The foreign currency exchange market size stands as a colossal force in the global financial landscape, shaping the flow of international trade and investment. Its vast scale and dynamic nature present a compelling narrative, one that we will explore in depth, examining historical trends, growth drivers, and future prospects.

From bustling trading floors to digital platforms, the foreign currency exchange market connects economies worldwide, facilitating the seamless exchange of currencies for businesses, travelers, and investors alike. Join us as we delve into this intricate ecosystem, uncovering its size, segments, key players, and the challenges and opportunities that lie ahead.

Market Overview

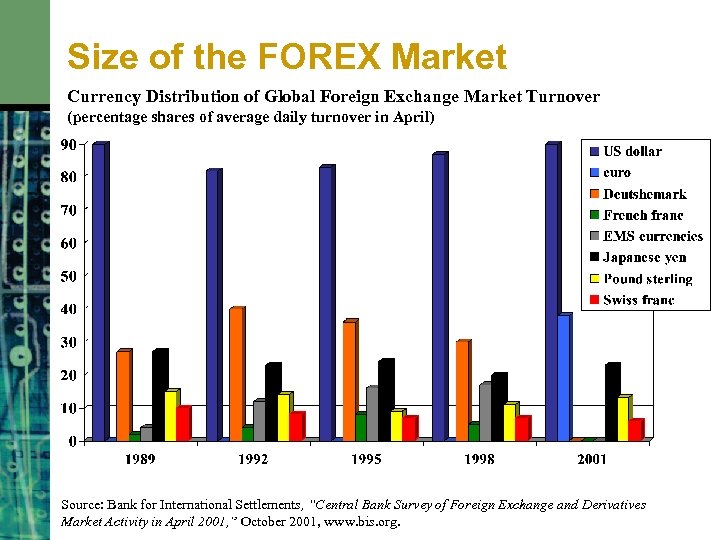

The global foreign currency exchange market is the largest financial market in the world, with a daily trading volume that exceeds $5 trillion.

Examine how foreign exchange market participants exporters importers brokers local retailers can boost performance in your area.

The market has grown rapidly in recent years, driven by the increasing globalization of trade and investment. The growth is expected to continue in the coming years, as more and more businesses and individuals participate in the global economy.

Factors Driving Growth

- Increasing globalization of trade and investment

- Growing demand for foreign currency from businesses and individuals

- Technological advancements that have made it easier to trade foreign currency

- Deregulation of the foreign currency exchange market

Market Segments

The foreign currency exchange market is divided into various segments based on the type of participants and the purpose of transactions. Here are the major segments:

Spot Market

The spot market involves the immediate exchange of currencies at the current market rate. It is the largest segment of the foreign exchange market, with transactions typically settled within two business days.

Forward Market

The forward market allows participants to lock in exchange rates for future transactions. Forward contracts are customized agreements that specify the exchange rate and the future date of settlement, providing protection against currency fluctuations.

Swap Market, Foreign currency exchange market size

Swap markets involve the simultaneous exchange of two different currencies for a specific period and then exchanging them back at a future date. Interest rate swaps, currency swaps, and basis swaps are common types of swap transactions.

Options Market

Options markets provide the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined exchange rate within a specified time frame. Currency options offer flexibility and can be used for hedging or speculative purposes.

Key Players

The foreign currency exchange market is a vast and complex ecosystem, with a diverse range of participants. Major players in the market include banks, non-bank financial institutions, hedge funds, and central banks. Each player has its own unique market share and competitive strategies, shaping the overall dynamics of the market.

Check what professionals state about largest foreign exchange market in world and its benefits for the industry.

Banks are the traditional powerhouses of the foreign exchange market, accounting for the majority of global currency trading. They provide a wide range of services to their clients, including spot trading, forward contracts, and currency options. Major banks such as Citigroup, HSBC, and JPMorgan Chase have a significant presence in the market, leveraging their extensive networks and global reach to facilitate cross-border transactions.

Non-Bank Financial Institutions

Non-bank financial institutions, such as investment banks and brokerage firms, have emerged as major players in the foreign exchange market. They offer specialized services tailored to the needs of institutional investors, such as high-frequency trading and algorithmic trading. Non-bank financial institutions have gained market share by leveraging their technological capabilities and innovative trading strategies.

Hedge Funds

Hedge funds are actively involved in the foreign exchange market, seeking to generate profits through speculative trading. They use a variety of strategies, including carry trade, arbitrage, and momentum trading. Hedge funds have become increasingly influential in the market, with some of the largest funds managing billions of dollars in assets.

Central Banks

Central banks play a crucial role in the foreign exchange market by managing their countries’ foreign exchange reserves and intervening to influence currency values. They buy and sell currencies to maintain exchange rate stability, control inflation, and support economic growth. Central banks’ actions can have a significant impact on the market, particularly in emerging economies.

Regional Analysis

The foreign currency exchange market is a global marketplace where currencies are traded. The market is highly fragmented, with different regions exhibiting varying levels of activity and growth. Factors such as economic stability, political climate, and interest rate differentials influence the market’s performance in each region.

