What is foreign exchange market essay? It’s a question that delves into the intricate world of currency exchange, where the global economy takes shape. In this essay, we embark on a journey to unravel the complexities of the foreign exchange market, exploring its history, significance, participants, and the factors that shape its ever-fluctuating landscape.

From the bustling trading floors to the intricate web of economic forces, we will delve into the dynamics of this fascinating market, shedding light on its impact on businesses, economies, and individuals alike.

Introduction to Foreign Exchange Market

The foreign exchange market, also known as forex or FX, is a global decentralized market where currencies are traded. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion. The foreign exchange market plays a vital role in the global economy, facilitating international trade and investment.

Discover the crucial elements that make role of rbi in foreign exchange market ppt the top choice.

History of Foreign Exchange Market

The foreign exchange market has its roots in the early days of international trade. Merchants would exchange currencies to facilitate transactions across borders. Over time, the foreign exchange market evolved into a more organized system, with the establishment of currency exchanges and the development of standardized trading practices.

Significance and Role of Foreign Exchange Market

The foreign exchange market plays a significant role in the global economy. It facilitates international trade by allowing businesses to exchange currencies to settle transactions. It also facilitates investment by allowing investors to diversify their portfolios across different countries and currencies.

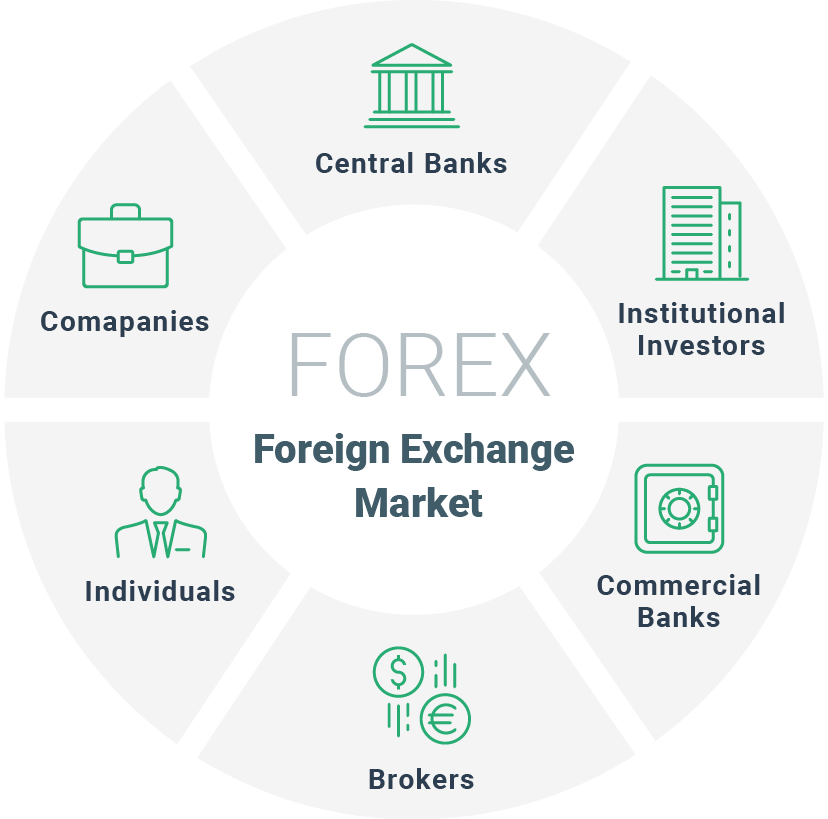

Participants in Foreign Exchange Market

The foreign exchange market is a global, decentralized market for the trading of currencies. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion.

The participants in the foreign exchange market can be broadly classified into two categories: dealers and non-dealers. Dealers are financial institutions that make a market in foreign currencies, while non-dealers are individuals or institutions that trade foreign currencies for their own account.

Dealers, What is foreign exchange market essay

Dealers are the primary participants in the foreign exchange market. They provide liquidity to the market by quoting bid and ask prices for foreign currencies. Dealers make a profit by buying currencies at a lower price and selling them at a higher price.

The largest dealers in the foreign exchange market are commercial banks. Other types of dealers include investment banks, hedge funds, and proprietary trading firms.

Non-Dealers

Non-dealers are individuals or institutions that trade foreign currencies for their own account. Non-dealers include corporations, governments, and individuals.

Corporations trade foreign currencies to facilitate their international business transactions. Governments trade foreign currencies to manage their exchange rates and foreign reserves.

Understand how the union of foreign exchange market names can improve efficiency and productivity.

The impact of different participants on market dynamics is significant. Dealers play a key role in providing liquidity to the market and determining exchange rates. Non-dealers can also impact market dynamics by placing large orders or by speculating on the direction of exchange rates.

Factors Affecting Foreign Exchange Rates

Foreign exchange rates are determined by a complex interplay of economic and non-economic factors. These factors can influence the demand and supply for currencies, leading to fluctuations in their values.

Economic Factors

- Interest Rates: Changes in interest rates can affect currency values. Higher interest rates tend to attract foreign investment, increasing demand for the currency and leading to its appreciation.

