Foreign exchange market a level economics – In the realm of international finance, the foreign exchange market stands as a dynamic and ever-evolving landscape. A-level economics students embarking on this subject will delve into the intricate workings of this global marketplace, exploring the factors that drive currency exchange rates and their profound impact on businesses worldwide.

From understanding the participants and functions of the foreign exchange market to analyzing the role of central banks and mitigating foreign exchange risks, this comprehensive guide will equip students with a solid foundation in this captivating field.

Definition of Foreign Exchange Market

The foreign exchange market, often abbreviated as forex or FX, is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with an estimated daily trading volume of over $5 trillion.

You also can investigate more thoroughly about foreign exchange market introduction essay to enhance your awareness in the field of foreign exchange market introduction essay.

The participants in the foreign exchange market include banks, investment firms, hedge funds, corporations, and individual traders. These participants buy and sell currencies for various reasons, such as international trade, investment, and speculation.

Functions of the Foreign Exchange Market

The foreign exchange market serves several important functions, including:

- Facilitating international trade: The foreign exchange market allows businesses to exchange currencies so they can import and export goods and services from other countries.

- Providing liquidity: The foreign exchange market provides liquidity to participants, which means they can quickly and easily buy and sell currencies at a fair price.

- Hedging against risk: The foreign exchange market allows participants to hedge against currency risk. This means they can protect themselves from the effects of currency fluctuations.

- Speculation: The foreign exchange market is also a popular market for speculation. Traders buy and sell currencies in the hope of making a profit.

Factors Affecting Foreign Exchange Rates

Foreign exchange rates are constantly fluctuating due to a complex interplay of economic and political factors. Understanding these factors is crucial for businesses and individuals involved in international trade and investments.

Economic Factors

- Economic growth: Countries with strong economic growth tend to experience appreciation in their currencies, as increased demand for their goods and services attracts foreign investment.

- Interest rates: Higher interest rates make a country’s currency more attractive to investors, leading to appreciation. This is because investors seek higher returns on their investments.

- Inflation: High inflation erodes the value of a currency, leading to depreciation. This is because investors are less willing to hold a currency that is losing purchasing power.

- Balance of payments: A country with a persistent trade deficit (imports exceeding exports) may experience depreciation in its currency, as foreign exchange is required to pay for the trade imbalance.

Political Factors

- Political stability: Countries with stable political environments tend to have stronger currencies, as investors are more confident in the long-term value of their investments.

- Government policies: Government policies, such as monetary and fiscal policies, can influence exchange rates. For example, expansionary monetary policies can lead to currency depreciation.

- International relations: Tensions between countries or geopolitical events can affect exchange rates. For instance, trade wars or sanctions can cause currencies to depreciate.

