Definition and meaning of foreign exchange market – The foreign exchange market, also known as forex, is a global marketplace where currencies are traded. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion. The forex market plays a vital role in facilitating international trade and investment, and it is used by a wide range of participants, including banks, corporations, and individual investors.

The forex market is open 24 hours a day, five days a week, and it operates in all major financial centers around the world. Currencies are traded in pairs, and the exchange rate between two currencies is determined by supply and demand.

Definition of Foreign Exchange Market

The foreign exchange (forex) market is a global decentralized marketplace where currencies are traded. It’s the largest financial market in the world, with a daily trading volume exceeding $5 trillion.

Purpose of the Forex Market

The primary purpose of the forex market is to facilitate the exchange of currencies for international trade and investment. It allows businesses, individuals, and governments to convert their currencies into other currencies as needed.

Role of Currencies in the Forex Market

Currencies are the basic units of exchange in the forex market. Each currency is assigned a three-letter currency code, such as USD for the US dollar or EUR for the euro. Currencies are traded in pairs, with one currency being bought and the other being sold.

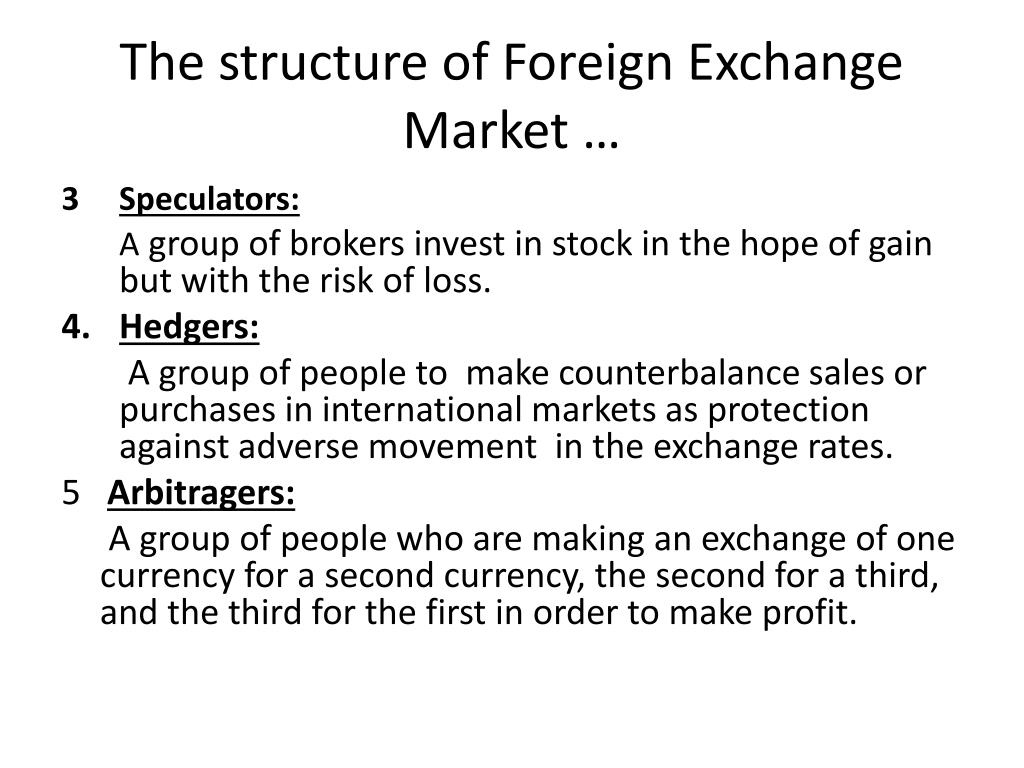

Participants in the Foreign Exchange Market: Definition And Meaning Of Foreign Exchange Market

The foreign exchange market (forex market) is a global, decentralized marketplace where currencies are traded. Various participants interact in this market, each with distinct roles and motivations.

Commercial Banks

Commercial banks are major players in the forex market, facilitating currency transactions for businesses and individuals. They buy and sell currencies on behalf of their clients, primarily to settle international trade and investment transactions. Commercial banks also provide hedging services to protect clients from currency fluctuations.

Central Banks

Central banks, such as the Federal Reserve (US) and the European Central Bank (EU), participate in the forex market to manage their countries’ exchange rates and monetary policies. They buy and sell currencies to influence the value of their domestic currencies relative to others.

Investment Funds

Investment funds, including hedge funds and mutual funds, engage in the forex market to speculate on currency movements and generate profits. They take positions in currencies based on economic forecasts and market trends.

Retail Traders, Definition and meaning of foreign exchange market

Retail traders, often known as individual or small-scale traders, participate in the forex market through online platforms. They buy and sell currencies in smaller amounts, seeking to profit from short-term price fluctuations.

Corporations

Corporations with international operations participate in the forex market to manage their currency exposure. They buy and sell currencies to facilitate cross-border transactions, protect against currency risks, and optimize their financial performance.

Types of Foreign Exchange Transactions

The foreign exchange market involves various types of transactions that facilitate the exchange of currencies for different purposes. These transactions can be broadly categorized into spot, forward, and swap transactions, each with its unique characteristics and purposes.

Spot Transactions

Spot transactions are the most common type of foreign exchange transaction, where currencies are exchanged at the prevailing market rate on the spot date, which is typically two business days after the trade date. These transactions are used for immediate settlement of financial obligations or to take advantage of short-term market fluctuations.

Forward Transactions

Forward transactions involve the buying or selling of currencies at a predetermined rate for delivery on a future date, typically ranging from one month to one year. These transactions are used to hedge against future currency fluctuations or to lock in a favorable exchange rate for future payments or receipts.

