Foreign exchange market ap macro frq – Delve into the intricacies of the foreign exchange market (forex) with this comprehensive guide, exploring its significance, participants, and the myriad factors that shape its dynamics. Discover how supply and demand, economic indicators, and central bank policies influence currency valuations, and delve into the diverse instruments and regulations that govern this global marketplace.

This in-depth analysis provides a solid foundation for AP Macroeconomics students seeking to master the complexities of the forex market and its impact on global economies.

Foreign Exchange Market Overview

The foreign exchange market, also known as the forex market, is a global decentralized market for the trading of currencies. It is the largest financial market in the world, with a daily trading volume of over $5 trillion. The forex market is open 24 hours a day, five days a week, and it is used by a wide range of participants, including banks, corporations, governments, and individual investors.

The foreign exchange market has a long history, dating back to the early days of international trade. In the past, the exchange rates between currencies were determined by the supply and demand for those currencies. However, in the early 20th century, the gold standard was adopted by most countries, which fixed the exchange rates between currencies to the price of gold. The gold standard was abandoned in the early 1970s, and since then, the exchange rates between currencies have been determined by the forces of supply and demand.

Participants in the Foreign Exchange Market

The foreign exchange market is a global market, and it is used by a wide range of participants, including:

- Banks: Banks are the largest participants in the foreign exchange market. They trade currencies on behalf of their customers, and they also use the forex market to manage their own risk.

- Corporations: Corporations use the foreign exchange market to exchange currencies for their international operations. For example, a company that imports goods from China will need to exchange its home currency for Chinese yuan.

- Governments: Governments use the foreign exchange market to manage their currencies and to intervene in the market to achieve specific economic goals.

- Individual investors: Individual investors can also trade currencies in the foreign exchange market. However, individual investors typically have less experience and knowledge than other participants in the market, and they should be aware of the risks involved in currency trading.

Factors Influencing Foreign Exchange Rates

Foreign exchange rates are influenced by various factors, including supply and demand, economic and political conditions, and central bank policies. These factors can lead to fluctuations in the value of currencies, affecting international trade, investment, and tourism.

Discover the crucial elements that make jelaskan fungsi dari foreign exchange market the top choice.

