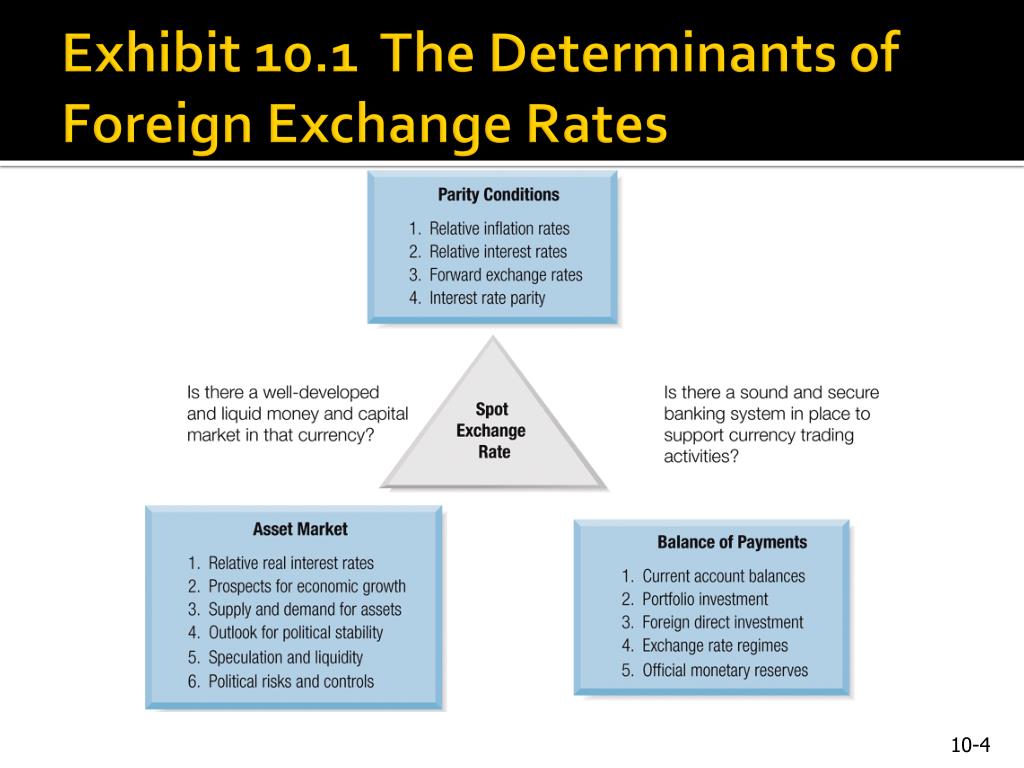

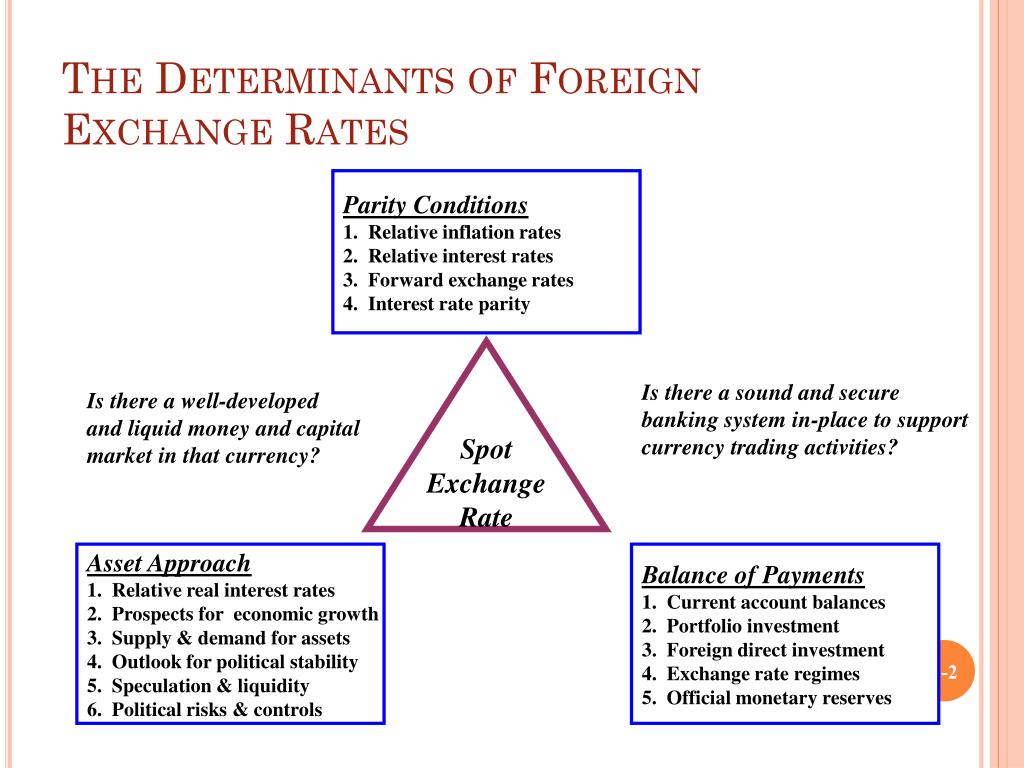

The determinants of foreign exchange market are the various factors that influence the exchange rates between different currencies. These factors can be economic, political, psychological, supply and demand-related, technological, or even other external events. Understanding these determinants is crucial for businesses, investors, and anyone involved in international trade or finance.

Economic factors, such as economic growth, inflation, and interest rates, play a significant role in determining currency values. Political stability, elections, and international conflicts can also impact exchange rates. Psychological factors, including market sentiment and expectations, can lead to market bubbles and crashes.

Economic Factors

Economic factors play a crucial role in shaping foreign exchange rates. Economic growth and stability, inflation, interest rates, and fiscal and monetary policies all have significant implications for currency values.

Strong economic growth and stability tend to strengthen a country’s currency. Investors are more likely to invest in a country with a stable and growing economy, leading to increased demand for its currency. Conversely, economic weakness and instability can weaken a currency as investors become more cautious and withdraw their investments.

Inflation

Inflation, or the general increase in prices, can also affect exchange rates. High inflation can erode the purchasing power of a currency, making it less valuable compared to other currencies. Central banks may raise interest rates to combat inflation, which can make the currency more attractive to investors seeking higher returns.

Interest Rates

Interest rates set by central banks influence exchange rates. Higher interest rates make a currency more attractive to investors seeking higher returns. This increased demand for the currency can lead to its appreciation against other currencies.

Expand your understanding about foreign exchange market interview questions with the sources we offer.

Fiscal and Monetary Policies

Fiscal and monetary policies implemented by governments can also impact exchange rates. Expansionary fiscal policies, such as increased government spending or tax cuts, can stimulate economic growth and increase demand for a country’s currency. On the other hand, contractionary fiscal policies, such as reduced spending or tax increases, can slow economic growth and weaken the currency.

