Short definition of foreign exchange market – The foreign exchange market, also known as forex or FX, is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion. The forex market plays a vital role in facilitating international trade and investment, and it also serves as a barometer of global economic health.

The participants in the forex market include banks, investment firms, hedge funds, and retail traders. Banks are the largest participants in the market, and they play a key role in facilitating currency trading between their customers. Investment firms and hedge funds also participate in the forex market, often using complex trading strategies to generate profits. Retail traders make up a small but growing segment of the forex market, and they typically trade currencies for speculative purposes.

Overview of Foreign Exchange Market

The foreign exchange market, also known as forex or FX, is a global decentralized market for the trading of currencies. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $5 trillion. The forex market is open 24 hours a day, 5 days a week, and participants can trade currencies from anywhere in the world.

The forex market plays a crucial role in facilitating international trade and investment. It allows businesses and individuals to exchange currencies to pay for goods and services, invest in foreign assets, and hedge against currency fluctuations. The market is also used by central banks to manage their reserves and influence the value of their currencies.

Participants in the Forex Market

The forex market is a diverse and complex ecosystem, with a wide range of participants, including:

- Commercial banks: Commercial banks are the largest participants in the forex market, facilitating currency exchange for their customers and managing their own currency positions.

- Investment banks: Investment banks engage in forex trading for their clients and to hedge their own investment portfolios.

- Hedge funds: Hedge funds use forex trading to speculate on currency movements and generate profits.

- Retail traders: Retail traders, also known as individual traders, participate in the forex market through online trading platforms.

- Central banks: Central banks intervene in the forex market to influence the value of their currencies and manage their reserves.

Functions of Foreign Exchange Market

The foreign exchange market serves as a platform for various essential functions in the global financial system. It facilitates international trade, enables currency exchange, and provides investment opportunities.

Facilitating International Trade

The foreign exchange market plays a crucial role in international trade. It allows businesses to convert their currencies into foreign currencies to purchase goods and services from other countries. For instance, a US-based company importing goods from Japan would need to exchange US dollars for Japanese yen to pay for the imports.

Currency Exchange and Investment

The foreign exchange market also facilitates currency exchange for individuals and institutions. Travelers need to convert their domestic currency into the local currency of the destination country. Investors may also buy or sell foreign currencies for investment purposes, such as hedging against currency fluctuations or seeking higher returns in different markets.

Types of Foreign Exchange Transactions

Foreign exchange transactions can be categorized into two main types: spot transactions and forward transactions. Understanding these types is crucial for effective participation in the foreign exchange market.

You also will receive the benefits of visiting explain functions of foreign exchange market today.

Spot Transactions

Spot transactions involve the immediate exchange of currencies at the current market rate. They are typically settled within two business days, making them suitable for immediate currency needs or short-term investments. Spot transactions play a significant role in determining the value of currencies and facilitating international trade.

Remember to click foreign exchange market in sa to understand more comprehensive aspects of the foreign exchange market in sa topic.

Forward Transactions, Short definition of foreign exchange market

Forward transactions, also known as foreign exchange forwards, are contracts to exchange currencies at a predetermined rate on a future date. They are primarily used to manage risk and hedge against potential currency fluctuations. Forward transactions allow businesses and investors to lock in an exchange rate today for a future transaction, reducing the uncertainty associated with exchange rate movements.

