Functions and significance of foreign exchange market – The foreign exchange market, a global marketplace where currencies are traded, plays a pivotal role in facilitating international trade, enabling currency conversion, and providing liquidity and price discovery for currencies. Its significance extends far beyond these core functions, impacting global economic growth, exchange rates, and foreign exchange risk management.

As the backbone of international commerce, the foreign exchange market enables businesses and individuals to exchange currencies seamlessly, allowing for cross-border transactions and investments. It provides a platform for currency conversion, ensuring that businesses can operate globally and individuals can travel and transact internationally without currency barriers.

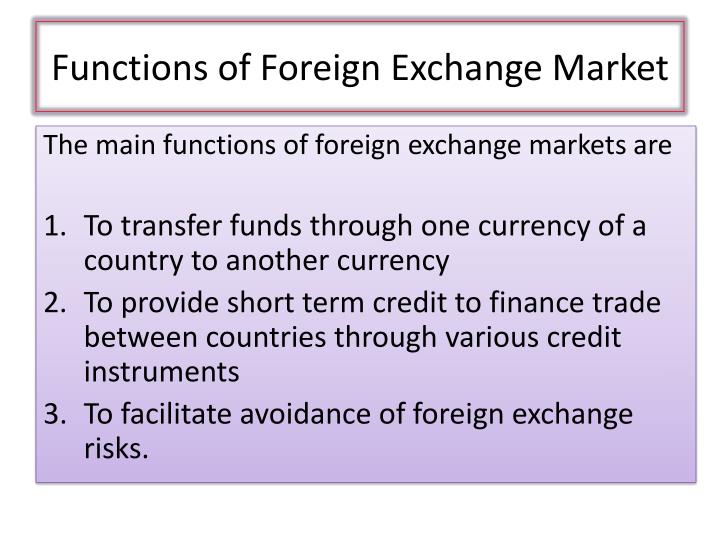

Functions of the Foreign Exchange Market

The foreign exchange market is a global marketplace where currencies are traded. It plays a crucial role in facilitating international trade, enabling currency conversion for businesses and individuals, and providing liquidity and price discovery for currencies.

Facilitating International Trade

International trade requires the exchange of currencies to settle payments between buyers and sellers. The foreign exchange market provides a platform for this exchange, allowing businesses to convert their currencies into the currencies of their trading partners.

Currency Conversion

Individuals and businesses often need to convert currencies for various reasons, such as travel, investments, or business transactions. The foreign exchange market enables these conversions by providing a network of banks, brokers, and other financial institutions that offer currency exchange services.

Liquidity and Price Discovery

The foreign exchange market provides liquidity, ensuring that there are always buyers and sellers willing to trade currencies. This liquidity allows for efficient price discovery, as the market constantly adjusts prices to reflect supply and demand.

Significance of the Foreign Exchange Market

The foreign exchange market, as a global marketplace for currency exchange, plays a pivotal role in facilitating international trade and investments. Its significance extends beyond currency conversion, shaping the global economic landscape in various ways.

Impact on Global Economic Growth

The foreign exchange market enables the smooth flow of capital across borders, facilitating foreign direct investments (FDIs) and international trade. By providing a platform for currency conversion, it allows businesses to invest in global markets and expand their operations internationally. This increased investment and trade activity contribute to economic growth and job creation worldwide.

Influence on Exchange Rates

The foreign exchange market determines exchange rates, which are crucial for businesses and consumers engaging in international transactions. Fluctuations in exchange rates can impact the profitability of exports and imports, as well as the purchasing power of consumers when traveling or buying foreign goods.

Management of Foreign Exchange Risk

The foreign exchange market provides financial instruments and strategies for businesses and investors to manage foreign exchange risk. These instruments, such as forward contracts and currency options, allow them to mitigate the impact of exchange rate fluctuations on their financial positions and protect against potential losses.

Browse the implementation of foreign exchange market meaning functions determination of equilibrium rate of exchange in real-world situations to understand its applications.

Participants in the Foreign Exchange Market

The foreign exchange market is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion.

There are many different participants in the foreign exchange market, including banks, corporations, central banks, and individual investors. Each type of participant has different roles and motivations in the market.