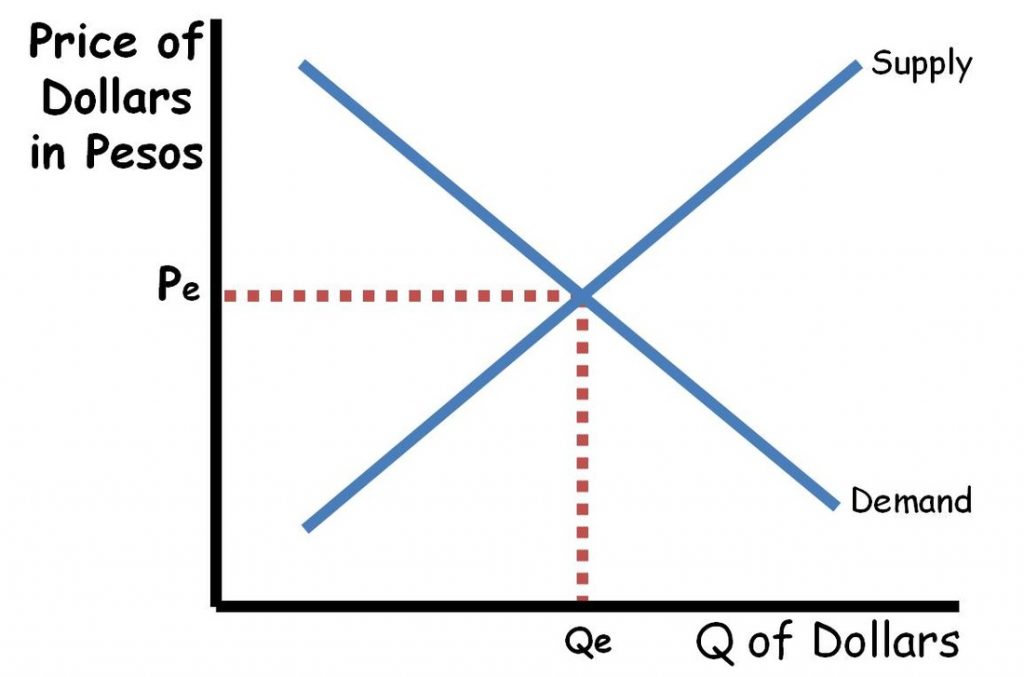

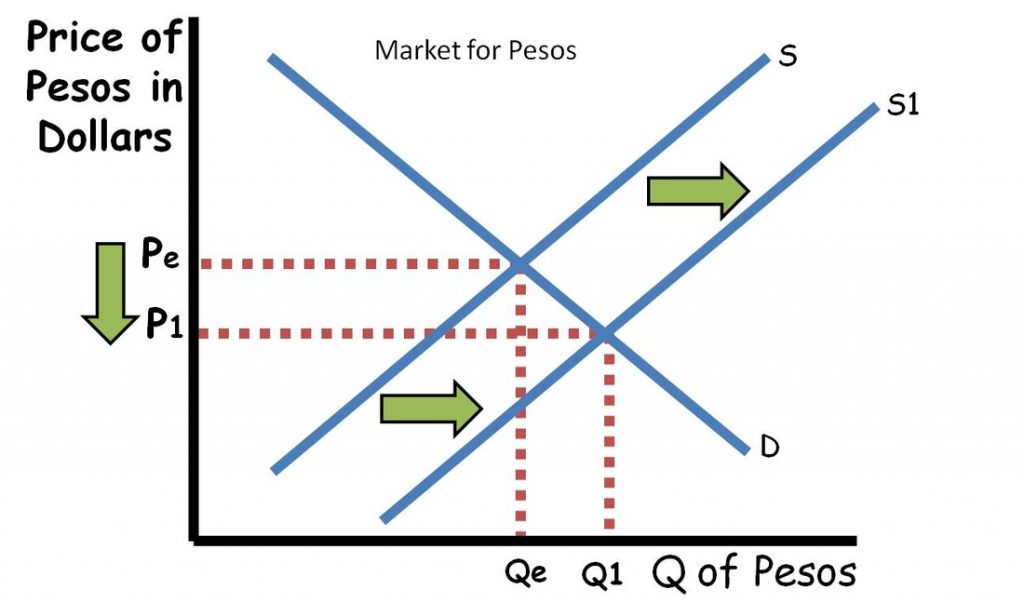

Role of Supply and Demand

The foreign exchange market operates on the principles of supply and demand. When the demand for a currency exceeds its supply, its value appreciates. Conversely, when supply exceeds demand, the currency depreciates.

Obtain access to meaning of foreign exchange market in simple language to private resources that are additional.

Types of Foreign Exchange Transactions

Foreign exchange transactions are broadly classified into three types: spot transactions, forward transactions, and swaps.

Spot transactions are the most common type of foreign exchange transaction. They involve the immediate exchange of one currency for another at the current market rate. For example, if you are traveling to the United States from the United Kingdom, you would need to exchange your British pounds for US dollars. You could do this by going to a bank or currency exchange and exchanging your pounds for dollars at the current spot rate.

Forward transactions are similar to spot transactions, but they involve the exchange of currencies at a future date. Forward transactions are typically used to hedge against currency fluctuations. For example, if you are a US company that is expecting to receive a payment in euros in the future, you could enter into a forward contract to sell euros at a fixed rate. This would protect you from the risk of the euro depreciating against the dollar before you receive the payment.

Over-the-Counter vs. Exchange-Traded Markets

Foreign exchange transactions can be executed in either the over-the-counter (OTC) market or the exchange-traded market.

The OTC market is a decentralized market where foreign exchange transactions are traded directly between two parties. The OTC market is the largest market for foreign exchange trading, and it is where most spot and forward transactions are executed.

The exchange-traded market is a centralized market where foreign exchange transactions are traded on an exchange. The exchange-traded market is a smaller market than the OTC market, and it is where most futures and options contracts are traded.

Derivatives in Foreign Exchange Trading

Derivatives are financial instruments that derive their value from an underlying asset. In foreign exchange trading, derivatives are used to hedge against currency fluctuations and to speculate on currency movements.

The most common types of derivatives used in foreign exchange trading are futures and options.

Obtain direct knowledge about the efficiency of foreign exchange market control meaning through case studies.

- Futures contracts are standardized contracts that obligate the buyer to purchase a certain amount of a currency at a fixed price on a future date.

- Options contracts give the buyer the right, but not the obligation, to purchase or sell a certain amount of a currency at a fixed price on a future date.

Derivatives can be a complex and risky, but they can also be a powerful tool for managing currency risk.

Role of Central Banks in the Foreign Exchange Market

Central banks play a significant role in the foreign exchange market, intervening to achieve various objectives, including stabilizing exchange rates, managing inflation, and influencing monetary conditions. They use monetary policy tools to influence the exchange rate, such as adjusting interest rates, buying or selling foreign currencies, and implementing capital controls.

Objectives of Central Bank Intervention, Foreign exchange market a level economics

Central banks intervene in the foreign exchange market to achieve several objectives, including:

- Stabilizing Exchange Rates: Central banks may intervene to prevent excessive fluctuations in the exchange rate, which can disrupt trade and investment.

- Managing Inflation: Central banks may intervene to influence the exchange rate to manage inflation. A weaker exchange rate can make imports more expensive, potentially contributing to inflation.

- Influencing Monetary Conditions: Central banks may intervene to influence monetary conditions, such as interest rates and the money supply. By buying or selling foreign currencies, central banks can affect the domestic money supply and influence interest rates.

Monetary Policy Tools

Central banks use various monetary policy tools to influence exchange rates, including:

- Interest Rate Adjustments: Central banks can adjust interest rates to influence the exchange rate. Raising interest rates can make the domestic currency more attractive to investors, leading to an appreciation in its value.

- Foreign Exchange Intervention: Central banks can directly intervene in the foreign exchange market by buying or selling foreign currencies. Buying foreign currencies can lead to a depreciation of the domestic currency, while selling foreign currencies can lead to an appreciation.

- Capital Controls: Central banks may implement capital controls to restrict the flow of capital into or out of the country. This can influence the exchange rate by limiting the demand for or supply of foreign currencies.

Examples of Central Bank Intervention Strategies

Central banks have used various intervention strategies in the foreign exchange market, including:

- Swiss National Bank: The Swiss National Bank has intervened heavily in the foreign exchange market to prevent the Swiss franc from appreciating too much against the euro.

- Bank of Japan: The Bank of Japan has intervened in the foreign exchange market to weaken the yen against the US dollar to boost exports and stimulate the economy.

- People’s Bank of China: The People’s Bank of China has implemented capital controls to manage the flow of foreign currencies and stabilize the exchange rate.

Impact of the Foreign Exchange Market on Businesses

The foreign exchange market significantly impacts businesses operating internationally. Fluctuations in exchange rates can affect their revenue, expenses, and profitability.

Businesses face currency risk when they engage in transactions denominated in foreign currencies. Currency risk arises from the potential loss or gain resulting from changes in exchange rates. Managing currency risk is crucial for businesses to protect their financial performance and stability.

Strategies to Mitigate Foreign Exchange Risks

Businesses can adopt various strategies to mitigate foreign exchange risks:

- Natural Hedging: Matching foreign currency receivables with payables to reduce exposure.

- Forward Contracts: Locking in an exchange rate for future transactions to minimize uncertainty.

- Currency Options: Giving businesses the right, but not the obligation, to buy or sell foreign currencies at a specified exchange rate.

- Diversification: Operating in multiple countries to reduce reliance on a single currency.

Final Summary: Foreign Exchange Market A Level Economics

In conclusion, the foreign exchange market presents a complex and fascinating subject that challenges students to think critically and apply economic principles to real-world scenarios. By grasping the intricacies of this dynamic marketplace, A-level economics students will gain invaluable insights into the global economy and the forces that shape international trade and investment.