Welcome to the captivating world of foreign exchange, where currencies dance and economies intertwine. Our comprehensive guide, “Foreign Exchange Market Book in Hindi,” invites you on an immersive journey into this dynamic realm, empowering you with the knowledge and strategies to navigate its complexities.

Through lucid explanations and practical insights, this book unveils the intricacies of exchange rates, market structure, trading strategies, and risk management. Whether you’re a seasoned trader or a curious novice, our expert guidance will equip you to make informed decisions and seize opportunities in the ever-evolving foreign exchange market.

Market Overview

The Indian foreign exchange market is one of the largest and most active in the world, with an average daily turnover of over USD 50 billion.

The market has grown significantly over the past few years, driven by factors such as the liberalization of the Indian economy, the growth of international trade and investment, and the rise of electronic trading platforms.

Obtain direct knowledge about the efficiency of advantages of foreign exchange market in india through case studies.

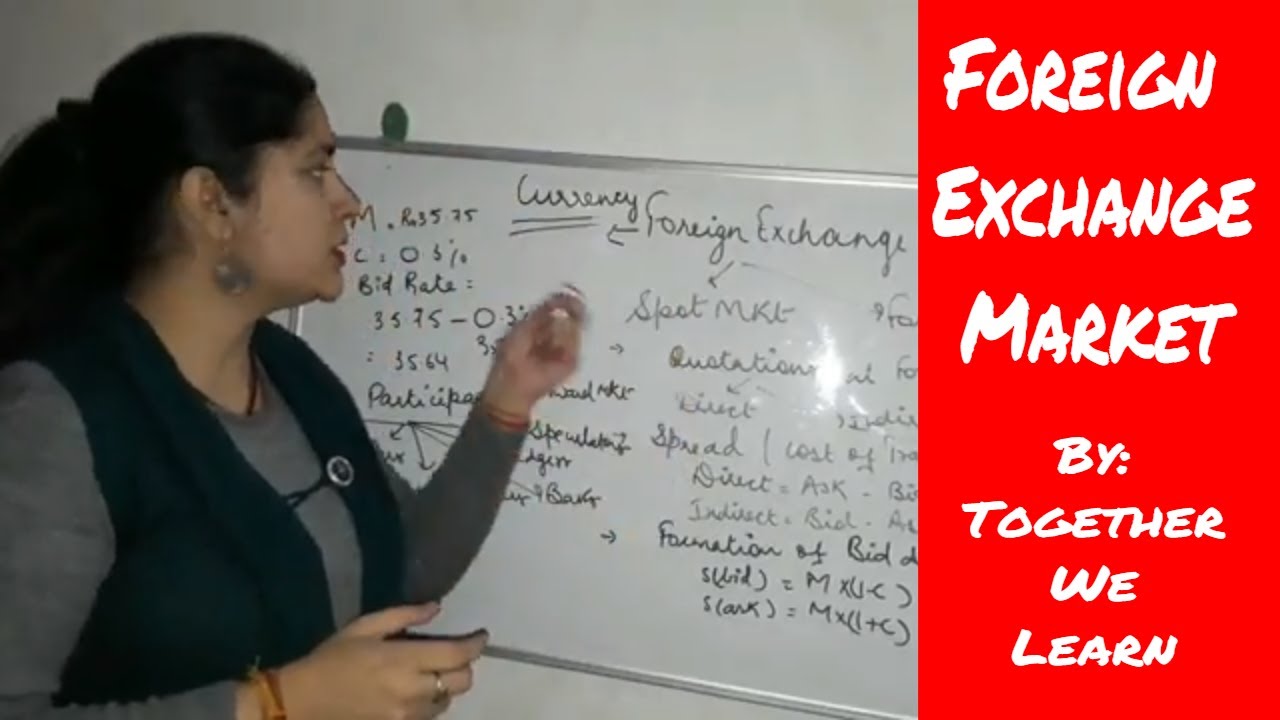

Major Participants

The major participants in the Indian forex market include banks, financial institutions, corporations, and individuals.

- Banks are the largest participants in the market, accounting for over 70% of total turnover.

- Financial institutions, such as mutual funds and hedge funds, are also major participants in the market.

- Corporations use the forex market to hedge their foreign exchange risk and to facilitate international trade.

- Individuals participate in the forex market through retail forex brokers.

Key Concepts: Foreign Exchange Market Book In Hindi

In the foreign exchange market, understanding key concepts is essential. These concepts form the foundation for comprehending the market’s dynamics and making informed decisions.

Obtain direct knowledge about the efficiency of foreign exchange market opening times through case studies.

Let’s delve into the definitions of exchange rate, currency pair, bid-ask spread, and the factors that influence exchange rates. We’ll also explore the different types of foreign exchange transactions.

