Delving into the world of define interbank foreign exchange market, we embark on a journey that explores the intricacies of international currency trading. This interconnected marketplace, where banks and other financial institutions exchange currencies, plays a pivotal role in facilitating global commerce and investment.

The interbank foreign exchange market, often referred to as the forex market or FX market, is a vast and dynamic arena where currencies are bought, sold, and traded in real-time. Its participants, ranging from central banks to multinational corporations, interact through a complex network of electronic platforms and trading mechanisms.

Definition and Overview

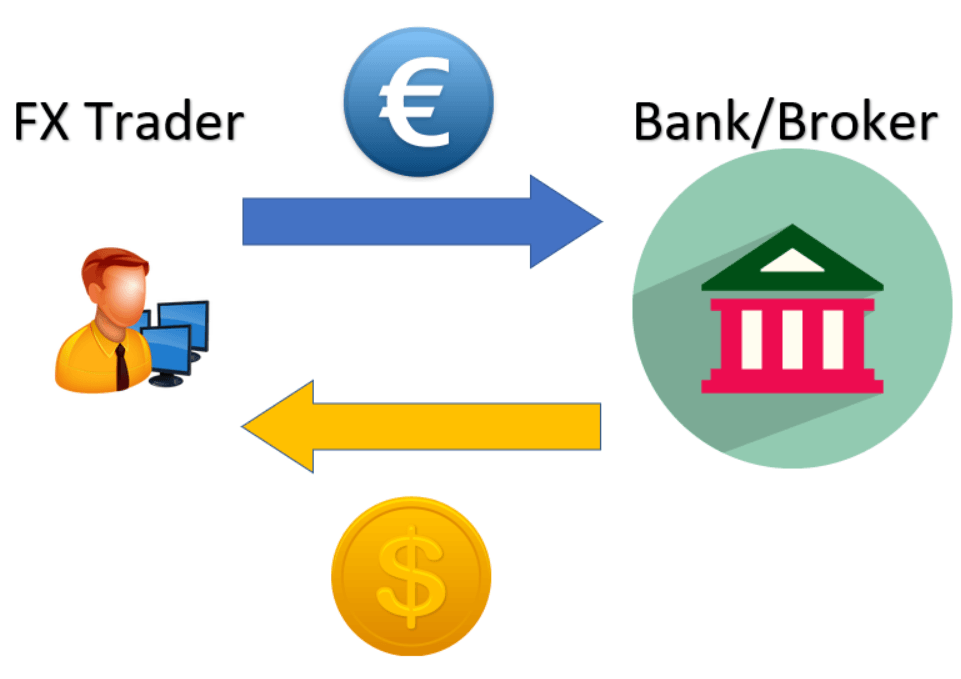

An interbank foreign exchange market, also known as the interbank market, is a decentralized global network of banks and other financial institutions that trade currencies among themselves.

Get the entire information you require about foreign exchange market interview questions on this page.

It is the primary market for the exchange of currencies and plays a crucial role in facilitating international trade and investment. The interbank market allows banks to manage their foreign exchange risk, speculate on currency movements, and provide liquidity to their clients.

Role in International Trade

The interbank foreign exchange market facilitates international trade by enabling businesses to exchange currencies to settle cross-border transactions. For example, if a U.S. company imports goods from Japan, it needs to convert its U.S. dollars into Japanese yen to pay the Japanese exporter. This conversion typically occurs through the interbank market, where the U.S. company’s bank exchanges dollars for yen with a Japanese bank.

Participants and Structure

The interbank foreign exchange market is a complex and interconnected network of financial institutions that facilitate the exchange of currencies between each other. The key participants in this market include:

- Central banks: Central banks are responsible for managing their country’s monetary policy and often intervene in the foreign exchange market to influence the value of their currency.

- Commercial banks: Commercial banks are the primary providers of foreign exchange services to businesses and individuals. They buy and sell currencies on behalf of their clients and maintain correspondent relationships with other banks around the world.

- Investment banks: Investment banks facilitate large-scale currency transactions for institutional investors and hedge funds.

- Forex brokers: Forex brokers provide a platform for individuals and small businesses to trade currencies.

The interbank foreign exchange market is structured into different levels, from retail to wholesale. The retail market is where individuals and small businesses trade currencies, while the wholesale market is where large financial institutions trade currencies in bulk.

Do not overlook the opportunity to discover more about the subject of foreign exchange market components.

Market Structure

The interbank foreign exchange market is a hierarchical structure with three main levels:

- Tier 1 banks: These are the largest and most active banks in the foreign exchange market. They have a global presence and trade currencies with each other directly.

