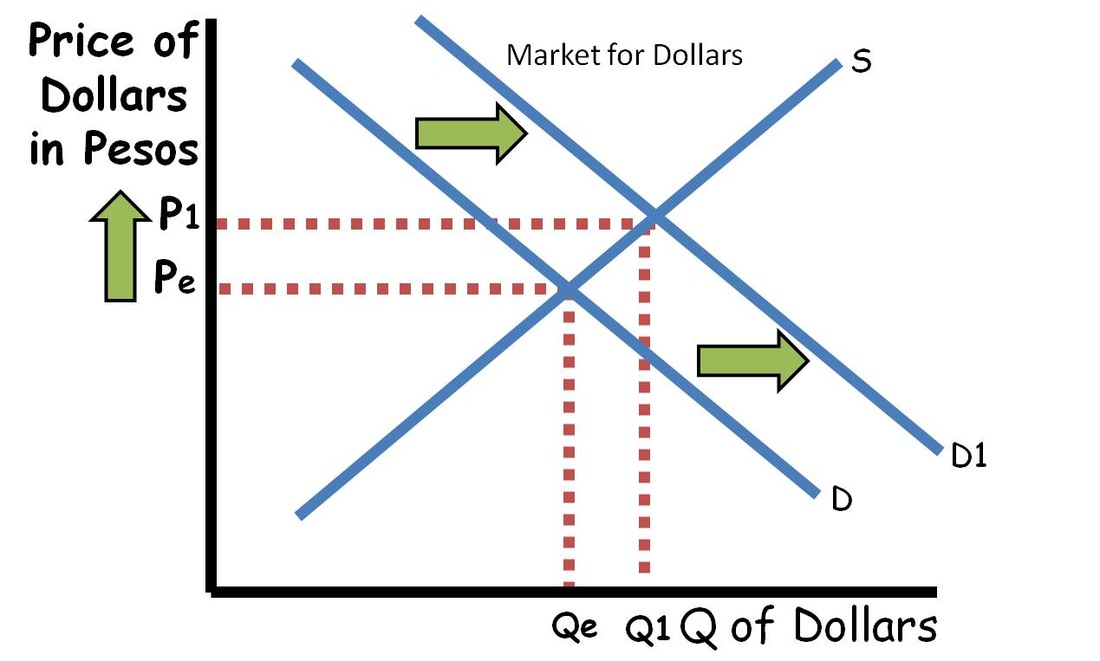

The foreign exchange market, often known as Forex or FX, is a global marketplace where currencies from different countries are traded. Currencies are bought and sold in pairs, with the value of one currency quoted relative to another. Currency appreciation occurs when the value of a currency increases relative to other currencies.

Factors Contributing to Currency Appreciation

Several factors can contribute to currency appreciation, including:

- Strong economic growth: When an economy experiences strong economic growth, demand for its currency tends to increase, leading to appreciation.

- High interest rates: Higher interest rates in a country make its currency more attractive to investors seeking higher returns, leading to increased demand and appreciation.

- Political stability and low inflation: Political stability and low inflation create a favorable investment climate, attracting foreign capital and leading to currency appreciation.

- Trade surplus: A trade surplus occurs when a country exports more goods and services than it imports. This creates demand for the country’s currency, leading to appreciation.

Examples of Currency Appreciation

Some notable examples of countries that have experienced currency appreciation include:

- Switzerland: The Swiss franc has been one of the most stable and appreciated currencies globally due to Switzerland’s strong economy, political stability, and low inflation.

- Norway: The Norwegian krone has appreciated significantly in recent years due to Norway’s strong economic growth and high interest rates.

- Japan: The Japanese yen has appreciated in recent years due to Japan’s trade surplus and safe-haven status during periods of global economic uncertainty.

Foreign Exchange Market: Depreciation

Currency depreciation in the foreign exchange market refers to a decrease in the value of a currency relative to other currencies. This means that it takes more units of the depreciated currency to buy the same amount of goods or services from other countries.

Causes of Currency Depreciation

There are various factors that can contribute to currency depreciation, including:

- Economic slowdown: A decline in economic growth or a recession can lead to a decrease in demand for a country’s goods and services, resulting in a lower demand for its currency.

- High inflation: When inflation is higher in a country compared to its trading partners, it can make its exports more expensive and imports cheaper, leading to a depreciation of its currency.

- Political instability: Political uncertainty or turmoil can create a lack of confidence in a country’s economy, leading to investors and businesses selling off its currency.

- Central bank policy: Monetary policy decisions by a country’s central bank, such as lowering interest rates, can make its currency less attractive to investors, leading to depreciation.

Examples of Currency Depreciation

Throughout history, several countries have experienced currency depreciation, including:

- Argentina: The Argentine peso has experienced significant depreciation in recent years due to economic instability and high inflation.

- Turkey: The Turkish lira has depreciated sharply in recent years due to political uncertainty and economic challenges.

- Venezuela: The Venezuelan bolivar has experienced hyperinflation, leading to a severe depreciation of its currency.

Factors Influencing Appreciation and Depreciation

The value of a currency is influenced by a complex interplay of economic, political, and central bank factors. Understanding these factors is crucial for businesses, investors, and individuals navigating the foreign exchange market.

Browse the multiple elements of foreign exchange market today philippines to gain a more broad understanding.

Economic Indicators

Economic indicators provide insights into the health of an economy and can significantly impact currency value. Key indicators include:

- GDP growth rate: A strong GDP growth rate indicates a growing economy and increased demand for the country’s goods and services, leading to currency appreciation.

