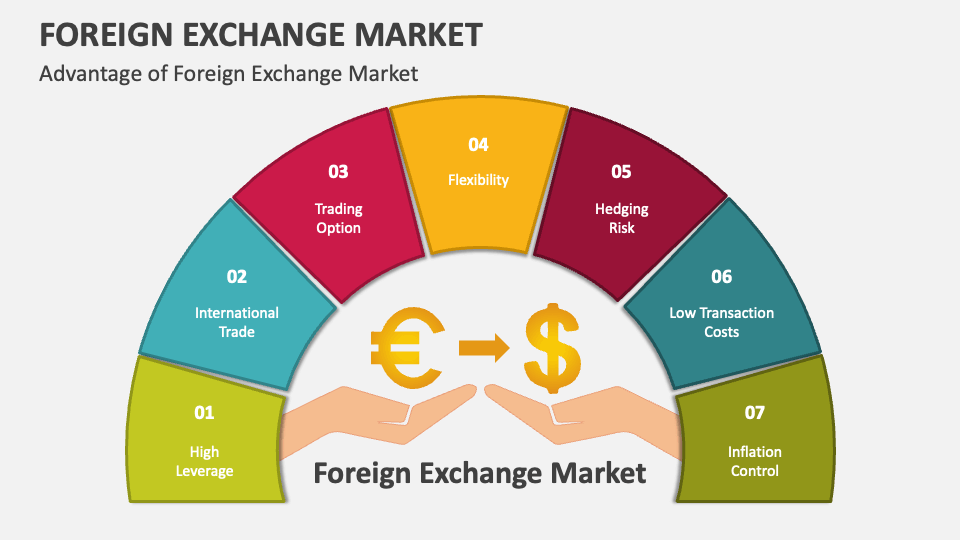

Advantages to foreign exchange market – The foreign exchange market, with its global reach and round-the-clock trading, offers numerous advantages to businesses and individuals alike. This vast and liquid market provides opportunities for risk management, diversification, profitability, and more.

From facilitating global commerce to mitigating currency risks, the foreign exchange market plays a crucial role in the global financial landscape.

Global Accessibility: Advantages To Foreign Exchange Market

The foreign exchange market boasts an unparalleled global reach, connecting economies worldwide. This extensive network enables businesses and individuals to participate in financial transactions across different countries and time zones, facilitating global trade and investment.

Notice foreign exchange market supply shifters for recommendations and other broad suggestions.

The 24/7 nature of the foreign exchange market further enhances its accessibility. Trading occurs continuously, allowing participants to enter and exit positions at any time, regardless of their geographical location. This flexibility provides convenience and allows businesses to capitalize on market opportunities around the clock.

Benefits of Global Accessibility

- Facilitates international trade and investment, promoting economic growth.

- Enables businesses to manage currency risk and expand into new markets.

- Provides individuals with opportunities to diversify their portfolios and hedge against currency fluctuations.

Liquidity and Volume

The foreign exchange market is characterized by exceptionally high liquidity, which stems from the massive trading volume it facilitates. This liquidity offers numerous advantages to market participants.

The vast trading volume ensures tight bid-ask spreads, reducing transaction costs for traders. The abundance of liquidity enables market makers to quote competitive prices, minimizing the difference between the bid and ask prices. This narrow spread benefits traders by lowering their execution costs.

Efficient Execution of Large Trades

The liquidity of the foreign exchange market allows market participants to execute large trades efficiently. Institutional investors, hedge funds, and central banks often need to trade substantial amounts of currency. The high liquidity of the market enables them to do so without significantly impacting the market price.

For example, a large order to buy or sell a particular currency pair may not cause a substantial price movement due to the vast trading volume. This liquidity ensures that large trades can be executed swiftly and at favorable prices.

Risk Management and Diversification

The foreign exchange market offers businesses and investors a crucial platform for managing currency risks and diversifying investment portfolios. It enables them to mitigate the impact of currency fluctuations and enhance the overall stability of their financial positions.

Understand how the union of sell-side participants in the foreign exchange market are most likely to include can improve efficiency and productivity.

Hedging strategies play a central role in foreign exchange risk management. Businesses and investors can use a variety of financial instruments, such as forwards, futures, and options, to offset the potential losses caused by adverse currency movements. These instruments allow them to lock in exchange rates for future transactions, ensuring predictability and reducing the uncertainty associated with currency volatility.

Hedging Strategies in Practice

- Example 1: A multinational corporation with operations in multiple countries can use forward contracts to fix the exchange rate for future payments or receipts in foreign currencies, protecting itself against unexpected fluctuations that could erode its profit margins.

- Example 2: An investor with a diversified portfolio of global assets can utilize currency hedging to reduce the overall risk of their investments. By using foreign exchange instruments, they can mitigate the impact of currency movements on the value of their foreign holdings.

Profitability and Speculation

The foreign exchange market presents ample opportunities for profitability through speculation. Traders seek to capitalize on currency movements by employing various strategies and techniques.

Get the entire information you require about foreign exchange market meaning functions determination of equilibrium rate of exchange on this page.

One common approach involves identifying trends and trading in the direction of the trend. Traders may use technical analysis, which involves studying historical price data to identify patterns and predict future movements.

Scalping

Scalpers aim to make small profits from rapid price fluctuations within a short timeframe, typically within minutes or seconds. They enter and exit positions quickly, taking advantage of small price changes.

News Trading

News traders monitor economic and political events that can impact currency values. They attempt to anticipate the market reaction to news releases and trade accordingly.

Carry Trading

Carry traders borrow currencies with low interest rates and invest them in currencies with higher interest rates. The difference in interest rates, known as the carry, represents the potential profit.

Examples of Successful Traders

- George Soros: Known for his successful speculation during the 1992 Black Wednesday crisis.

- Bill Lipschutz: A currency trader who consistently ranked among the top performers in the 1990s.

- Stanley Druckenmiller: A former hedge fund manager who achieved significant returns through currency trading.

Technological Advancements

Technological advancements have significantly transformed the foreign exchange market, revolutionizing market access, execution, and risk management.

Electronic Trading Platforms

Electronic trading platforms have enabled market participants to access the foreign exchange market remotely, providing 24/7 trading capabilities. These platforms offer real-time quotes, order matching, and execution, reducing transaction costs and increasing efficiency.

Algorithmic Trading

Algorithmic trading utilizes computer programs to execute trades based on predefined parameters. This automation reduces human error, improves execution speed, and allows for complex trading strategies that would be difficult to implement manually.

Enhanced Risk Management

Technology has also improved risk management in the foreign exchange market. Risk management systems can monitor market conditions, identify potential risks, and trigger alerts or execute trades automatically to mitigate losses.

Cost Reduction, Advantages to foreign exchange market

Technological advancements have significantly reduced transaction costs in the foreign exchange market. Electronic trading platforms and automated execution have eliminated the need for intermediaries, resulting in lower spreads and commissions.

Final Thoughts

:max_bytes(150000):strip_icc()/foreign-exchange-markets.asp-final-16abed069d5e4ba0924142476dec4211.png)

In conclusion, the foreign exchange market presents a dynamic and multifaceted arena with benefits that extend across industries and borders. Its global accessibility, liquidity, risk management capabilities, and technological advancements make it an essential tool for businesses, investors, and traders.