- Tier 2 banks: These banks are smaller than Tier 1 banks but still have a significant presence in the foreign exchange market. They typically trade currencies with Tier 1 banks and other Tier 2 banks.

- Tier 3 banks: These banks are the smallest and least active in the foreign exchange market. They typically trade currencies with Tier 2 banks and retail clients.

The interbank foreign exchange market is a complex and dynamic market that is constantly evolving. The participants and structure of the market are constantly changing to meet the needs of the global economy.

Trading Mechanisms

The interbank foreign exchange market utilizes various trading mechanisms to facilitate currency exchange. These mechanisms play a crucial role in determining the exchange rates and ensuring efficient market operations.

The primary trading mechanisms in the interbank foreign exchange market include the spot market, forward market, and swap market.

Spot Market

The spot market involves the immediate exchange of currencies at the current market rate. Transactions in the spot market are typically settled within two business days.

Forward Market

The forward market allows participants to lock in an exchange rate for a future date. Forward contracts are used to hedge against exchange rate fluctuations and speculate on future currency movements.

Swap Market

The swap market facilitates the exchange of one currency for another for a specified period, with the currencies being exchanged back at the end of the period. Swap transactions are commonly used for managing interest rate risk and currency risk.

Find out further about the benefits of foreign exchange market definition for dummies that can provide significant benefits.

Market Dynamics

:max_bytes(150000):strip_icc()/vdotdash_INV_final-The-Foreign-Exchange-Interbank-Market_Feb_2021-01-bb2f378cd30b4e52903c2dc382c1121d.jpg)

The interbank foreign exchange market is a dynamic environment where exchange rates are constantly fluctuating. Several factors influence these fluctuations, including:

Supply and Demand

The most fundamental factor influencing exchange rates is supply and demand. When there is more demand for a currency than there is supply, its value will increase. Conversely, when there is more supply of a currency than there is demand, its value will decrease.

Interest Rates

Interest rates are another important factor that influences exchange rates. When interest rates in a country are high, it attracts foreign investment. This increased demand for the country’s currency leads to an appreciation in its value.

Economic Data

Economic data, such as GDP growth, inflation, and unemployment rates, can also impact exchange rates. Strong economic data can lead to a currency appreciation, while weak economic data can lead to a currency depreciation.

Market Regulations: Define Interbank Foreign Exchange Market

The interbank foreign exchange market operates within a regulatory framework designed to ensure its stability, transparency, and integrity. This framework involves various regulations and guidelines established by central banks, government agencies, and international organizations.

Central banks play a crucial role in regulating the interbank foreign exchange market. They set monetary policies, manage foreign exchange reserves, and supervise financial institutions involved in foreign exchange trading. Central banks also implement prudential regulations to ensure the soundness and resilience of the financial system, including requirements for capital adequacy, risk management, and reporting.

Role of Central Banks

- Set monetary policies

- Manage foreign exchange reserves

- Supervise financial institutions

- Implement prudential regulations

Role of Other Regulatory Bodies

In addition to central banks, other regulatory bodies also play a role in overseeing the interbank foreign exchange market. These bodies include government agencies, such as the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom, as well as international organizations, such as the Bank for International Settlements (BIS).

These regulatory bodies establish and enforce rules and regulations governing foreign exchange trading, including requirements for transparency, disclosure, and market conduct. They also monitor market activity for potential risks and take enforcement actions against violations of regulations.

Technology and Innovation

The interbank foreign exchange market has undergone significant transformation due to technological advancements, leading to increased efficiency, transparency, and accessibility.

Electronic trading platforms have revolutionized the market by providing a centralized platform for market participants to execute trades electronically. These platforms offer real-time market data, liquidity aggregation, and order matching capabilities, reducing transaction costs and improving execution speed.

Algorithmic Trading, Define interbank foreign exchange market

Algorithmic trading, also known as algo trading, has gained prominence in the interbank foreign exchange market. Algorithmic trading involves the use of computer programs to execute trades based on predefined rules and strategies. These algorithms can monitor market conditions, identify trading opportunities, and place orders automatically, allowing traders to respond to market movements more quickly and efficiently.

Algorithmic trading has contributed to increased market liquidity and reduced bid-ask spreads, benefiting both market makers and traders.

Wrap-Up

In essence, the interbank foreign exchange market is the backbone of global finance, providing the liquidity and infrastructure necessary for cross-border transactions. Its continued evolution, driven by technological advancements and regulatory oversight, ensures its relevance and importance in the ever-changing landscape of international trade and investment.