Political Factors

Political stability and uncertainty significantly impact foreign exchange markets. Political events can influence investor confidence, currency demand, and exchange rate fluctuations.

Political stability generally leads to currency appreciation, as investors are more confident in the country’s economic outlook and stability. Conversely, political uncertainty, such as elections or international conflicts, can cause currency depreciation as investors become more risk-averse.

Elections, Determinants of foreign exchange market

Elections can trigger currency volatility as investors anticipate changes in government policies and economic direction. Unexpected election outcomes or changes in ruling parties can lead to significant exchange rate movements.

Trade Agreements

Trade agreements between countries can affect currency values by altering trade flows and investment patterns. New or amended trade deals can impact currency demand and supply, leading to fluctuations in exchange rates.

International Conflicts

International conflicts or geopolitical tensions can have a profound impact on currency markets. Uncertainty and risk aversion during conflicts can lead to currency depreciation, especially for countries directly involved or economically exposed to the conflict.

For instance, the outbreak of the Russia-Ukraine conflict in 2022 caused significant volatility in currency markets, with the Russian ruble depreciating sharply due to economic sanctions and geopolitical uncertainty.

Finish your research with information from foreign exchange market case study.

3. Psychological Factors

The foreign exchange market is heavily influenced by psychological factors, which stem from market sentiment and expectations. These factors can significantly impact currency values and lead to market volatility.

Market sentiment refers to the overall attitude and perception of market participants towards a particular currency or the market as a whole. Positive sentiment, characterized by optimism and bullishness, can lead to increased demand for a currency, while negative sentiment, marked by pessimism and bearishness, can result in decreased demand.