Factors Influencing Foreign Exchange Rates

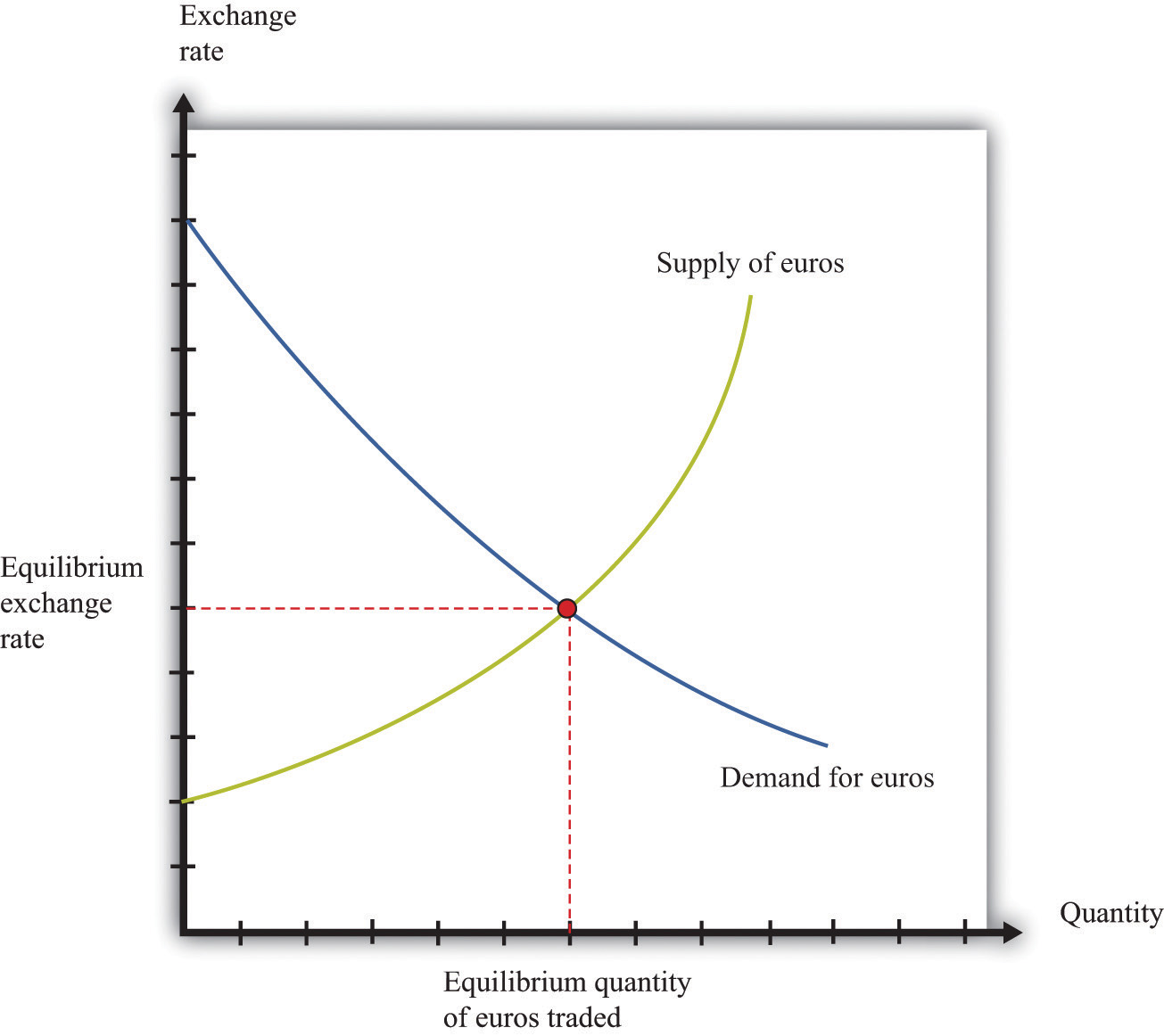

Foreign exchange rates are influenced by a complex interplay of economic and political factors. These factors determine the supply and demand for currencies, which in turn affects their relative values.

You also can investigate more thoroughly about currency conversion of foreign exchange market to enhance your awareness in the field of currency conversion of foreign exchange market.

Economic Factors

- Economic Growth: Strong economic growth leads to increased demand for a country’s currency, as foreign investors seek to invest in its assets.

- Interest Rates: Higher interest rates make a currency more attractive to foreign investors, leading to increased demand and a stronger exchange rate.

- Inflation: High inflation erodes the purchasing power of a currency, making it less desirable and leading to a weaker exchange rate.

- Trade Balance: A trade deficit, where imports exceed exports, can lead to a weaker exchange rate, as the demand for foreign currencies increases to pay for imports.

- Government Debt: High levels of government debt can raise concerns about a country’s financial stability, leading to a weaker exchange rate.

Political Factors

- Political Stability: Political instability, such as wars or coups, can erode investor confidence and lead to a weaker exchange rate.

- Government Policies: Government policies, such as currency controls or foreign exchange regulations, can influence the supply and demand for currencies.

- International Relations: Diplomatic tensions or trade disputes between countries can impact the value of their currencies.

Importance of Foreign Exchange Market

The foreign exchange market plays a pivotal role in facilitating international trade, investments, and economic stability worldwide. It enables the exchange of currencies between countries, ensuring seamless cross-border transactions and the efficient allocation of capital.

Role in Global Economic Stability

- Exchange Rate Stabilization: The forex market helps stabilize exchange rates, reducing volatility and mitigating risks for businesses and investors. This stability supports economic growth and promotes confidence in global markets.

- Balance of Payments Management: Central banks and governments utilize the forex market to manage their balance of payments, influencing the flow of funds into and out of their economies.

- Economic Policy Coordination: International cooperation and coordination among central banks in the forex market help maintain financial stability and address global economic challenges.

Impact on Businesses and Individuals

- International Trade: Businesses engaged in international trade rely on the forex market to convert currencies, facilitating the import and export of goods and services.

- Foreign Direct Investment: Investors seeking opportunities in foreign markets use the forex market to exchange currencies for investments, contributing to economic development and growth.

- Tourism and Travel: Individuals traveling abroad require the forex market to convert their local currency into the currency of the destination country, enabling them to make purchases and enjoy their travels.

Last Recap: Short Definition Of Foreign Exchange Market

The foreign exchange market is a complex and dynamic marketplace, but it is also an essential part of the global economy. By understanding the basics of the forex market, you can better understand how the world economy works and how it affects your own financial well-being.