Banks

Banks are the largest participants in the foreign exchange market. They act as intermediaries between buyers and sellers of currencies, and they also provide a range of other services, such as currency exchange and hedging.

Banks have a number of motivations for participating in the foreign exchange market. They may trade currencies to facilitate international trade, to hedge against currency risk, or to speculate on currency movements.

Corporations

Corporations are another major participant in the foreign exchange market. They trade currencies to facilitate international trade and to hedge against currency risk.

For example, a U.S. company that imports goods from China may need to buy Chinese yuan to pay for those goods. The company can buy yuan in the foreign exchange market from a bank or another corporation.

Central Banks

Central banks are the monetary authorities of their respective countries. They participate in the foreign exchange market to manage their countries’ exchange rates and to implement monetary policy.

For example, the Federal Reserve (the central bank of the United States) may buy or sell U.S. dollars in the foreign exchange market to influence the value of the dollar relative to other currencies.

Check foreign exchange market meaning and concept to inspect complete evaluations and testimonials from users.

Individual Investors

Individual investors also participate in the foreign exchange market, although they account for a relatively small share of overall trading volume.

Individual investors may trade currencies for a variety of reasons, such as to speculate on currency movements or to hedge against currency risk.

Impact of Central Bank Interventions

Central bank interventions can have a significant impact on the foreign exchange market. By buying or selling currencies, central banks can influence the value of those currencies relative to other currencies.

You also will receive the benefits of visiting foreign exchange market today in nigeria today.

For example, if the Federal Reserve buys U.S. dollars in the foreign exchange market, the value of the dollar will tend to rise relative to other currencies. This is because the increased demand for dollars will make them more expensive.

Market Structure and Trading

The foreign exchange market operates through a decentralized network of banks, brokers, and other financial institutions. It consists of two main segments: the spot market and the forward market.

The spot market involves the immediate exchange of currencies, with settlement typically occurring within two business days. The forward market, on the other hand, allows participants to buy or sell currencies at a predetermined rate for delivery at a future date.

Types of Foreign Exchange Transactions

- Spot transactions: The purchase or sale of currencies for immediate delivery.

- Forward transactions: The purchase or sale of currencies for delivery at a specified future date.

- Swap transactions: The simultaneous purchase and sale of currencies with different delivery dates.

- Option transactions: The purchase of the right, but not the obligation, to buy or sell a currency at a specified price on or before a certain date.

Factors Influencing Foreign Exchange Rates, Functions and significance of foreign exchange market

Foreign exchange rates are influenced by various factors, including:

- Economic data: Economic indicators such as GDP growth, inflation, and interest rates affect the relative attractiveness of different currencies.

- Political events: Political instability, wars, and elections can lead to currency fluctuations.

- Central bank policies: Central banks intervene in the foreign exchange market to influence currency values and maintain stability.

- Supply and demand: The availability of currencies in the market and the demand for them affect exchange rates.

Regulation and Supervision: Functions And Significance Of Foreign Exchange Market

The foreign exchange market is a global and decentralized market, operating 24 hours a day, five days a week. Due to its size and complexity, it is essential to have a robust regulatory framework in place to ensure market stability and prevent manipulation.

The regulatory framework governing the foreign exchange market consists of a combination of international agreements and national regulations. International agreements, such as the Basel Accords, set out minimum standards for capital adequacy and risk management for banks and other financial institutions involved in foreign exchange trading. National regulations vary from country to country, but typically include measures to prevent insider trading, market manipulation, and other forms of financial crime.

Regulatory bodies play a crucial role in ensuring market stability and preventing manipulation. These bodies have the authority to investigate and prosecute violations of foreign exchange regulations, and to impose sanctions on individuals and institutions that engage in misconduct.

The challenges and trends in foreign exchange market regulation include the increasing use of electronic trading platforms, the globalization of the market, and the emergence of new financial instruments. These developments have made it more difficult for regulators to monitor and supervise the market, and have led to calls for increased international cooperation and coordination in the area of foreign exchange regulation.

Final Conclusion

In summary, the foreign exchange market serves as a vital cog in the global financial system, facilitating international trade, enabling currency conversion, and providing liquidity and price discovery for currencies. Its impact extends to businesses, consumers, and economies worldwide, underscoring its significance in today’s interconnected world.