Fear, Greed, and Speculation

Fear and greed are powerful emotions that drive currency trading. Fear of missing out (FOMO) can lead traders to buy a currency that is rising in value, while fear of loss can prompt them to sell a currency that is falling. Greed, on the other hand, can lead traders to hold onto a currency for too long in anticipation of further gains, even when market conditions suggest otherwise.

Speculation is another significant psychological factor in the foreign exchange market. Speculators buy and sell currencies based on their expectations of future price movements, often without any underlying economic fundamentals to support their trades. Speculative trading can amplify market movements and increase volatility.

Market Bubbles and Crashes

Psychological factors can lead to market bubbles and crashes. When market sentiment is overly optimistic, a currency’s value can become inflated beyond its fundamental value, creating a bubble. This can eventually burst, leading to a sharp decline in the currency’s value.

Similarly, when market sentiment is overly pessimistic, a currency’s value can fall below its fundamental value, creating a crash. This can occur when traders panic and sell their currencies en masse, leading to a self-fulfilling prophecy of further decline.

Supply and Demand

The foreign exchange market is driven by the forces of supply and demand. When the supply of a currency increases relative to demand, its value will depreciate. Conversely, when the demand for a currency increases relative to supply, its value will appreciate.

Factors Affecting Currency Demand

Several factors can affect the demand for a currency, including:

- Trade flows: Countries that export more goods and services than they import will have a higher demand for their currency to settle international transactions.

- Tourism: Countries with a large tourism industry will have a higher demand for their currency from foreign visitors.

- Foreign investment: Countries that offer attractive investment opportunities will attract foreign investors, increasing demand for their currency.

Central Bank Interventions

Central banks can intervene in the foreign exchange market to influence the supply and demand dynamics. They can do this by buying or selling their own currency, which can affect the exchange rate.

| Change in Supply | Change in Demand | Impact on Exchange Rate |

|---|---|---|

| Increase | Decrease | Depreciation |

| Decrease | Increase | Appreciation |

5. Technological Factors: Determinants Of Foreign Exchange Market

Technological advancements have revolutionized the foreign exchange market, introducing electronic trading platforms, high-frequency trading, and artificial intelligence, transforming how currencies are traded and influencing exchange rates.

Electronic Trading Platforms

Electronic trading platforms provide online marketplaces where traders can connect and execute trades directly, eliminating the need for intermediaries. These platforms offer real-time quotes, transparency, and faster execution, reducing transaction costs and increasing market efficiency.

Do not overlook explore the latest data about foreign exchange market supply shifters.

High-Frequency Trading

High-frequency trading involves using sophisticated algorithms and technology to execute a large number of trades in milliseconds. This enables traders to take advantage of tiny price fluctuations and profit from short-term market movements, further increasing market liquidity and efficiency.

Artificial Intelligence

Artificial intelligence (AI) is transforming the foreign exchange market by automating tasks, providing real-time analysis, and predicting market trends. AI-powered trading algorithms can process vast amounts of data, identify patterns, and make trading decisions, reducing human bias and improving accuracy.

6. Other Factors

In addition to the factors mentioned above, there are several other factors that can impact foreign exchange rates, including natural disasters, commodity prices, and geopolitical events.

Natural Disasters

Natural disasters, such as earthquakes, hurricanes, and floods, can have a significant impact on foreign exchange rates. These events can damage infrastructure, disrupt supply chains, and lead to a loss of confidence in the economy. This can result in a depreciation of the currency of the affected country.

Commodity Prices

Commodity prices, such as oil, gold, and copper, can also impact foreign exchange rates. When the price of a commodity rises, it can lead to an appreciation of the currency of the country that produces that commodity. This is because the increased demand for the commodity leads to an increase in demand for the currency of the producing country.

Geopolitical Events

Geopolitical events, such as wars, political instability, and trade disputes, can also have a significant impact on foreign exchange rates. These events can create uncertainty and volatility in the market, which can lead to a depreciation of the currency of the affected country.

Last Recap

In conclusion, the determinants of foreign exchange market are complex and interconnected. By understanding these factors, individuals and businesses can make informed decisions and navigate the complexities of the global currency market.