The following table provides an overview of the regional distribution of the foreign currency exchange market:

| Region | Market Size (USD billions) | Growth Rate (%) |

|---|---|---|

| Asia-Pacific | 2,500 | 6.5% |

| Europe | 2,000 | 5.0% |

| North America | 1,500 | 4.0% |

| South America | 500 | 3.0% |

| Middle East and Africa | 250 | 2.5% |

As the table shows, the Asia-Pacific region is the largest foreign currency exchange market, accounting for over 40% of global trading volume. The region’s strong economic growth and increasing trade activity have contributed to its dominance in the market.

Europe is the second-largest market, followed by North America. South America and the Middle East and Africa are smaller markets but have experienced steady growth in recent years.

In this topic, you find that foreign exchange market essay grade 12 pdf free download is very useful.

Factors Influencing Growth

Several factors influence the growth of the foreign currency exchange market in different regions:

- Economic Stability: Political and economic stability attracts foreign investment and increases demand for currency exchange.

- Interest Rate Differentials: Differences in interest rates between countries create opportunities for arbitrage, driving trading activity.

- Trade Activity: Countries with high levels of international trade have a greater need for foreign currency exchange.

- Tourism: Tourism generates demand for foreign currency as travelers need to exchange their own currency for local currency.

- Government Regulations: Government regulations can impact the ease of currency exchange and influence market growth.

Challenges and Opportunities

The foreign currency exchange market is constantly evolving, and with its evolution comes a unique set of challenges and opportunities.

One of the primary challenges facing the market is the increasing volatility of currency exchange rates. This volatility can make it difficult for businesses and individuals to plan for the future, as they are unsure of how much their money will be worth in the future.

Another challenge is the rise of electronic trading platforms. While these platforms have made it easier for people to trade currencies, they have also increased the risk of fraud and abuse.

However, despite these challenges, there are also a number of opportunities in the foreign currency exchange market. One of the most significant opportunities is the growing demand for foreign currencies. As the global economy becomes increasingly interconnected, more and more businesses and individuals are needing to exchange currencies.

Another opportunity is the development of new technologies that are making it easier and more efficient to trade currencies. These technologies include blockchain and artificial intelligence.

Overcoming Challenges and Capitalizing on Opportunities

In order to overcome the challenges and capitalize on the opportunities in the foreign currency exchange market, it is important to be aware of the latest trends and developments. It is also important to have a clear understanding of the risks involved in trading currencies.

By taking the time to understand the market, you can position yourself to succeed in the foreign currency exchange market.

Future Outlook

The foreign currency exchange market is poised for continued growth in the coming years, driven by increasing global trade, rising cross-border investments, and the emergence of new technologies.

The market is expected to benefit from the growing demand for foreign exchange services as businesses and individuals seek to expand their global reach and diversify their portfolios. Additionally, the increasing adoption of digital technologies, such as blockchain and artificial intelligence (AI), is expected to further streamline and enhance the efficiency of foreign exchange transactions.

Emerging Trends and Technologies

Several emerging trends and technologies are expected to shape the future of the foreign currency exchange market. These include:

- Blockchain technology: Blockchain technology has the potential to revolutionize the foreign exchange market by providing a secure and transparent platform for cross-border payments and settlements. It can reduce transaction costs, increase settlement speeds, and improve the overall efficiency of the market.

- Artificial intelligence (AI): AI is being used to develop new tools and technologies that can automate and optimize foreign exchange transactions. These tools can help businesses and individuals make more informed decisions, reduce risks, and improve their overall trading performance.

- Mobile payments: The growing adoption of mobile payments is expected to drive growth in the foreign exchange market as it makes it easier for individuals and businesses to make cross-border payments and remittances.

- Increased regulation: As the foreign exchange market continues to grow, regulators are likely to increase their oversight of the industry. This could lead to new regulations and requirements that could impact the way that businesses and individuals participate in the market.

Potential Impact of Emerging Trends and Technologies

The emerging trends and technologies discussed above are expected to have a significant impact on the foreign currency exchange market. They have the potential to:

- Reduce transaction costs: Blockchain technology and AI can help to reduce transaction costs by eliminating intermediaries and automating processes.

- Increase settlement speeds: Blockchain technology can significantly increase settlement speeds, reducing the time it takes for cross-border payments to be completed.

- Improve transparency: Blockchain technology provides a transparent and immutable record of transactions, which can help to reduce fraud and increase trust in the market.

- Increase accessibility: Mobile payments and other digital technologies can make it easier for individuals and businesses to participate in the foreign exchange market, regardless of their location.

- Create new opportunities: The emergence of new technologies can create new opportunities for businesses and individuals to participate in the foreign exchange market, such as through the development of new products and services.

Overall, the future outlook for the foreign currency exchange market is positive. The market is expected to continue to grow in the coming years, driven by increasing global trade, rising cross-border investments, and the emergence of new technologies. These technologies have the potential to transform the market, making it more efficient, transparent, and accessible for businesses and individuals alike.

Wrap-Up: Foreign Currency Exchange Market Size

As we conclude our exploration of the foreign currency exchange market size, it becomes evident that this dynamic and ever-evolving landscape holds immense potential for growth. With emerging technologies and shifting geopolitical dynamics shaping its future, the market presents both challenges and opportunities for those who seek to navigate its complexities. By understanding the market’s size, segments, and key players, we can gain valuable insights into its future trajectory and position ourselves to capitalize on its potential.