Capital market foreign exchange risks pose significant challenges and opportunities in the dynamic world of global finance. As currencies fluctuate, investors, businesses, and governments must navigate the complexities of exchange rate movements to mitigate risks and maximize returns. This article delves into the intricacies of capital market foreign exchange risks, exploring their impact on investments, regulatory frameworks, and risk management strategies.

Understanding the dynamics of currency exchange is crucial for participants in the capital markets. Currency fluctuations can have profound effects on investment returns, capital flows, and the overall stability of financial systems. By examining case studies and best practices, we can gain valuable insights into managing foreign exchange risks effectively.

Market Risks in Foreign Exchange

The foreign exchange market is a global decentralized market for the trading of currencies. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion. The foreign exchange market is used by a wide range of participants, including banks, corporations, governments, and individual investors.

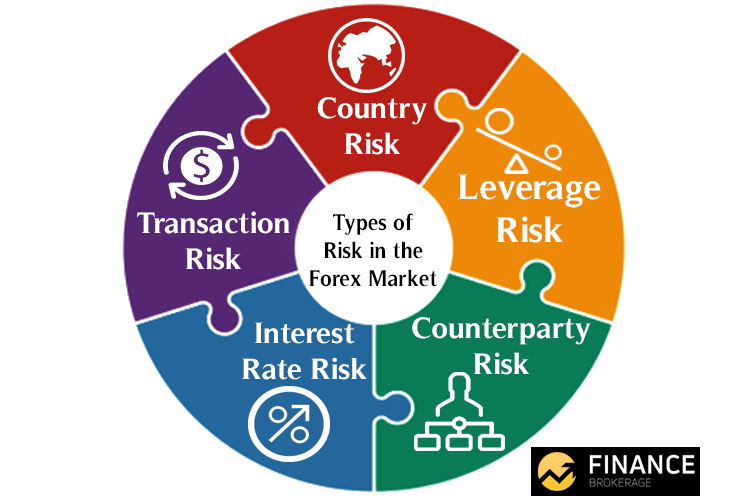

There are a number of risks associated with currency exchange rate fluctuations. These risks can impact capital markets in a number of ways.

Currency Risk

Currency risk is the risk that the value of a currency will change relative to another currency. This can have a significant impact on the value of investments denominated in foreign currencies. For example, if an investor purchases a bond denominated in euros and the euro贬值, the investor will lose money.

Notice functions and structure of foreign exchange market for recommendations and other broad suggestions.

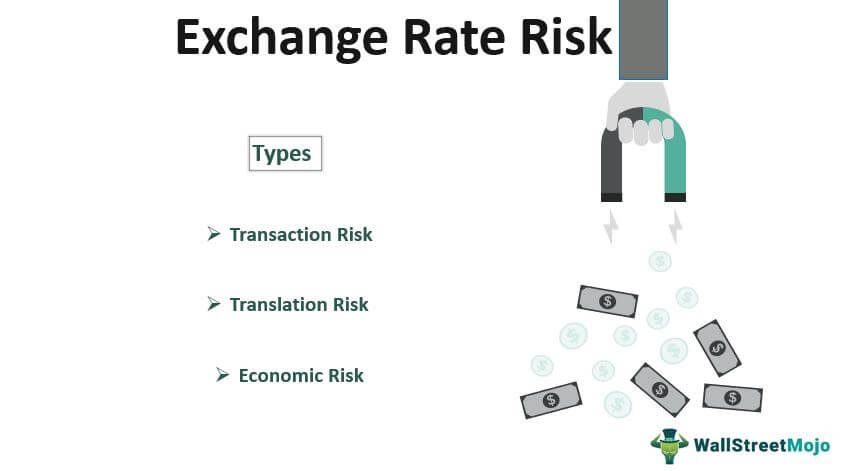

Transaction Risk

Transaction risk is the risk that the exchange rate will change between the time an order is placed and the time it is executed. This can result in a loss for the investor if the exchange rate moves in an unfavorable direction.

