Foreign exchange market definition and example – Welcome to the captivating world of the foreign exchange market, where currencies dance to the rhythm of global trade and investment. From bustling trading floors to the fingertips of retail traders, this dynamic marketplace plays a pivotal role in facilitating international commerce and shaping the global economy.

The foreign exchange market, also known as forex, is a decentralized global marketplace where currencies are traded 24 hours a day, 5 days a week. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion.

Definition of the Foreign Exchange Market

The foreign exchange market (forex market) is a global, decentralized marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $5 trillion.

The forex market serves several important purposes. It allows businesses and individuals to exchange currencies for international trade and investment. It also provides a way for investors to speculate on currency movements and hedge against currency risk.

Obtain access to foreign exchange market graph determinants to private resources that are additional.

Types of Participants in the Forex Market

There are many different types of participants in the forex market, including:

- Banks

- Currency brokers

- Investment funds

- Individuals

li>Corporations

Factors that Influence Exchange Rates

The exchange rate between two currencies is determined by a number of factors, including:

- Economic growth

- Interest rates

- Inflation

- Political stability

- Government intervention

Structure and Mechanics of the Foreign Exchange Market

The foreign exchange market operates in an over-the-counter (OTC) format, where participants trade directly with each other without the use of a central exchange. This decentralized structure provides flexibility and allows for a wide range of market participants, from large financial institutions to individual traders.

Transactions in the foreign exchange market can be classified into different types:

- Spot transactions involve the immediate exchange of currencies at the current market rate.

- Forward transactions are contracts to exchange currencies at a predetermined rate and date in the future.

- Swap transactions are agreements to exchange different currencies and interest rates for a specified period.

Liquidity providers and market makers play a crucial role in the foreign exchange market by providing quotes and facilitating trades. Liquidity providers, such as large banks, offer bid and ask prices to other participants, creating a liquid market. Market makers take on the risk of holding inventory and quote prices to both buyers and sellers, ensuring that there is always a counterparty available to execute trades.

Currency Pairs and Exchange Rates

The foreign exchange market is a global marketplace where currencies are traded. Currency pairs are the fundamental units of exchange in this market, representing the value of one currency relative to another. These pairs are typically denoted using three-letter currency codes, with the first currency representing the base currency and the second currency representing the quote currency.

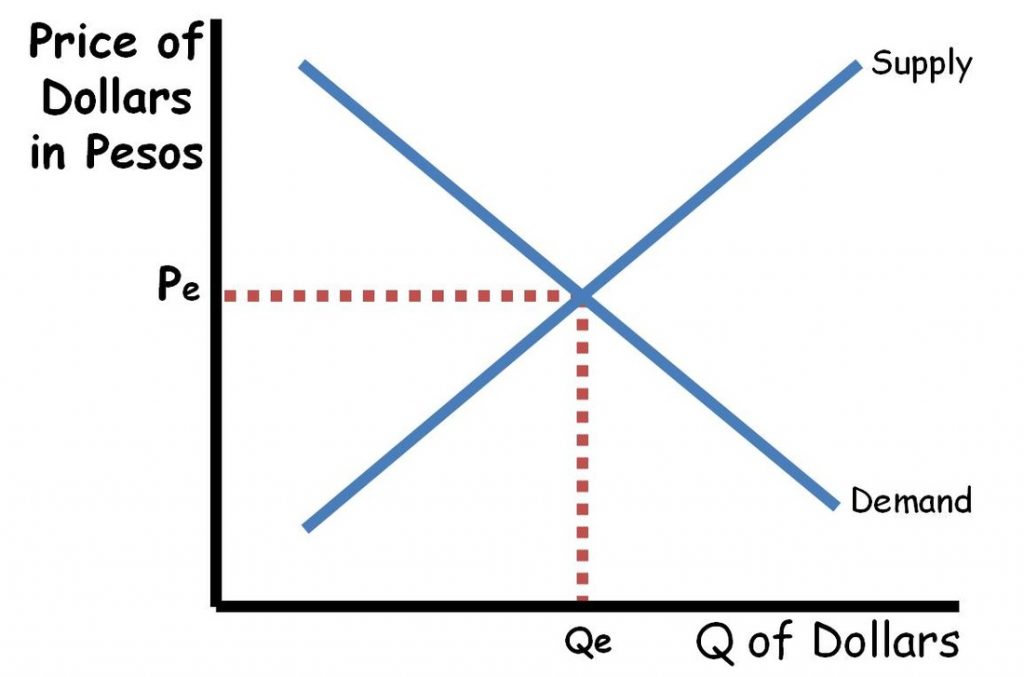

Exchange rates determine the value of one currency in terms of another. They are influenced by various factors, including economic conditions, political stability, interest rates, and supply and demand. The exchange rate is expressed as the number of units of the quote currency required to purchase one unit of the base currency.

Major Currency Pairs

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- AUD/USD (Australian Dollar/US Dollar)

Bid-Ask Spread

The bid-ask spread is the difference between the bid price (the price at which a currency can be bought) and the ask price (the price at which a currency can be sold). This spread represents the profit margin for market makers, who facilitate the trading of currencies.

Do not overlook explore the latest data about foreign exchange market germany.

Trading in the Foreign Exchange Market

The foreign exchange market is the world’s largest financial market, with a daily trading volume of over $5 trillion. It is a global marketplace where currencies are bought and sold.

There are many different trading strategies that can be used in the foreign exchange market. Some of the most common strategies include:

– Carry trade: This strategy involves borrowing money in one currency with a low interest rate and investing it in another currency with a higher interest rate. The profit is made from the difference in interest rates.