Swap Transactions

Swap transactions are complex agreements that involve the simultaneous buying and selling of currencies at different dates and rates. These transactions are used for various purposes, such as currency hedging, interest rate arbitrage, and speculation.

Obtain direct knowledge about the efficiency of foreign exchange market introduction pdf through case studies.

Factors Influencing Transaction Type

The choice of foreign exchange transaction type depends on several factors, including:

- Time horizon: Spot transactions are suitable for immediate currency needs, while forward and swap transactions are used for managing future currency exposures.

- Currency risk tolerance: Forward and swap transactions allow businesses to hedge against currency fluctuations, while spot transactions expose them to short-term market movements.

- Transaction size: Larger transactions may require forward or swap transactions to ensure market liquidity and minimize transaction costs.

Factors Affecting Foreign Exchange Rates

The foreign exchange market is influenced by a complex interplay of economic, political, and market factors. These factors drive fluctuations in currency values and shape the dynamics of international trade and investment.

Remember to click foreign exchange market trading books to understand more comprehensive aspects of the foreign exchange market trading books topic.

Economic Factors

- Economic Growth: Strong economic growth indicates a healthy economy, attracting foreign investment and boosting the demand for a country’s currency.

- Interest Rates: Higher interest rates attract foreign investors seeking higher returns, strengthening the currency.

- Inflation: High inflation erodes the value of a currency, making it less desirable in international markets.

Political Factors

- Political Stability: Stable political environments foster investor confidence and support currency values.

- Government Policies: Government policies, such as trade restrictions or foreign exchange controls, can impact currency values.

- Geopolitical Events: Wars, conflicts, or other geopolitical events can create uncertainty and drive currency fluctuations.

Market Factors

Browse the multiple elements of foreign exchange market definition finance to gain a more broad understanding.

- Supply and Demand: The balance of supply and demand for a currency determines its value in the market.

- Speculation: Currency traders often speculate on future currency movements, which can influence market sentiment and currency values.

- Carry Trade: Investors may borrow in low-interest currencies and invest in high-interest currencies, potentially strengthening the low-interest currency.

Role of Central Banks

Central banks play a crucial role in managing foreign exchange rates through monetary policy. They can:

- Intervene in the Market: Central banks can buy or sell currencies to influence their value.

- Adjust Interest Rates: Interest rate changes can impact currency demand and value.

- Implement Foreign Exchange Controls: Central banks may restrict foreign exchange transactions to stabilize currency values.

Risks and Benefits of Foreign Exchange Trading

Participating in the foreign exchange market offers both potential risks and benefits. It is essential to understand these factors before engaging in forex trading to make informed decisions and manage risks effectively.

Risks of Forex Trading

- Market Volatility: Forex markets are highly volatile, and currency prices can fluctuate rapidly due to various factors. This volatility can lead to significant losses if not managed properly.

- Leverage: Forex trading often involves the use of leverage, which can amplify both profits and losses. While leverage can increase potential returns, it also magnifies risks and can lead to substantial losses if the market moves against the trader’s position.

- Liquidity Risk: Liquidity in the forex market can vary, especially during times of market stress. If liquidity dries up, it can be challenging to execute trades or close positions, leading to potential losses.

- Counterparty Risk: Forex transactions involve counterparties, such as brokers or banks. There is a risk that these counterparties may default on their obligations, resulting in losses for the trader.

- Fraud and Scams: Forex trading can attract fraudulent schemes and scams. It is crucial to research and choose reputable brokers and platforms to mitigate this risk.

Benefits of Forex Trading

- Potential for High Returns: Forex trading offers the potential for significant returns due to high leverage and market volatility. However, it is essential to note that these returns come with corresponding risks.

- 24/5 Market Access: The forex market operates 24 hours a day, five days a week, allowing traders to access the market at convenient times.

- Diversification: Forex trading can provide diversification benefits for a portfolio by offering exposure to different currencies and economies.

- Low Transaction Costs: Compared to other financial markets, forex trading typically has lower transaction costs, making it more accessible to a wider range of traders.

- Learning and Skill Development: Forex trading requires traders to develop analytical and risk management skills, which can be valuable in other areas of life.

Overall, the risks and benefits of foreign exchange trading are significant. It is crucial for traders to carefully consider these factors, understand risk management strategies, and develop a trading plan that aligns with their financial goals and risk tolerance.

Applications of Foreign Exchange Market

The foreign exchange market is not just a platform for trading currencies; it plays a vital role in facilitating international trade and investment. Businesses and individuals use the forex market for various purposes, including:

- Facilitating International Trade: The forex market enables businesses to exchange currencies to settle international transactions. For example, a U.S. company importing goods from Japan needs to convert its U.S. dollars into Japanese yen to pay the Japanese supplier.

- Managing Currency Risk: Businesses operating in multiple countries are exposed to currency risk, which is the risk of losing money due to fluctuations in exchange rates. The forex market allows businesses to hedge against currency risk by using financial instruments like forward contracts and options.

- Investing in Foreign Markets: The forex market enables individuals and institutional investors to invest in foreign stocks, bonds, and other assets. By investing in foreign markets, investors can diversify their portfolios and potentially earn higher returns.

- Tourism and Travel: Individuals traveling abroad need to exchange their home currency into the local currency of their destination. The forex market provides a convenient and efficient way to do this, ensuring that travelers have access to local currency for their expenses.

Ultimate Conclusion

The foreign exchange market is a complex and ever-changing market, but it can also be a lucrative one. By understanding the definition and meaning of the foreign exchange market, you can gain a better understanding of how the global economy works and how you can use the forex market to your advantage.