Translation Risk

Translation risk is the risk that the financial statements of a company will be distorted when they are translated from one currency to another. This can occur when the exchange rate changes between the time the financial statements are prepared and the time they are translated.

There are a number of methods that can be used to mitigate these risks. These methods include:

- Hedging

- Diversification

- Currency matching

Regulatory and Legal Considerations

Foreign exchange transactions are subject to a complex web of regulations and laws that vary from country to country. These regulations are designed to ensure the stability of the financial system, protect investors, and prevent money laundering and other financial crimes.

One of the most important regulatory frameworks governing foreign exchange transactions is the Basel Accords. The Basel Accords are a set of international banking regulations that were developed by the Basel Committee on Banking Supervision (BCBS). The BCBS is a group of central bank governors and supervisors from around the world that was established in 1974 to promote the safety and soundness of the global financial system.

The Basel Accords set out minimum capital requirements for banks that are engaged in foreign exchange transactions. These capital requirements are designed to ensure that banks have sufficient capital to absorb losses that may arise from foreign exchange fluctuations.

Investigate the pros of accepting foreign exchange market perfect competition in your business strategies.

In addition to the Basel Accords, there are a number of other regulations that govern foreign exchange transactions. These regulations include the Foreign Exchange Management Act (FEMA) in India, the Foreign Exchange and Foreign Trade Act (FETFA) in Japan, and the Foreign Exchange Control Act (FECA) in South Africa.

These regulations typically require banks to obtain a license from the central bank before they can engage in foreign exchange transactions. They also set out a number of other requirements, such as the requirement to maintain a certain level of foreign exchange reserves and the requirement to report all foreign exchange transactions to the central bank.

Legal Implications of Cross-Border Currency Exchange

The legal implications of cross-border currency exchange can be complex. These implications vary depending on the countries involved and the amount of money being exchanged.

In some cases, cross-border currency exchange may be subject to capital controls. Capital controls are restrictions on the movement of money across borders. These controls can make it difficult or expensive to exchange currency, and they can also affect the value of the currency.

In addition to capital controls, there are a number of other legal issues that can arise in connection with cross-border currency exchange. These issues include the following:

- Taxation: Cross-border currency exchange may be subject to taxation in both the country where the currency is exchanged and the country where the currency is received.

- Money laundering: Cross-border currency exchange can be used to launder money. Money laundering is the process of converting illegally obtained money into legitimate money.

- Fraud: Cross-border currency exchange can be used to commit fraud. Fraud is the intentional deception of another person for the purpose of obtaining something of value.

Role of Central Banks in Managing Foreign Exchange Risks

Central banks play a critical role in managing foreign exchange risks. These risks include the risk of exchange rate fluctuations, the risk of currency devaluation, and the risk of capital flight.

Central banks can use a variety of tools to manage foreign exchange risks. These tools include the following:

- Monetary policy: Central banks can use monetary policy to influence the value of their currency. Monetary policy refers to the actions that a central bank takes to control the money supply and interest rates.

- Foreign exchange intervention: Central banks can buy and sell foreign currencies in order to influence the value of their currency. Foreign exchange intervention is the process of buying or selling foreign currencies in the foreign exchange market.

- Capital controls: Central banks can impose capital controls in order to restrict the movement of money across borders. Capital controls can make it difficult or expensive to exchange currency, and they can also affect the value of the currency.

Central banks use these tools to achieve a variety of objectives, including the following:

- Stabilizing the exchange rate

- Preventing currency devaluation

- Preventing capital flight

- Promoting economic growth

Forecasting and Risk Management: Capital Market Foreign Exchange Risks

Managing foreign exchange risks requires accurate forecasting of currency exchange rates and effective risk management strategies. This section explores the techniques used for forecasting and provides examples of risk management strategies for foreign exchange exposure.

Forecasting Currency Exchange Rates

Various techniques are employed to forecast currency exchange rates, including:

- Technical analysis: This approach uses historical price data to identify patterns and trends that may indicate future price movements.