- Inflation: Inflation can erode the purchasing power of a currency, making it less desirable to hold. High inflation can lead to currency depreciation.

- Economic Growth: Strong economic growth can boost demand for a currency as investors seek opportunities in growing markets. This can lead to currency appreciation.

- Fiscal Policy: Government spending and taxation policies can impact currency values. Expansionary fiscal policies can increase demand for a currency, while contractionary policies can reduce demand.

Non-Economic Factors

- Political Stability: Political instability can make investors hesitant to invest in a country, leading to currency depreciation.

- Natural Disasters: Major natural disasters can damage a country’s economy and infrastructure, reducing the demand for its currency.

li>Speculation: Currency traders can speculate on future exchange rate movements, creating volatility in the market.

These factors interact and influence each other, making it difficult to predict foreign exchange rates with certainty. However, understanding the key drivers of currency values is crucial for businesses and investors who engage in international trade or financial transactions.

Browse the multiple elements of foreign exchange market definition with example to gain a more broad understanding.

Types of Foreign Exchange Transactions: What Is Foreign Exchange Market Essay

Foreign exchange transactions are the buying and selling of currencies between two parties. They can be conducted for various purposes, including international trade, investment, and tourism. There are several types of foreign exchange transactions, each with its unique purpose and process.

Spot Transactions

Spot transactions are the most common type of foreign exchange transaction. They involve the immediate delivery of currencies at the prevailing market rate. Spot transactions are typically used for urgent payments or to take advantage of short-term fluctuations in exchange rates.

Forward Transactions

Forward transactions are agreements to buy or sell a currency at a predetermined rate on a future date. They are used to lock in exchange rates and mitigate the risk of currency fluctuations. Forward transactions are typically used for large transactions or when there is a need to hedge against future currency risks.

Swap Transactions

Swap transactions involve the simultaneous buying and selling of two currencies with different maturities. They are used to manage currency exposure and to take advantage of interest rate differentials. Swap transactions are typically used by large corporations and financial institutions.

Option Transactions

Option transactions give the buyer the right, but not the obligation, to buy or sell a currency at a predetermined rate on a future date. They are used to speculate on currency movements or to hedge against currency risks. Option transactions are typically used by investors and traders.

Each type of foreign exchange transaction has its advantages and disadvantages. Spot transactions are simple and quick, but they expose the parties to the risk of currency fluctuations. Forward transactions lock in exchange rates, but they can be more expensive than spot transactions. Swap transactions can be used to manage currency exposure and to take advantage of interest rate differentials, but they can be complex and require a high level of expertise. Option transactions provide flexibility and the potential for profit, but they can also be risky.

The choice of foreign exchange transaction type depends on the specific needs and risk tolerance of the parties involved.

Foreign Exchange Market Regulation

The foreign exchange market is a vast and complex global marketplace where currencies are traded. Due to its size and importance, regulation is essential to ensure its stability, transparency, and fairness.

Regulatory bodies play a crucial role in overseeing the foreign exchange market. They establish rules and regulations to prevent market manipulation, insider trading, and other illegal activities. These bodies also monitor market activities, investigate suspicious transactions, and enforce compliance with regulations.

Examples of Regulations and Their Impact

- Know-Your-Customer (KYC) Regulations: These regulations require financial institutions to verify the identity of their customers and assess their risk profile. This helps prevent money laundering and other financial crimes.

- Anti-Money Laundering (AML) Regulations: These regulations prohibit financial institutions from engaging in transactions involving money laundering. They require institutions to report suspicious transactions and cooperate with law enforcement.

- Capital Adequacy Requirements: These regulations ensure that financial institutions have sufficient capital to cover potential losses. This helps maintain the stability of the financial system.

Challenges and Opportunities in Foreign Exchange Market

The foreign exchange market presents a unique landscape of challenges and opportunities for participants. Navigating this dynamic market requires a thorough understanding of its complexities and a keen eye for potential risks and rewards.

Challenges

- Currency Volatility: Exchange rates are subject to constant fluctuations influenced by economic, political, and geopolitical factors, making it challenging to predict market movements accurately.

- Market Complexity: The foreign exchange market is a vast and interconnected network, involving a wide range of currencies, instruments, and participants, which can make it difficult to grasp its intricacies.

- Transaction Costs: Forex transactions often involve various fees, such as bid-ask spreads, commissions, and currency conversion charges, which can impact profitability.

Opportunities

- Profit Potential: Currency movements offer opportunities for profit by speculating on exchange rate fluctuations and capitalizing on market inefficiencies.

- Diversification: Investing in foreign currencies can diversify investment portfolios, reducing risk by mitigating the impact of fluctuations in a single currency.

- Hedging: Companies and individuals can use the foreign exchange market to hedge against currency risk, protecting themselves from adverse exchange rate movements.

Risks and Rewards

Foreign exchange trading carries inherent risks and rewards. The potential for profit is balanced by the risk of loss, and participants must carefully weigh these factors before entering the market.

- