Foreign exchange market with example – Welcome to the foreign exchange market, where currencies from around the world are traded in a dynamic and ever-evolving marketplace. This comprehensive guide will provide you with an in-depth understanding of the forex market, from its participants and strategies to its analysis and regulation.

As we delve into the intricacies of the forex market, we will explore real-world examples to illustrate the concepts and make the learning process both engaging and accessible.

Market Overview

The foreign exchange market, also known as the forex market or FX market, is a global decentralized marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $5 trillion.

In the forex market, currencies are traded in pairs. The most commonly traded currency pair is the EUR/USD, which represents the exchange rate between the euro and the US dollar. Other popular currency pairs include the USD/JPY, GBP/USD, and AUD/USD.

Find out about how foreign exchange market reference books can deliver the best answers for your issues.

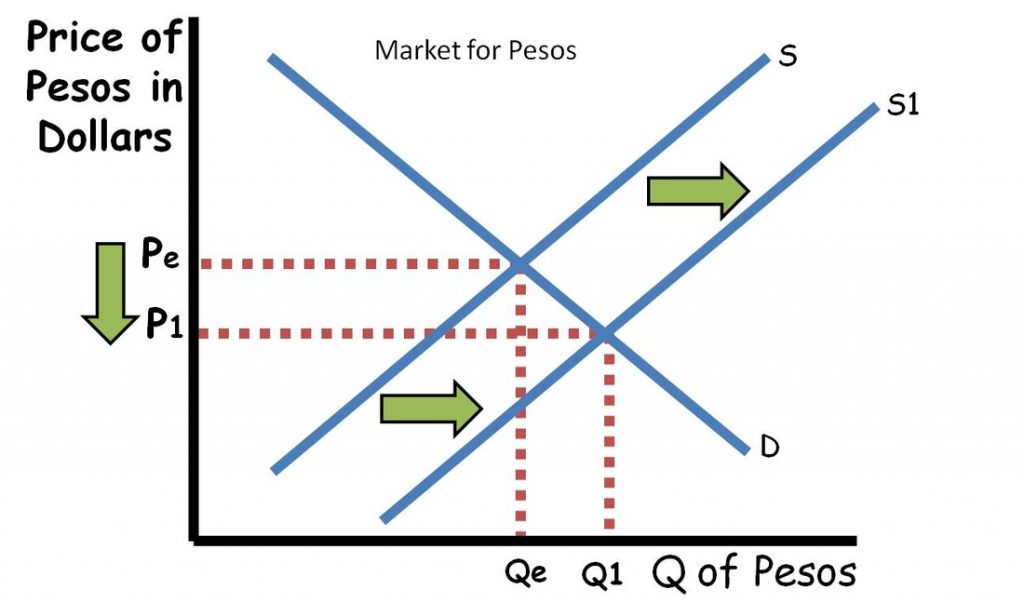

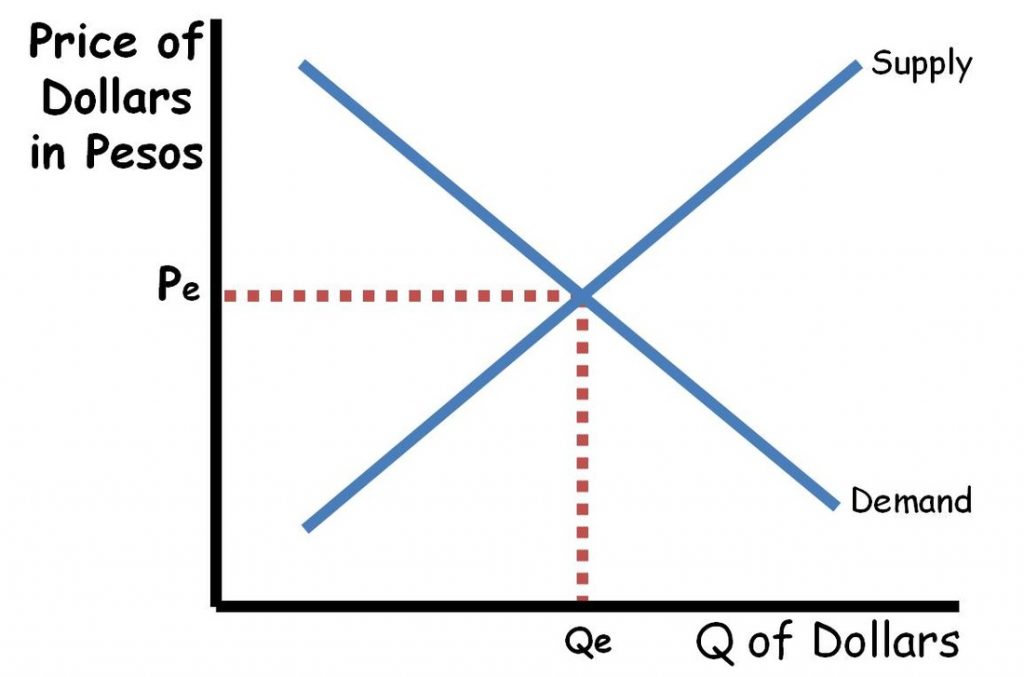

The exchange rate between two currencies is determined by a number of factors, including economic conditions, political stability, and interest rates. When the economic outlook for a country is positive, its currency tends to appreciate against other currencies. Conversely, when the economic outlook for a country is negative, its currency tends to depreciate.

Factors Influencing Exchange Rates, Foreign exchange market with example

- Economic growth

- Interest rates

- Inflation

- Political stability

- Government policies

Economic growth is one of the most important factors that influence exchange rates. When a country’s economy is growing, it tends to attract foreign investment. This increased demand for the country’s currency leads to an appreciation in its value.

Discover how forex market structure has transformed methods in RELATED FIELD.

Interest rates are another important factor that influence exchange rates. When a country’s interest rates are high, it tends to attract foreign investment. This increased demand for the country’s currency leads to an appreciation in its value.

Learn about more about the process of foreign currency markets and exchange rates in the field.

Market Participants

The foreign exchange market, also known as the forex market, is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with an average daily trading volume of over $5 trillion. The market participants in the forex market include banks, hedge funds, retail traders, and central banks.

Banks are the largest participants in the forex market. They provide liquidity to the market by buying and selling currencies on behalf of their clients. Banks also trade currencies for their own account, in order to profit from changes in currency prices.

Hedge funds are investment funds that use sophisticated trading strategies to generate profits. Hedge funds often trade currencies as part of their overall investment strategy.

Retail traders are individuals who trade currencies on their own account. Retail traders typically trade smaller amounts of currency than banks or hedge funds.

Central banks are the monetary authorities of their respective countries. Central banks intervene in the forex market to influence the value of their currency. For example, a central bank may buy or sell its currency in order to stabilize its value against other currencies.

Trading Strategies

The forex market offers a wide range of trading strategies, each with its own advantages and risks. These strategies can be broadly categorized into two main types: technical analysis and fundamental analysis.

Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends that can help predict future price movements. Technical analysts use a variety of indicators and charting techniques to identify these patterns, including moving averages, support and resistance levels, and candlestick patterns.

- Moving averages are calculated by taking the average price of a security over a specified period of time. They can be used to identify trends and potential trading opportunities.

- Support and resistance levels are price levels at which a security has historically found resistance or support. These levels can be used to identify potential trading opportunities and set stop-loss and take-profit orders.

- Candlestick patterns are graphical representations of price movements over a specific period of time. They can be used to identify potential trading opportunities and confirm trends.

Fundamental Analysis

Fundamental analysis involves studying the economic and political factors that can affect the value of a currency. Fundamental analysts consider factors such as economic growth, inflation, interest rates, and political stability when making trading decisions.

- Economic growth is a key factor that can affect the value of a currency. Strong economic growth can lead to increased demand for a currency, which can cause its value to rise.

- Inflation is another important factor that can affect the value of a currency. High inflation can erode the value of a currency, while low inflation can help to preserve its value.

- Interest rates are also a key factor that can affect the value of a currency. Higher interest rates can make a currency more attractive to investors, which can lead to increased demand and a rise in its value.

- Political stability is another important factor that can affect the value of a currency. Political instability can lead to uncertainty and risk aversion, which can cause investors to sell a currency and its value to fall.

Risk Management

Risk management is essential in forex trading. The forex market is a volatile market, and there is always the potential for losses. Traders should use a variety of risk management techniques to protect their capital, including stop-loss orders, position sizing, and diversification.

- Stop-loss orders are used to limit the amount of money that a trader can lose on a trade. A stop-loss order is placed at a predetermined price level, and if the price of the security reaches that level, the order will be executed and the trade will be closed.

- Position sizing is another important risk management technique. Traders should only risk a small percentage of their capital on any one trade. This will help to protect their capital in the event of a losing trade.

- Diversification is also a key risk management technique. Traders should diversify their portfolio by trading a variety of different currencies. This will help to reduce the risk of losses in any one currency.

Market Analysis: Foreign Exchange Market With Example

Market analysis involves examining past and present market data to predict future price movements. Technical indicators and economic data play crucial roles in this process.

Technical Indicators

Technical indicators are mathematical formulas that analyze price data to identify trends, patterns, and trading opportunities. Some common indicators include:

- Moving averages: Show the average price over a specified period, smoothing out price fluctuations.

- Bollinger Bands: Calculate the standard deviation of price movements to identify overbought and oversold conditions.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to assess market momentum.

Economic Data

Economic data provides insights into the health of economies and can impact exchange rate movements. Important indicators include:

- Gross Domestic Product (GDP): Measures the value of goods and services produced in a country.

- Consumer Price Index (CPI): Tracks changes in the prices of goods and services purchased by consumers.

- Interest rates: Set by central banks, they influence the cost of borrowing and can affect currency demand.

Chart Interpretation

Traders analyze charts to identify potential trading opportunities. Candlestick charts show the open, close, high, and low prices for a specific period. Patterns like double tops, triple bottoms, and head-and-shoulders formations can indicate potential reversals or continuations.

By combining technical indicators, economic data, and chart analysis, traders can develop informed trading strategies to capitalize on market movements.

Market Regulation

The foreign exchange market, despite its global reach and immense size, operates under a complex regulatory framework designed to maintain market stability, protect investors, and prevent illicit activities.

This framework involves a combination of national regulations, international agreements, and the involvement of various organizations, each playing a crucial role in overseeing the forex market.

National Regulations

Individual countries have established their own regulatory bodies to supervise the forex market within their jurisdictions. These bodies, such as the Commodity Futures Trading Commission (CFTC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, are responsible for:

- Licensing and monitoring forex brokers

- Enforcing anti-money laundering and counter-terrorism financing regulations

- Investigating and prosecuting forex fraud

International Organizations

In addition to national regulations, several international organizations play a significant role in regulating the forex market:

- Bank for International Settlements (BIS): The BIS serves as a central bank for central banks and facilitates international cooperation on financial stability issues, including forex market regulation.

- International Monetary Fund (IMF): The IMF provides financial assistance to member countries and promotes economic stability worldwide. It also monitors the forex market and provides guidance on best practices for regulation.

- Financial Stability Board (FSB): The FSB is an international body that coordinates financial regulation and promotes financial stability. It has established principles for regulating the forex market and monitors its implementation.

Challenges and Opportunities for Regulation

Regulating the forex market presents several challenges:

- Cross-border nature: The forex market is global, making it difficult for individual countries to effectively regulate all activities.

- Technological advancements: The rapid development of technology has created new opportunities for forex trading, but it has also made it easier for criminals to engage in illicit activities.

- Complexity: The forex market is complex, with a wide range of products and instruments. This complexity makes it difficult to develop effective regulations.

Despite these challenges, there are also opportunities for improving forex market regulation:

- Increased cooperation: International cooperation can help to address the cross-border nature of the forex market and prevent regulatory loopholes.

- Innovation: Technological advancements can be used to enhance regulatory oversight and detect illicit activities.

- Education: Educating market participants about the risks of forex trading and the importance of compliance can help to prevent fraud and promote market integrity.

Closing Summary

In conclusion, the foreign exchange market is a complex and fascinating arena where global currencies interact, influenced by a myriad of factors. Understanding its dynamics and mastering trading strategies can open up a world of opportunities for those seeking to navigate the ever-changing financial landscape.

Whether you are a seasoned trader or just starting your journey into the forex market, this guide has equipped you with the essential knowledge and tools to succeed.