As shifters of foreign exchange market ap macro take center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Foreign exchange rates are constantly fluctuating, driven by a complex interplay of economic, political, and market factors. Understanding these shifters is crucial for businesses, investors, and policymakers alike.

Factors Influencing Foreign Exchange Rates

Foreign exchange rates are the values of currencies relative to each other. They are constantly fluctuating due to a variety of factors, including economic growth, political stability, and interest rate differentials.

Economic Growth

Economic growth is a major factor that affects currency values. When an economy is growing, it is generally seen as a more attractive investment destination, which leads to an increase in demand for its currency. This, in turn, leads to an appreciation of the currency’s value.

For example, the Chinese economy has been growing rapidly in recent years. This has led to an increase in demand for the Chinese yuan, which has appreciated in value against other currencies.

Examine how foreign exchange market meaning in urdu can boost performance in your area.

Political Stability

Political stability is another important factor that affects currency values. When a country is politically stable, it is seen as a more attractive investment destination, which leads to an increase in demand for its currency. This, in turn, leads to an appreciation of the currency’s value.

For example, the Swiss franc is often seen as a safe haven currency. This is because Switzerland is a politically stable country with a strong economy. As a result, the Swiss franc tends to appreciate in value during periods of political uncertainty.

Interest Rate Differentials

Interest rate differentials are the differences in interest rates between two countries. When a country has a higher interest rate than another country, it makes it more attractive for investors to invest in that country. This leads to an increase in demand for the country’s currency, which, in turn, leads to an appreciation of the currency’s value.

For example, the United States has a higher interest rate than the European Union. This has led to an increase in demand for the US dollar, which has appreciated in value against the euro.

Major Shifters of Foreign Exchange Market

The foreign exchange market is a dynamic and complex system, influenced by a myriad of factors. Understanding these factors is crucial for comprehending currency movements and making informed investment decisions.

The major shifters of the foreign exchange market can be broadly categorized into two groups: economic fundamentals and market sentiment. Economic fundamentals refer to the underlying economic conditions of a country, such as its GDP growth rate, inflation, and trade balance. Market sentiment, on the other hand, reflects the collective expectations and attitudes of market participants towards a particular currency.

Trade Imbalances

Trade imbalances occur when a country’s imports exceed its exports. A persistent trade deficit can lead to a depreciation of the country’s currency, as the demand for foreign currency to pay for imports outweighs the supply of foreign currency earned from exports. Conversely, a trade surplus can lead to an appreciation of the currency.

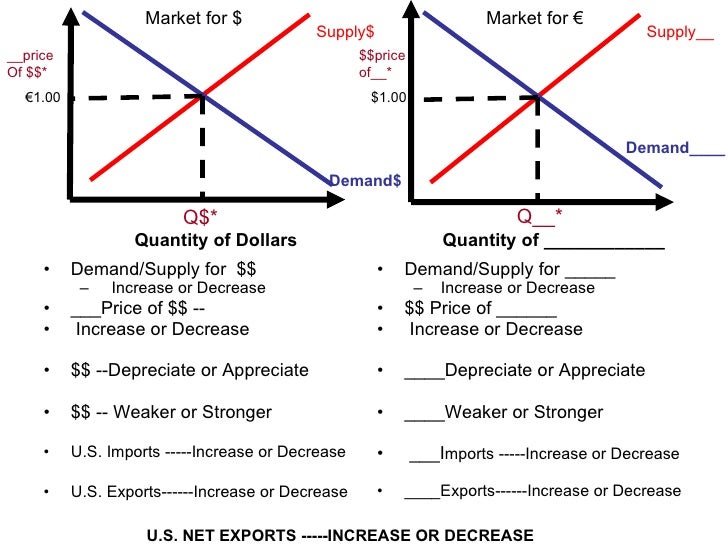

You also will receive the benefits of visiting foreign exchange market graph macroeconomics today.

- A trade deficit can weaken a currency by increasing the demand for foreign currency.

- A trade surplus can strengthen a currency by reducing the demand for foreign currency.

Capital Flows

Capital flows refer to the movement of funds across borders in search of higher returns or safer havens. Foreign direct investment (FDI), portfolio investment, and currency speculation are all examples of capital flows.

- An inflow of capital can strengthen a currency by increasing the demand for the currency.

- An outflow of capital can weaken a currency by reducing the demand for the currency.

Central Bank Intervention

Central bank intervention involves actions taken by a central bank to influence the exchange rate of its currency. It is used to achieve various economic objectives, such as maintaining a stable exchange rate, promoting economic growth, and controlling inflation.

Central banks use various methods to intervene in the foreign exchange market, including buying or selling foreign currencies, adjusting interest rates, and imposing capital controls.

Methods of Central Bank Intervention

- Buying or selling foreign currencies: Central banks can buy or sell foreign currencies in the foreign exchange market to influence the exchange rate. By buying a foreign currency, the central bank increases the demand for that currency, which leads to an appreciation of its value. Conversely, by selling a foreign currency, the central bank decreases the demand for that currency, which leads to a depreciation of its value.

- Adjusting interest rates: Central banks can also influence the exchange rate by adjusting interest rates. Higher interest rates make a currency more attractive to investors, which leads to an appreciation of its value. Conversely, lower interest rates make a currency less attractive to investors, which leads to a depreciation of its value.

- Imposing capital controls: Capital controls are restrictions on the movement of capital into and out of a country. Central banks can impose capital controls to limit the supply of foreign currencies in the foreign exchange market, which can lead to an appreciation of the domestic currency.

