Embark on a journey into the dynamic world of foreign exchange markets, where currencies dance to the rhythm of international trade, investments, and risk management. Define foreign exchange market function as the catalyst for these global financial endeavors, enabling seamless currency conversions and hedging against currency risks.

Foreign exchange markets serve as the lifeblood of international commerce, facilitating cross-border transactions with ease. They empower investors to diversify their portfolios globally and provide businesses with tools to mitigate currency fluctuations. Join us as we delve deeper into the functions, participants, and factors that shape these vibrant marketplaces.

Definition of Foreign Exchange Market

The foreign exchange market (forex market or FX market) is a global decentralized market for the trading of currencies. It is the largest and most liquid market in the world, with an estimated daily trading volume of over $5 trillion.

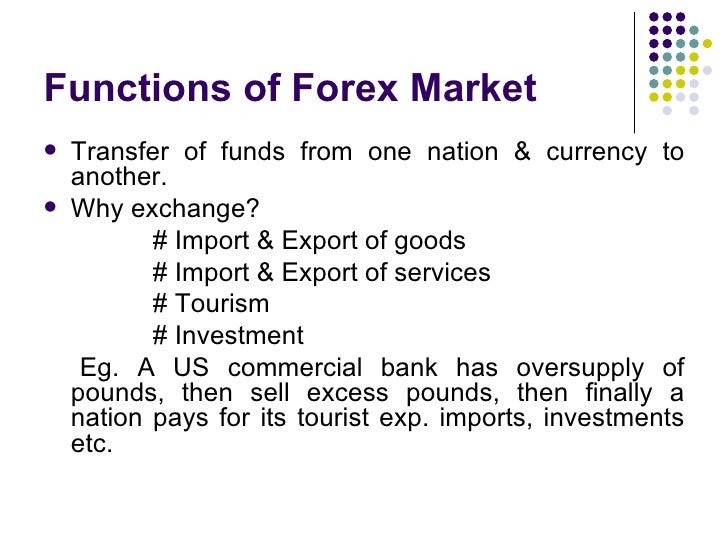

The foreign exchange market is used by a wide range of participants, including banks, corporations, governments, and individuals. It is used for a variety of purposes, including:

- Facilitating international trade and investment

- Hedging against foreign exchange risk

- Speculating on the value of currencies

Functions of Foreign Exchange Market

The foreign exchange market plays a pivotal role in facilitating international trade and investments. It serves as a global marketplace where currencies are traded, enabling the exchange of goods and services across borders.

You also will receive the benefits of visiting foreign exchange market rates live today.

Currency Conversion for Investments

The foreign exchange market allows investors to convert their currencies into foreign currencies for investment purposes. This is essential for accessing global investment opportunities, diversifying portfolios, and hedging against currency fluctuations.

Hedging Against Currency Risks

The foreign exchange market also serves as a platform for hedging against currency risks. Businesses and individuals can use derivative instruments, such as forwards and options, to protect themselves from potential losses due to currency fluctuations.

Participants in Foreign Exchange Market

The foreign exchange market is a global marketplace where currencies are traded. It involves various participants who play significant roles in facilitating currency exchange and influencing market dynamics.

Major participants in the foreign exchange market include banks, corporations, individual traders, and central banks. Banks act as intermediaries, facilitating currency transactions and providing liquidity to the market. Corporations engage in foreign exchange transactions to support their international operations, such as importing and exporting goods and services. Individual traders speculate on currency price movements for potential profits. Central banks manage foreign exchange reserves to influence their exchange rates and maintain economic stability.

Banks

Banks are the primary participants in the foreign exchange market. They act as market makers, providing liquidity and facilitating currency exchange for their clients. Banks offer various foreign exchange services, including spot and forward transactions, currency swaps, and hedging instruments. They also provide advisory services and market analysis to their clients.

Corporations

Corporations engage in foreign exchange transactions to support their international operations. They convert currencies to pay for imports, receive payments for exports, and manage their foreign subsidiaries. Corporations also use foreign exchange derivatives to hedge against currency risks and protect their profit margins.

Individual Traders

Individual traders participate in the foreign exchange market for speculative purposes. They buy and sell currencies based on their predictions of future price movements. Individual traders typically use leverage to increase their potential profits but also expose themselves to higher risks.

Central Banks, Define foreign exchange market function

Central banks are responsible for managing their country’s foreign exchange reserves. They intervene in the foreign exchange market to influence exchange rates, stabilize the economy, and maintain financial stability. Central banks buy and sell currencies to adjust the supply and demand for their own currency and influence its value relative to other currencies.

Factors Influencing Foreign Exchange Rates

The foreign exchange market is a complex and dynamic system, influenced by a multitude of factors. These factors can be broadly classified into three main categories: economic conditions, political factors, and market sentiment and speculation.

Obtain access to in the foreign exchange market the relative value of any two currencies is determined by their to private resources that are additional.

Economic Conditions

Economic conditions have a significant impact on foreign exchange rates. A country with a strong and stable economy will typically have a stronger currency than a country with a weak and unstable economy.

Obtain access to foreign currency exchange market mall calgary to private resources that are additional.

- Economic growth: A country with a strong economy, characterized by high GDP growth, low unemployment, and low inflation, will attract foreign investment. This increased demand for the country’s currency will lead to an appreciation in its value.

- Inflation: High inflation can erode the value of a currency, making it less attractive to foreign investors. This is because inflation reduces the purchasing power of the currency, making it less valuable in terms of goods and services.