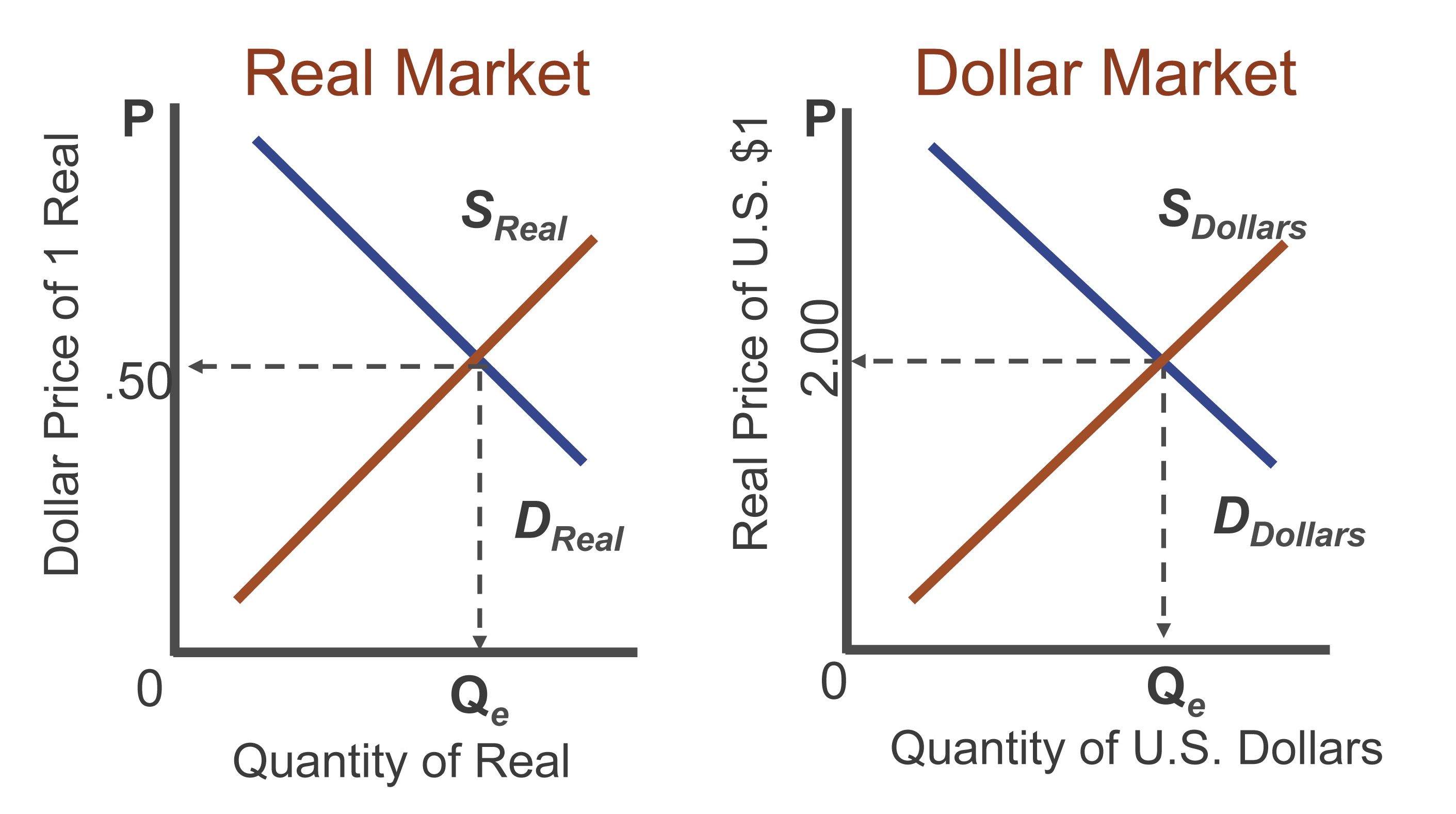

Supply and Demand

The supply and demand of currencies play a significant role in determining their exchange rates. When there is a high demand for a particular currency, its value tends to increase, as more buyers are willing to pay a higher price for it. Conversely, when the supply of a currency is high and there are fewer buyers, its value tends to decrease.

- Increased demand for a currency can occur due to factors such as economic growth, political stability, or favorable interest rates.

- Increased supply of a currency can result from factors such as economic recession, political instability, or unfavorable interest rates.

Economic and Political Factors

Economic and political factors can significantly impact foreign exchange rates. A country’s economic growth, inflation rate, unemployment rate, and trade balance all influence the demand and supply of its currency.

- Strong economic growth can increase demand for a currency, leading to a higher exchange rate.

- High inflation can reduce the value of a currency, as it erodes its purchasing power.

- Political stability and low risk perception can attract foreign investment and increase demand for a currency.

- Trade imbalances, where imports exceed exports, can lead to a decrease in a currency’s value.

Central Bank Policies

Central banks play a crucial role in managing foreign exchange rates through monetary policy. They can use tools such as interest rate adjustments and foreign exchange interventions to influence the supply and demand of currencies.

- Increasing interest rates can make a currency more attractive to foreign investors, leading to increased demand and a higher exchange rate.

- Central banks can also intervene in the foreign exchange market by buying or selling their own currency to influence its value.

Foreign Exchange Market Dynamics

The foreign exchange market is a dynamic and complex system influenced by various factors. Exchange rate regimes play a significant role in shaping the behavior of exchange rates and the overall functioning of the market.

Exchange Rate Regimes

An exchange rate regime refers to the system of rules and policies that a country adopts to manage its currency’s value relative to other currencies. There are several types of exchange rate regimes:

- Fixed exchange rate regime: The government sets a fixed value for its currency against a specific foreign currency or a basket of currencies.

- Floating exchange rate regime: The value of the currency is determined by market forces, with no government intervention.

- Managed floating exchange rate regime: The government intervenes in the market to influence the value of its currency, but allows market forces to play a role.

Implications of Exchange Rate Regimes

The choice of exchange rate regime has significant implications for a country’s economy. Fixed exchange rates provide stability and predictability, but they can also limit a country’s ability to respond to economic shocks. Floating exchange rates allow for greater flexibility and adjustment, but they can also lead to volatility in the value of the currency.

Relationship between Exchange Rates and Inflation

Exchange rates can have a significant impact on inflation. A depreciation in the value of a currency (a fall in its value relative to other currencies) can lead to higher import prices, which can contribute to inflation. Conversely, an appreciation in the value of a currency can lead to lower import prices, which can help to reduce inflation.

Foreign Exchange Market Instruments

The foreign exchange market employs a range of instruments to facilitate the exchange of currencies. These instruments vary in their terms, maturities, and purposes, catering to different needs of market participants.

Spot Transactions

Spot transactions involve the immediate exchange of currencies at the prevailing market rate. These transactions are typically settled within two business days and are commonly used for short-term currency needs, such as settling international trade transactions.

Advantages:

- Immediate execution

- Transparent pricing

Disadvantages:

- Limited flexibility

- Exposure to immediate currency fluctuations

Forward Contracts

Forward contracts are agreements to exchange currencies at a predetermined rate on a future date. They allow businesses and investors to hedge against future currency fluctuations and lock in exchange rates for upcoming transactions.

Remember to click what is foreign exchange market pdf to understand more comprehensive aspects of the what is foreign exchange market pdf topic.

Advantages:

- Protection against currency risk

- Customized contracts to meet specific needs

Disadvantages:

Explore the different advantages of foreign exchange market participants and functions that can change the way you view this issue.

- Less flexibility compared to spot transactions

- Potential for losses if the market rate moves unfavorably

Options Contracts

Options contracts give the buyer the right, but not the obligation, to buy or sell a currency at a specified price on a future date. They provide flexibility and allow for speculation or hedging strategies.

Advantages:

- Flexibility to take advantage of favorable market movements

- Limited risk compared to forward contracts

Disadvantages:

- Premiums paid for the option

- Potential for losses if the market moves against the desired direction

Example of Use

A multinational corporation with operations in multiple countries may use forward contracts to mitigate the risk of exchange rate fluctuations on its future international payments. By locking in exchange rates, the company can protect its profit margins and avoid unexpected losses.

Foreign Exchange Market Regulation

The foreign exchange market is a global and decentralized marketplace where currencies are traded. It is essential for international trade and investment and can have a significant impact on the economies of countries. Due to its size and complexity, the foreign exchange market is subject to regulation by various regulatory bodies.

Role of Regulatory Bodies, Foreign exchange market ap macro frq

Regulatory bodies play a crucial role in ensuring the stability and integrity of the foreign exchange market. They establish rules and regulations to prevent fraud, manipulation, and other illegal activities. Regulatory bodies also supervise the activities of market participants, such as banks, brokers, and traders, to ensure compliance with these regulations.

Types of Regulations and their Objectives

There are different types of regulations that apply to the foreign exchange market. These regulations vary depending on the jurisdiction, but they generally aim to achieve the following objectives:

- Prevent fraud and manipulation

- Ensure fair and orderly trading

- Protect investors and consumers

- Maintain the stability of the financial system

Challenges and Opportunities

Regulating the foreign exchange market poses several challenges. The market is global and decentralized, making it difficult to enforce regulations. Additionally, the market is constantly evolving, which requires regulatory bodies to adapt their regulations accordingly. Despite these challenges, regulation is essential for maintaining the stability and integrity of the foreign exchange market.

Regulation can also create opportunities for market participants. By providing a level playing field and protecting investors, regulation can attract more participants to the market, leading to increased liquidity and efficiency.

Epilogue: Foreign Exchange Market Ap Macro Frq

In conclusion, the foreign exchange market stands as a complex and ever-evolving landscape, where economic forces, political events, and regulatory frameworks converge to determine currency values. Understanding the intricacies of this dynamic marketplace is crucial for navigating international trade, managing risk, and gaining insights into the interconnectedness of global economies.