Exchange Rate

An exchange rate is the value of one currency relative to another. It represents the number of units of one currency required to purchase one unit of another currency.

Currency Pair

A currency pair is a combination of two currencies used to quote an exchange rate. The first currency in the pair is called the base currency, while the second currency is called the counter currency.

Bid-Ask Spread

The bid-ask spread is the difference between the bid price and the ask price of a currency pair. The bid price is the price at which a market maker is willing to buy the base currency, while the ask price is the price at which the market maker is willing to sell the base currency.

Factors Influencing Exchange Rates

- Economic growth

- Inflation

- Interest rates

- Political stability

- Central bank policies

- Supply and demand

Types of Foreign Exchange Transactions

- Spot transactions

- Forward transactions

- Swap transactions

- Options

- Futures

Market Structure

The Indian forex market is a decentralized, over-the-counter (OTC) market. It is not organized like a stock exchange, and there is no central location where all forex transactions take place. Instead, forex trades are executed between two parties, typically a bank and a customer, over the phone or through an electronic trading platform.

The Reserve Bank of India (RBI) is the central bank of India and is responsible for regulating the forex market. The RBI sets the rules and regulations that govern the market, and it also intervenes in the market to manage the value of the rupee.

Market Participants

There are a variety of different types of market participants in the Indian forex market, including:

- Banks: Banks are the most important participants in the forex market. They provide liquidity to the market and they execute trades on behalf of their customers.

- Brokers: Brokers are intermediaries who bring together buyers and sellers of foreign exchange. They do not take on any risk themselves, but they charge a commission for their services.

- Institutional investors: Institutional investors, such as hedge funds and pension funds, are major participants in the forex market. They trade foreign exchange for a variety of reasons, including speculation, hedging, and portfolio diversification.

Trading Strategies

In the foreign exchange market, traders employ a diverse range of strategies to capitalize on market fluctuations. These strategies can be broadly classified into three main categories: technical analysis, fundamental analysis, and algorithmic trading.

Technical Analysis

Technical analysis involves studying historical price data to identify patterns and trends that may provide insights into future price movements. Traders using this approach rely on technical indicators, such as moving averages, Bollinger Bands, and support and resistance levels, to make trading decisions.

Fundamental Analysis

Fundamental analysis focuses on economic and geopolitical factors that influence the value of currencies. Traders using this approach consider macroeconomic data, such as GDP growth, inflation rates, and interest rates, to assess the overall health of an economy and its currency’s potential value.

Algorithmic Trading

Algorithmic trading, also known as automated trading, involves using computer programs to execute trades based on predefined rules. These algorithms can be designed to trade based on technical analysis, fundamental analysis, or a combination of both. Algorithmic trading allows traders to automate their trading strategies and execute trades quickly and efficiently.

The choice of trading strategy depends on the trader’s risk tolerance, time horizon, and investment goals. Technical analysis is suitable for short-term trading, while fundamental analysis is more appropriate for long-term trading. Algorithmic trading can be used for both short-term and long-term trading, depending on the algorithm’s design.

It’s important to note that all trading strategies carry some level of risk. Traders should carefully consider the potential risks and rewards associated with each strategy before making any trading decisions.

Risk Management

In the dynamic and ever-changing forex market, risk management is paramount for traders seeking to navigate the potential pitfalls and maximize their returns. It involves implementing strategies to mitigate potential losses and protect capital while maximizing profit opportunities.

Effective risk management in forex trading encompasses a range of techniques, each serving a specific purpose in controlling exposure to market risks.

Examine how nature and functions of foreign exchange market can boost performance in your area.

Stop-Loss Orders, Foreign exchange market book in hindi

Stop-loss orders are a crucial risk management tool that allows traders to pre-define an exit point from a trade when the market moves against their position. By setting a stop-loss order at a specific price level, traders can limit their potential losses if the market turns unfavorable.

Position Sizing

Position sizing refers to the calculation of the appropriate trade size based on the trader’s risk tolerance and account balance. It involves determining the number of units or lots to trade while considering the potential risks associated with the position.

Hedging

Hedging involves taking offsetting positions in the same or correlated currency pairs to reduce the overall risk exposure. By creating a hedge, traders can mitigate the potential losses from one position by the gains from the other.

Strategies for Managing Risk in Volatile Market Conditions

In volatile market conditions, traders must adopt more stringent risk management strategies to minimize potential losses. These strategies may include:

- Reducing Leverage: Lowering leverage ratios can limit the potential losses by reducing the trader’s exposure to market fluctuations.

- Tightening Stop-Loss Levels: Adjusting stop-loss orders closer to the entry price can help minimize losses during periods of high volatility.

