Foreign exchange risk adalah an ever-present concern in the globalized business landscape, posing challenges and opportunities for companies and individuals alike. This risk arises from fluctuations in exchange rates, which can significantly impact financial performance, strategic decision-making, and overall economic stability.

As international trade and investment continue to expand, understanding foreign exchange risk adalah becomes increasingly critical. This comprehensive guide delves into the intricacies of foreign exchange risk, exploring its types, measurement, management strategies, and impact on financial statements. Through real-world case studies and emerging trends, we aim to provide a thorough understanding of this complex topic and empower readers to navigate the challenges and capitalize on the opportunities it presents.

Define Foreign Exchange Risk

Foreign exchange risk, also known as currency risk, refers to the potential loss or gain that may occur due to fluctuations in the exchange rates between different currencies.

In international business, companies often deal with multiple currencies, exposing them to foreign exchange risk. Changes in exchange rates can impact the value of assets, liabilities, revenues, and expenses, leading to financial gains or losses.

Impact on Companies

- Reduced profitability: Unfavorable exchange rate movements can erode profits, especially for companies with significant overseas operations.

- Increased costs: When the value of the local currency depreciates against foreign currencies, companies may face higher costs for imported goods and services.

- Difficulty in planning and forecasting: Currency fluctuations can make it challenging for companies to accurately plan and forecast their financial performance.

Impact on Individuals, Foreign exchange risk adalah

- Reduced purchasing power: Individuals traveling or living abroad may experience a decrease in their purchasing power if the local currency depreciates against their home currency.

- Increased cost of remittances: When sending money abroad, individuals may face higher costs due to unfavorable exchange rates.

- Impact on investments: Currency fluctuations can affect the value of foreign investments, potentially leading to losses or gains.