Stabilizing Currencies

Central bank intervention can be used to stabilize currencies and prevent excessive volatility in the foreign exchange market. By buying or selling foreign currencies, central banks can smooth out fluctuations in the exchange rate and prevent sharp movements that could harm the economy.

Discover more by delving into function functions of foreign exchange market further.

For example, if the exchange rate of a country’s currency is falling rapidly, the central bank can intervene by buying the currency. This will increase the demand for the currency and help to stabilize its value.

Risks of Central Bank Intervention

While central bank intervention can be effective in influencing exchange rates, it also carries some potential risks.

- Moral hazard: Central bank intervention can create a moral hazard, where market participants come to expect that the central bank will always intervene to support the exchange rate. This can lead to excessive risk-taking and speculation in the foreign exchange market.

- Loss of credibility: If the central bank is unable to maintain the exchange rate at the desired level, it can lose credibility. This can lead to a loss of confidence in the currency and make it more difficult for the central bank to influence the exchange rate in the future.

- International tensions: Central bank intervention can also lead to international tensions, as other countries may view it as an attempt to manipulate the exchange rate to gain an unfair advantage.

Market Participants and Their Impact

The foreign exchange market is a vast and complex global network of individuals, institutions, and organizations involved in the buying and selling of currencies. These participants play a crucial role in determining foreign exchange rates and influencing currency volatility.

The major participants in the foreign exchange market include:

- Commercial banks: These banks facilitate the majority of foreign exchange transactions, acting as intermediaries between buyers and sellers.

- Central banks: Central banks intervene in the foreign exchange market to influence the value of their currencies, often to achieve specific economic or monetary policy objectives.

- Institutional investors: These include hedge funds, mutual funds, and pension funds that invest in foreign currencies as part of their asset allocation strategies.

- Corporations: Multinational corporations engage in foreign exchange transactions to facilitate international trade and manage currency risk.

- Individual investors: Retail investors participate in the foreign exchange market through brokers and online platforms, often for speculative purposes.

Speculators and Currency Volatility

Speculators are a significant force in the foreign exchange market. They buy and sell currencies based on their expectations of future price movements, hoping to profit from fluctuations in exchange rates. Speculative activity can contribute to currency volatility, as speculators can drive up or down the demand for a particular currency, influencing its value.

Hedging and Foreign Exchange Risk

Hedging is a strategy used to mitigate foreign exchange risk. It involves entering into a contract to buy or sell a currency at a predetermined exchange rate in the future. This allows businesses and investors to protect themselves against potential losses due to adverse currency fluctuations.

Forecasting Foreign Exchange Rates

Forecasting foreign exchange rates is a crucial aspect of currency trading and risk management. Various methods are employed to predict future exchange rate movements, each with its advantages and limitations.

Common Methods Used to Forecast Exchange Rates

Some common methods used to forecast exchange rates include:

- Fundamental analysis: Examines economic and political factors that influence currency values, such as GDP growth, inflation, interest rates, and political stability.

- Technical analysis: Analyzes historical price data to identify patterns and trends that may indicate future price movements.

- Econometric models: Use statistical techniques to estimate the relationship between exchange rates and economic variables, such as interest rate differentials and trade balances.

Examples of How Technical Analysis Can Be Applied to Currency Trading

Technical analysis involves identifying patterns in price charts to predict future price movements. Some commonly used technical indicators include:

- Moving averages: Calculate the average price of a currency over a specified period to smooth out price fluctuations and identify trends.

- Support and resistance levels: Identify price levels where the currency has consistently found support or resistance, indicating potential turning points.

- Candlestick patterns: Analyze the shape and position of candlesticks on a price chart to identify potential trading opportunities.

Limitations of Foreign Exchange Forecasting, Shifters of foreign exchange market ap macro

It is important to note that foreign exchange forecasting is not an exact science. Factors such as unexpected economic events, political turmoil, and market sentiment can impact currency values in unpredictable ways. As a result, forecasting exchange rates can be challenging and subject to a high degree of uncertainty.

Strategies for Managing Foreign Exchange Risk: Shifters Of Foreign Exchange Market Ap Macro

Managing foreign exchange risk is crucial for businesses and individuals engaged in international trade and investments. Various strategies can be employed to mitigate the impact of exchange rate fluctuations.

Hedging

Hedging involves using financial instruments to offset potential losses arising from exchange rate movements. Common hedging techniques include:

- Forward contracts: Legally binding agreements to exchange currencies at a predetermined rate on a future date.

- Currency options: Contracts that give the buyer the right, but not the obligation, to buy or sell a currency at a specified rate within a specified period.

- Currency swaps: Agreements to exchange one currency for another at an agreed-upon exchange rate for a specific period.

Diversification

Diversifying foreign exchange exposure involves investing in assets denominated in different currencies. This strategy aims to reduce the overall risk by balancing potential gains and losses from currency fluctuations. For example, a multinational company may invest in subsidiaries in multiple countries, each generating revenue in local currencies.

Other Strategies

Additional strategies for managing foreign exchange risk include:

- Leading and lagging: Adjusting the timing of payments and receipts to take advantage of expected exchange rate movements.

- Matching: Matching assets and liabilities denominated in the same currency to minimize exposure to exchange rate risk.

- Invoicing in local currency: Reducing the impact of exchange rate fluctuations by invoicing customers in their local currency.

Conclusion

In conclusion, the shifters of foreign exchange market ap macro play a pivotal role in shaping currency movements. Central banks, market participants, and economic fundamentals all contribute to the dynamic nature of the forex market. By understanding these factors, individuals and organizations can navigate the complexities of foreign exchange and make informed decisions.