- Inflation rate: High inflation erodes the purchasing power of a currency, reducing its value. Conversely, low inflation can lead to currency appreciation.

- Interest rates: Higher interest rates attract foreign investment, increasing demand for the currency and leading to appreciation. Lower interest rates can have the opposite effect.

- Balance of payments: A positive balance of payments indicates more exports than imports, leading to increased demand for the currency and appreciation. A negative balance of payments can depreciate the currency.

Political Events

Political events can have a significant impact on currency value. Examples include:

- Political stability: Political uncertainty or instability can lead to currency depreciation as investors seek safer havens.

- Government policies: Changes in government policies, such as tax laws or trade regulations, can impact currency value.

- International relations: Positive international relations can boost currency value, while negative relations can lead to depreciation.

Central Bank Policies

Central banks play a crucial role in managing exchange rates through monetary policy:

- Interest rate adjustments: Central banks can raise or lower interest rates to influence currency value. Higher rates attract foreign investment and appreciate the currency.

- Foreign exchange intervention: Central banks can buy or sell their own currency to stabilize exchange rates. Buying the currency appreciates it, while selling depreciates it.

- Currency controls: In extreme cases, central banks may impose currency controls to limit the flow of money in and out of the country, impacting currency value.

Impact of Appreciation and Depreciation: Foreign Exchange Market Appreciation And Depreciation

Currency appreciation and depreciation have significant effects on a country’s economy, affecting exports, imports, inflation, and economic growth. Understanding these impacts is crucial for policymakers and businesses.

Check what professionals state about foreign exchange market trends and its benefits for the industry.

Impact on Exports and Imports, Foreign exchange market appreciation and depreciation

Currency appreciation makes a country’s exports more expensive and imports cheaper. This can lead to a decrease in exports and an increase in imports, resulting in a trade deficit. Conversely, currency depreciation makes exports cheaper and imports more expensive, leading to increased exports and decreased imports, potentially resulting in a trade surplus.

Find out about how foreign exchange market types of transaction can deliver the best answers for your issues.

Impact on Inflation and Economic Growth

Currency appreciation can lead to lower inflation by making imported goods cheaper. However, it can also slow economic growth by reducing exports and making domestic goods more expensive compared to imports. Currency depreciation, on the other hand, can lead to higher inflation by increasing the cost of imported goods. However, it can also stimulate economic growth by making exports more competitive and domestic goods cheaper.

Examples of Impacts on Specific Industries or Countries

The appreciation of the Swiss franc in 2015 significantly impacted the Swiss watch industry, making Swiss watches more expensive in export markets. Conversely, the depreciation of the Japanese yen in recent years has boosted Japan’s exports, particularly in the automotive sector.

Strategies for Managing Currency Risk

Businesses operating in the global marketplace face the challenge of managing currency risk, which arises from fluctuations in exchange rates. To mitigate these risks, businesses employ various strategies, including hedging techniques and risk management instruments.

Hedging Techniques

One common hedging technique is forward contracts. A forward contract is an agreement between two parties to exchange a specific amount of currency at a predetermined exchange rate on a future date. This allows businesses to lock in an exchange rate, protecting them from adverse currency movements.

Options

Another hedging instrument is options. Options provide the right, but not the obligation, to buy or sell a currency at a specified price on a specified date. Businesses can use options to limit their potential losses or lock in a favorable exchange rate.

Advantages and Disadvantages

The choice of risk management strategy depends on the specific circumstances and risk tolerance of the business. Forward contracts offer certainty in exchange rates, but they can be inflexible and may not fully mitigate all currency risks. Options provide more flexibility, but they come with a premium cost and may not always be available for all currencies.

Historical Examples of Currency Appreciation and Depreciation

Throughout history, numerous countries have experienced significant currency appreciation and depreciation events. These fluctuations have had profound impacts on their economies and societies.

Japanese Yen Appreciation in the 1980s

During the 1980s, the Japanese yen experienced a period of rapid appreciation against the US dollar. This was primarily due to Japan’s strong economic growth and the Plaza Accord of 1985, which aimed to depreciate the US dollar.

The appreciation of the yen led to several consequences, including:

- Increased exports and decreased imports, boosting Japan’s trade surplus.

- Deflation, as the higher value of the yen made imported goods cheaper.

- Challenges for Japanese exporters, who faced higher costs due to the stronger yen.

Mexican Peso Depreciation in 1994

In 1994, the Mexican peso experienced a severe devaluation known as the “Tequila Crisis.” This was caused by a combination of factors, including overvalued exchange rates, political instability, and a lack of foreign exchange reserves.

The peso’s depreciation had devastating consequences for Mexico, including:

- High inflation and economic recession.

- Increased poverty and social unrest.

- Loss of confidence in the Mexican government and economy.

Lessons Learned

Historical examples of currency appreciation and depreciation provide valuable lessons for policymakers and investors:

- Currency fluctuations can have significant economic and social consequences.

- Understanding the causes and potential impacts of currency fluctuations is crucial for managing risk.

- Policies aimed at influencing currency values should be carefully considered and implemented.

Epilogue

In conclusion, foreign exchange market appreciation and depreciation are complex and multifaceted phenomena that shape the global economic landscape. By understanding the factors influencing currency fluctuations and implementing effective risk management strategies, businesses and investors can navigate these dynamic markets and mitigate potential losses.