– Trend trading: This strategy involves buying a currency when it is trending up and selling it when it is trending down.

– Scalping: This strategy involves making small profits from small price movements.

– Arbitrage: This strategy involves buying a currency in one market and selling it in another market at a higher price.

The risks of foreign exchange trading include:

– Currency risk: The value of currencies can fluctuate, which can lead to losses.

– Interest rate risk: Interest rates can change, which can affect the profitability of carry trades.

– Liquidity risk: The foreign exchange market is a very liquid market, but there can be times when it is difficult to buy or sell a currency at a desired price.

Despite the risks, foreign exchange trading can be a profitable venture. However, it is important to understand the risks and to have a sound trading strategy before you start trading.

Companies and Individuals Use the Foreign Exchange Market

Companies and individuals use the foreign exchange market for a variety of purposes, including:

– Hedging: Companies can use the foreign exchange market to hedge against currency risk. For example, a company that exports goods to another country can use the foreign exchange market to lock in the exchange rate at which it will receive payment.

– Investment: Individuals and companies can use the foreign exchange market to invest in currencies. For example, an individual might buy a currency that is expected to appreciate in value.

– Trading: The foreign exchange market is a popular market for traders. Traders can use the foreign exchange market to speculate on the movement of currencies.

Regulation and Oversight of the Foreign Exchange Market

The foreign exchange market is a highly regulated environment to ensure market stability, protect investors, and prevent financial crimes. Central banks and other regulatory bodies play a crucial role in overseeing and regulating the market.

Central banks, such as the Federal Reserve in the United States or the European Central Bank in the Eurozone, are responsible for setting monetary policy and managing the exchange rates of their respective currencies. They use tools like interest rate adjustments and foreign exchange interventions to influence the value of their currencies and maintain economic stability.

Discover the crucial elements that make foreign exchange market meaning functions determination of equilibrium rate of exchange the top choice.

International Regulatory Initiatives, Foreign exchange market definition and example

In addition to central banks, various international organizations and agreements have been established to enhance cooperation and oversight of the foreign exchange market. These include:

- Basel Committee on Banking Supervision (BCBS): Sets global standards for banking regulation, including guidelines for foreign exchange trading.

- International Monetary Fund (IMF): Provides surveillance and technical assistance to member countries on foreign exchange market developments.

- Committee on Payment and Settlement Systems (CPSS): Promotes the safety and efficiency of payment and settlement systems, including those used in the foreign exchange market.

Anti-Money Laundering and Counter-Terrorism Financing

Regulatory bodies also enforce anti-money laundering (AML) and counter-terrorism financing (CTF) measures to prevent the misuse of the foreign exchange market for illicit activities. These measures include customer due diligence, transaction monitoring, and reporting suspicious transactions.

Case Studies and Examples

The foreign exchange market plays a crucial role in facilitating global trade, investment, and economic development. Here are some real-world examples:

Companies and Currency Risk Management

Multinational companies with operations in multiple countries face currency risk, which arises from fluctuations in exchange rates. To manage this risk, companies use the foreign exchange market to hedge their positions by buying or selling currencies forward. For example, a U.S.-based company with subsidiaries in Europe may buy euros forward to protect against a potential decline in the value of the euro against the U.S. dollar.

Governments and Exchange Rate Policies

Governments intervene in the foreign exchange market through monetary policy and other measures to influence the value of their currencies. For instance, central banks may buy or sell their currency in the market to stabilize exchange rates or to achieve specific economic objectives.

Impact of Major Events on Exchange Rates

Major economic and political events can significantly impact exchange rates. For example, the outbreak of the COVID-19 pandemic in 2020 led to a sharp decline in global economic activity, which in turn caused a depreciation of many currencies against the U.S. dollar. Similarly, political events such as elections or changes in government can also affect exchange rates.

Trends and Developments in the Foreign Exchange Market: Foreign Exchange Market Definition And Example

The foreign exchange market is constantly evolving, driven by emerging technologies, globalization, and technological advancements. These trends are shaping the market in significant ways, transforming the way currencies are traded and exchanged.

Impact of Emerging Technologies

Emerging technologies, such as blockchain, artificial intelligence (AI), and machine learning (ML), are revolutionizing the foreign exchange market. Blockchain technology, with its decentralized and secure nature, is enabling the development of new trading platforms and applications that offer increased transparency, efficiency, and security. AI and ML algorithms are being used to analyze market data, identify trading opportunities, and automate trading processes, leading to faster and more accurate decision-making.

Globalization and Technological Advancements

Globalization and technological advancements have also had a profound impact on the foreign exchange market. The increasing interconnectedness of global economies has led to a surge in cross-border trade and investment, resulting in a greater demand for foreign exchange services. Technological advancements, such as high-speed internet and mobile trading platforms, have made it easier for individuals and businesses to access the foreign exchange market, contributing to its growth and liquidity.

Future of the Foreign Exchange Market

Looking ahead, the foreign exchange market is expected to continue to grow and evolve. Emerging technologies, globalization, and technological advancements will continue to shape the market, driving innovation and creating new opportunities. The future of the foreign exchange market lies in the adoption of new technologies, the integration of global markets, and the development of innovative trading strategies.

Summary

:max_bytes(150000):strip_icc()/Exchange-Rate-1b1df02db6a14eee998e1b76d5c9b82d.jpg)

In essence, the foreign exchange market is a microcosm of the global economy, reflecting the ebb and flow of international trade, investment, and economic conditions. Understanding its dynamics and complexities empowers individuals and businesses alike to navigate the ever-changing currents of the global marketplace.