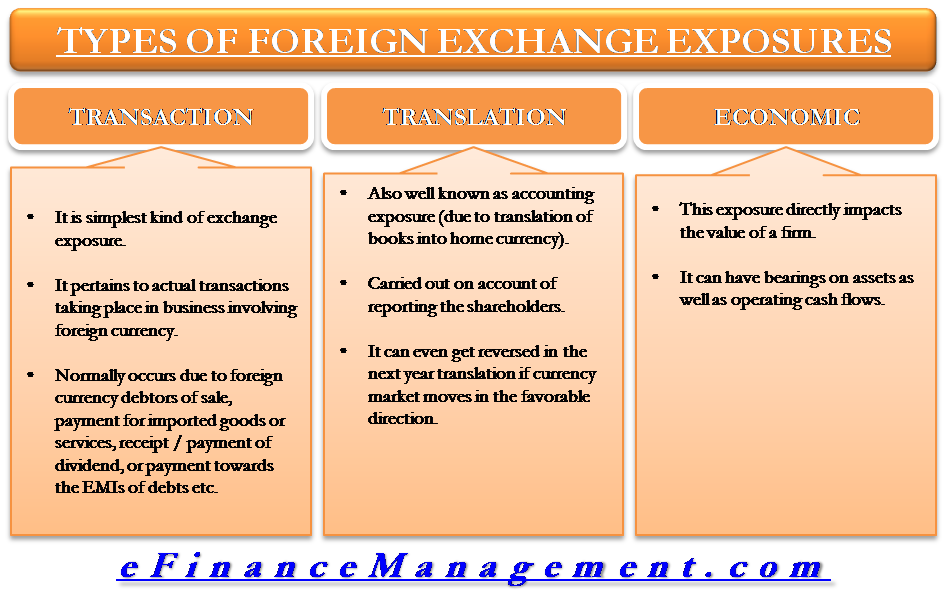

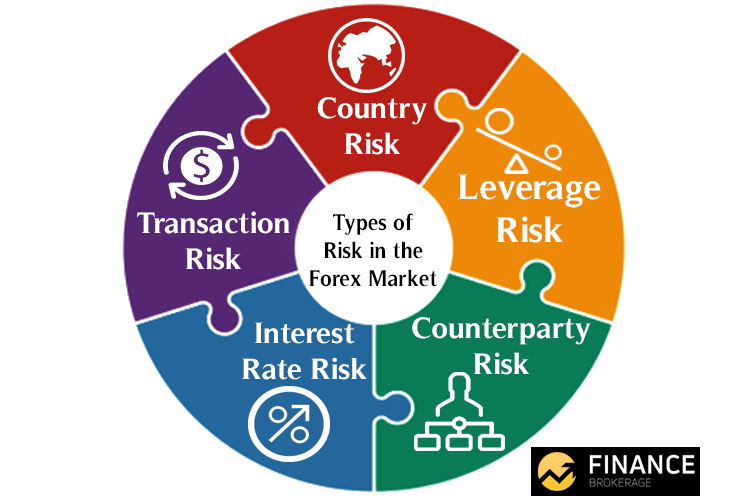

Types of Foreign Exchange Risk

Foreign exchange risk arises when a business or individual is exposed to potential losses due to fluctuations in the exchange rates of different currencies. Various types of foreign exchange risk exist, each with its own characteristics and contributing factors.

Transaction Risk

Transaction risk refers to the risk of exchange rate fluctuations affecting the value of a specific financial transaction, such as an import or export deal. This risk occurs when there is a time lag between the commitment to a transaction and its settlement, exposing the parties involved to potential gains or losses due to currency movements.

Factors contributing to transaction risk include:

- Currency volatility: The extent to which the exchange rate between two currencies fluctuates over time.

- Transaction size: The larger the transaction amount, the greater the potential financial impact of exchange rate changes.

- Settlement date: The time difference between the transaction date and the settlement date, which can increase the exposure to currency fluctuations.

Translation Risk

Translation risk arises when a company has subsidiaries or operations in foreign countries and needs to translate its financial statements into a single reporting currency. This risk occurs due to changes in exchange rates, which can affect the reported value of the company’s assets, liabilities, and equity.

Factors contributing to translation risk include:

- Currency exchange rates: The fluctuations in exchange rates between the functional currency of the foreign subsidiary and the reporting currency of the parent company.

- Magnitude of foreign operations: The larger the foreign operations relative to the domestic operations, the greater the potential impact of translation risk.

- Accounting standards: Different countries may use different accounting standards, which can affect the valuation of assets and liabilities, thus influencing the translation process.

Economic Risk

Economic risk refers to the broader impact of exchange rate fluctuations on a company’s overall financial performance and competitiveness. This risk arises when changes in exchange rates affect the company’s ability to generate revenue, control costs, and compete in international markets.

Factors contributing to economic risk include:

- Currency devaluation or appreciation: Significant changes in the value of a currency can affect the purchasing power of consumers, the cost of raw materials, and the competitiveness of exports.

- Interest rate differentials: Differences in interest rates between countries can influence investment decisions and the flow of capital, which can impact exchange rates and the economic environment.

- Political and economic events: Major political or economic events, such as wars, natural disasters, or changes in government policies, can trigger currency fluctuations and impact economic risk.

Measuring and Managing Foreign Exchange Risk

Measuring and managing foreign exchange risk is crucial for businesses operating in international markets. Exposure to currency fluctuations can significantly impact financial performance and overall stability.

Several methods can be used to measure foreign exchange risk exposure, including sensitivity analysis and scenario analysis. Sensitivity analysis assesses the impact of currency fluctuations on key financial metrics, such as revenue, expenses, and cash flow. Scenario analysis involves developing hypothetical scenarios of potential currency movements and evaluating their impact on the business.

Managing Foreign Exchange Risk

Once foreign exchange risk exposure has been measured, companies can implement strategies to manage it. Some common strategies include hedging, diversification, and currency invoicing.

- Hedging: Involves using financial instruments, such as forward contracts or options, to lock in exchange rates and mitigate the impact of currency fluctuations.

- Diversification: By operating in multiple countries with different currencies, companies can spread their foreign exchange risk across various markets, reducing the overall impact of currency fluctuations.

- Currency Invoicing: Companies can invoice customers in their local currency, eliminating the risk of currency fluctuations for the customer and transferring it to the company.

Examples

- A multinational corporation with operations in several countries may use hedging to protect against potential losses due to currency fluctuations. By entering into a forward contract, the company can fix the exchange rate for future transactions, ensuring a predictable cash flow.

- A company with a global supply chain may diversify its foreign exchange risk by sourcing materials from different countries. This reduces the impact of currency fluctuations in any one country on the company’s overall operations.

- A company that exports to a country with a volatile currency may choose to invoice customers in their local currency. This transfers the foreign exchange risk to the customer and protects the company from potential losses due to currency fluctuations.