- Fundamental analysis: This approach considers economic factors such as interest rates, inflation, and economic growth to forecast currency values.

- Econometric models: These statistical models use historical data and economic variables to predict future exchange rates.

- Expert judgment: Forecasts are made based on the opinions of experienced currency traders and economists.

Risk Management Strategies

To manage foreign exchange exposure, businesses can employ various risk management strategies:

- Hedging: Using financial instruments such as forwards, futures, or options to lock in exchange rates and reduce risk.

- Diversification: Investing in assets denominated in different currencies to reduce the impact of fluctuations in a single currency.

- Natural hedging: Matching foreign currency receivables and payables to offset exchange rate risks.

- Contingency planning: Developing plans to respond to unexpected currency fluctuations, such as adjusting prices or sourcing from alternative suppliers.

Importance of Scenario Analysis

Scenario analysis is crucial for managing foreign exchange risks as it allows businesses to assess the potential impact of different exchange rate scenarios on their operations and financial performance. By considering various scenarios, businesses can develop contingency plans and make informed decisions to mitigate risks and optimize their foreign exchange exposure.

Impact on Capital Markets

Foreign exchange risks can significantly impact capital flows and investment returns in global markets.

Impact on Capital Flows, Capital market foreign exchange risks

Currency fluctuations can affect the flow of capital across borders. When a currency depreciates, foreign investors may become less willing to invest in a country, leading to a decrease in capital inflows. Conversely, when a currency appreciates, it can attract foreign investment, increasing capital inflows.

Impact on Investment Returns

Currency fluctuations can also impact the returns on investments made in foreign markets. If an investor holds an investment denominated in a foreign currency, changes in the exchange rate can affect the value of the investment in their home currency.

Role of Foreign Exchange Markets

Foreign exchange markets play a crucial role in global capital markets. They facilitate the exchange of currencies, enabling investors to diversify their portfolios internationally. The availability of foreign exchange markets reduces the risk associated with investing in foreign markets by allowing investors to hedge against currency fluctuations.

Finish your research with information from foreign exchange market describe.

Case Studies and Examples

Foreign exchange risks can have a significant impact on companies and countries. The following case studies provide examples of how foreign exchange risks have affected real-world entities and the lessons learned from these experiences.

One well-known case study is the impact of the Asian financial crisis on Thailand in 1997. The Thai baht was pegged to the US dollar, and when the US dollar strengthened, the baht became overvalued. This led to a loss of competitiveness for Thai exports and a sharp decline in foreign investment. The Thai government was forced to devalue the baht, which led to a sharp increase in inflation and a recession.

Lessons Learned from Case Studies

- Avoid fixed exchange rates: Fixed exchange rates can lead to overvaluation or undervaluation of a currency, which can make a country less competitive and vulnerable to financial crises.

- Manage foreign exchange risk: Companies and countries should implement strategies to manage foreign exchange risk, such as hedging and diversification.

- Be prepared for volatility: Foreign exchange markets can be volatile, and companies and countries should be prepared for sharp fluctuations in exchange rates.

Best Practices for Managing Foreign Exchange Risks

- Hedging: Hedging is a technique used to reduce foreign exchange risk by entering into a contract that offsets the risk of a change in the exchange rate.

- Diversification: Diversification is a strategy of investing in assets in different countries or currencies to reduce the risk of losses due to exchange rate fluctuations.

- Scenario planning: Scenario planning is a technique used to identify and assess potential future scenarios and develop strategies to mitigate the risks associated with each scenario.

Final Wrap-Up

In conclusion, capital market foreign exchange risks are an integral part of the global financial landscape. By understanding the risks and implementing sound risk management strategies, investors and businesses can navigate currency fluctuations and harness their potential for growth. As the world becomes increasingly interconnected, managing foreign exchange risks will continue to be a critical factor in achieving financial success in the global capital markets.