- Hedging with Options: Utilizing options contracts can provide an additional layer of protection against adverse market movements.

Market Analysis

Market analysis is the process of evaluating market data to identify trading opportunities and make informed decisions. In the forex market, there are two main types of market analysis: technical analysis and fundamental analysis.

Technical Analysis

Technical analysis involves studying price charts and historical data to identify patterns and trends that may indicate future price movements. Some common technical indicators used in forex trading include:

- Moving averages

- Support and resistance levels

- Candlestick patterns

Fundamental Analysis

Fundamental analysis involves studying economic data, political events, and central bank announcements to assess the overall health and direction of the economy. This type of analysis can provide insights into the potential impact of these factors on currency values.

Trading Platforms and Tools

The foreign exchange market is a vast and complex ecosystem, and traders need access to reliable and sophisticated trading platforms to navigate it effectively. These platforms provide a gateway to the market, enabling traders to execute trades, monitor market movements, and manage their risk.

Types of Trading Platforms

- Desktop Platforms: These are software applications installed on a trader’s computer. They offer a comprehensive suite of features, including advanced charting tools, technical indicators, and automated trading capabilities.

- Web-Based Platforms: Accessed through a web browser, these platforms provide convenience and accessibility. They are typically less feature-rich than desktop platforms but offer ease of use and compatibility with various devices.

- Mobile Platforms: Designed for smartphones and tablets, these platforms allow traders to access the market on the go. They offer a simplified interface and essential trading functionality.

Features and Benefits

- Charting Tools: Visual representations of market data that help traders identify trends and patterns.

- Technical Indicators: Mathematical formulas that analyze market data to generate buy and sell signals.

- Order Management: Tools for placing, modifying, and canceling orders, including stop-loss and take-profit orders.

- Risk Management Tools: Features that help traders manage their risk exposure, such as margin calculators and position monitoring.

- Automated Trading: Capabilities that allow traders to set predefined trading rules and have the platform execute trades automatically.

Comparison of Popular Trading Platforms

| Platform | Features | Benefits |

|—|—|—|

| MetaTrader 4 | Advanced charting, technical indicators, automated trading | Widely used, customizable, third-party plugin support |

| MetaTrader 5 | Enhanced features over MT4, multi-asset trading | Newer, improved interface, more advanced features |

| cTrader | Modern interface, one-click trading, customizable indicators | User-friendly, high execution speed, low latency |

| NinjaTrader | Professional-grade platform, extensive charting tools, backtesting capabilities | Advanced order management, real-time data feeds, powerful technical analysis |

| TradingView | Cloud-based platform, social trading features, extensive charting capabilities | Wide range of indicators, community-driven analysis, mobile app |

Glossary of Terms

The foreign exchange market, also known as forex or FX, is a vast and complex global marketplace where currencies are traded. Like any other specialized field, forex has its own unique terminology. This glossary provides clear and concise definitions of some of the most common terms used in the foreign exchange market, along with examples to illustrate their usage.

Understanding these terms is essential for anyone who wants to trade in the forex market or simply stay informed about currency movements.

Base Currency

The base currency is the first currency listed in a currency pair. It is the currency that is being bought or sold.

Example: In the currency pair EUR/USD, EUR is the base currency.

Counter Currency

The counter currency is the second currency listed in a currency pair. It is the currency that is being bought or sold against the base currency.

Example: In the currency pair EUR/USD, USD is the counter currency.

Currency Pair

A currency pair is a combination of two currencies that are traded against each other.

Example: EUR/USD is a currency pair that represents the exchange rate between the euro and the US dollar.

Exchange Rate

The exchange rate is the price of one currency in terms of another currency.

Example: If the exchange rate between EUR/USD is 1.1000, it means that one euro is worth 1.1000 US dollars.

Pip

A pip (point in percentage) is the smallest unit of change in an exchange rate. It is typically the fourth decimal place in a currency pair.

Example: If the exchange rate between EUR/USD moves from 1.1000 to 1.1001, this is a change of one pip.

Spread

The spread is the difference between the bid price and the ask price of a currency pair.

Example: If the bid price for EUR/USD is 1.1000 and the ask price is 1.1002, the spread is two pips.

Volatility

Volatility is a measure of how much the exchange rate of a currency pair fluctuates.

Example: A currency pair with a high volatility is likely to experience large swings in its exchange rate.

Final Thoughts

As we conclude our exploration of the foreign exchange market, remember that knowledge is the key to unlocking its potential. By embracing the concepts and strategies Artikeld in this book, you’ll gain a competitive edge, navigate market fluctuations with confidence, and achieve your financial goals.

So, embrace the world of currencies, embrace the foreign exchange market, and let this guide be your compass on this exciting journey.