- Interest rates: Interest rates play a crucial role in influencing foreign exchange rates. Higher interest rates make a country’s currency more attractive to foreign investors, as they can earn a higher return on their investments. This increased demand for the currency leads to an appreciation in its value.

- Balance of trade: A country with a positive balance of trade, meaning it exports more goods and services than it imports, will typically have a stronger currency. This is because there is more demand for the country’s currency from foreign buyers, which leads to an appreciation in its value.

Foreign Exchange Market Structure: Define Foreign Exchange Market Function

The foreign exchange market operates through various structures, each with unique characteristics and purposes. Understanding these structures is crucial for navigating the market effectively.

Types of Foreign Exchange Markets

- Spot Market: Trades that are settled within two business days. Spot rates are determined by the current supply and demand for currencies.

- Forward Market: Contracts that agree on a future exchange rate for a specific amount of currency on a specified date in the future. Forward rates reflect expectations about future spot rates.

- Swap Market: Simultaneous buying and selling of the same amount of currency at different maturities. Swaps are used to hedge against currency fluctuations or to speculate on interest rate differentials.

Over-the-Counter (OTC) and Exchange-Traded Markets

Foreign exchange transactions can occur either over-the-counter (OTC) or through exchange-traded markets:

- OTC Market: Decentralized network of banks, brokers, and other financial institutions that trade currencies directly with each other. OTC trades are typically large-volume transactions and are not standardized.

- Exchange-Traded Market: Centralized platforms where currencies are traded on standardized contracts. Exchange-traded markets provide transparency and liquidity, making them suitable for smaller transactions.

Electronic Trading Platforms

Electronic trading platforms have revolutionized the foreign exchange market by providing efficient and real-time trading capabilities:

- Electronic Communication Networks (ECNs): Platforms that connect multiple market participants and facilitate anonymous trading.

- Multi-Dealer Platforms (MDPs): Platforms that allow multiple market makers to compete for orders, providing competitive pricing.

- Dark Pools: Private trading venues that allow large orders to be executed anonymously.

Regulation of Foreign Exchange Market

The foreign exchange market is a vast and complex global marketplace where currencies are traded. Given its size and importance, it is essential to have regulations in place to ensure its smooth functioning and protect participants from potential risks.

Central banks and other regulatory bodies play a crucial role in overseeing the foreign exchange market. They implement measures to prevent market manipulation, promote fair trading practices, and maintain stability within the market.

Role of Central Banks

- Monetary Policy: Central banks influence the supply of money in the economy, which can impact currency exchange rates. They use tools such as interest rate adjustments and quantitative easing to manage inflation, economic growth, and currency stability.

- Foreign Exchange Intervention: In certain circumstances, central banks may intervene in the foreign exchange market to stabilize exchange rates or influence the value of their currency.

- Oversight and Regulation: Central banks often have regulatory authority over the foreign exchange market, setting rules and guidelines for market participants and monitoring compliance.

Role of Other Regulatory Bodies

- Securities and Exchange Commissions (SECs): SECs regulate the issuance and trading of securities, including foreign exchange derivatives. They enforce disclosure requirements and investigate potential market misconduct.

- Financial Conduct Authorities (FCAs): FCAs supervise financial institutions and markets, including foreign exchange brokers and dealers. They ensure compliance with regulations and investigate potential market manipulation.

- International Monetary Fund (IMF): The IMF provides financial assistance to countries experiencing economic difficulties and monitors the global financial system, including the foreign exchange market.

Measures to Prevent Market Manipulation

- Surveillance and Monitoring: Regulatory bodies use advanced surveillance systems to monitor trading activities and identify suspicious patterns that may indicate market manipulation.

- Anti-Money Laundering and Know-Your-Customer (KYC) Regulations: These regulations require financial institutions to verify the identity of their customers and monitor transactions for suspicious activity.

- Enforcement Actions: Regulatory bodies can impose penalties, including fines and imprisonment, on individuals or institutions found guilty of market manipulation.

Impact of Foreign Exchange Market on Global Economy

The foreign exchange market plays a pivotal role in facilitating international trade and investment, influencing economic growth and stability, and managing global financial risks.

Impact on International Trade and Investment

The foreign exchange market enables businesses to exchange currencies, facilitating the purchase and sale of goods and services across borders. By providing a platform for currency conversion, it reduces transaction costs and allows businesses to expand their global reach. Similarly, investors can diversify their portfolios and access international markets by investing in foreign currencies and assets.

Impact on Economic Growth and Stability

The foreign exchange market contributes to economic growth by promoting trade and investment. It helps stabilize economies by absorbing fluctuations in currency values, mitigating the impact of external shocks. Stable exchange rates create a favorable environment for businesses and investors, fostering economic activity and growth.

Role in Managing Global Financial Risks

The foreign exchange market serves as a risk management tool for businesses and investors. By hedging against currency fluctuations, they can minimize potential losses and protect their financial positions. Additionally, central banks intervene in the foreign exchange market to manage exchange rates, maintaining stability and mitigating financial risks in the global economy.

Final Thoughts

In conclusion, foreign exchange markets stand as indispensable pillars of the global economy, facilitating international trade, investments, and risk management. Their functions are multifaceted, enabling currency conversion, hedging against currency risks, and providing liquidity for global financial transactions. Understanding define foreign exchange market function empowers individuals and businesses to navigate the complexities of international finance with confidence.