Impact of Foreign Exchange Risk on Financial Statements

Foreign exchange risk can have a significant impact on a company’s financial statements, particularly its balance sheet and income statement. This risk arises from the potential for changes in exchange rates to affect the value of a company’s assets and liabilities denominated in foreign currencies.

Under the International Financial Reporting Standards (IFRS), companies are required to translate their financial statements into a single reporting currency, typically their functional currency. This translation process can introduce foreign exchange gains or losses, which are recognized in the income statement.

Investigate the pros of accepting arbitrage in foreign exchange market pdf in your business strategies.

Impact on Balance Sheet

Foreign exchange risk can impact the balance sheet in several ways. For example, if a company has a receivable denominated in a foreign currency, a depreciation in the value of that currency relative to the reporting currency will result in a foreign exchange loss. Conversely, an appreciation in the foreign currency’s value will lead to a foreign exchange gain.

Impact on Income Statement

Foreign exchange risk can also affect the income statement. For instance, if a company generates revenue in a foreign currency, a depreciation in the value of that currency relative to the reporting currency will result in a decrease in the reported revenue. Conversely, an appreciation in the foreign currency’s value will lead to an increase in reported revenue.

Accounting Standards and Regulations

The accounting for foreign exchange risk is governed by various accounting standards and regulations, including IFRS 9 and FASB ASC 830. These standards provide guidance on the recognition, measurement, and disclosure of foreign exchange gains and losses.

Obtain recommendations related to foreign exchange market ap macro that can assist you today.

Case Studies of Foreign Exchange Risk Management

Many companies have successfully managed foreign exchange risk, implementing strategies and techniques to mitigate risk and achieve financial stability. Here are a few case studies:

Coca-Cola

Coca-Cola, a multinational beverage company, has a vast global presence and is exposed to significant foreign exchange risk. To manage this risk, Coca-Cola uses a combination of hedging strategies, including currency forwards, options, and swaps. By doing so, Coca-Cola can lock in exchange rates for future transactions, reducing the impact of currency fluctuations on its financial performance.

Toyota

Toyota, a Japanese automaker, has extensive operations in multiple countries. To mitigate foreign exchange risk, Toyota employs a centralized treasury function that monitors currency movements and develops hedging strategies. Toyota also uses natural hedging techniques, such as matching its foreign currency revenues and expenses, to reduce its exposure to exchange rate fluctuations.

Finish your research with information from simple definition for foreign exchange market.

Nestlé

Nestlé, a Swiss food and beverage company, operates in over 190 countries. To manage foreign exchange risk, Nestlé uses a combination of hedging instruments and risk management tools. Nestlé’s hedging strategies include currency forwards, options, and swaps, while its risk management tools include scenario analysis and stress testing.

Emerging Trends in Foreign Exchange Risk Management: Foreign Exchange Risk Adalah

In recent years, emerging technologies like artificial intelligence (AI) and machine learning (ML) have gained significant traction in the realm of foreign exchange (FX) risk management.

These technologies offer several potential benefits for managing FX risk, including:

- Enhanced Data Analysis: AI and ML algorithms can process vast amounts of data quickly and efficiently, enabling risk managers to identify patterns and trends that may not be apparent to humans.

- Predictive Analytics: These technologies can be used to develop predictive models that forecast future exchange rate movements, helping businesses make informed decisions about hedging strategies.

- Automated Risk Management: AI and ML can be integrated into FX risk management systems to automate certain tasks, such as monitoring exchange rates and executing trades.

However, there are also challenges associated with using these technologies in FX risk management:

- Data Quality: The accuracy and reliability of AI and ML models depend on the quality of the data used to train them.

- Interpretability: It can be difficult to understand the decision-making process of AI and ML models, which may limit their adoption in risk management.

- Regulatory Concerns: The use of AI and ML in FX risk management may raise regulatory concerns, as these technologies can potentially impact the stability of financial markets.

Despite these challenges, the potential benefits of AI and ML in FX risk management are significant. As these technologies continue to develop and mature, they are likely to play an increasingly important role in helping businesses manage their FX risk exposure.

Ultimate Conclusion

In conclusion, foreign exchange risk adalah an inherent aspect of international business that requires careful consideration and proactive management. By understanding the different types of risk, employing effective measurement and management strategies, and staying abreast of emerging trends, companies and individuals can mitigate potential losses, enhance financial stability, and seize opportunities in the global marketplace.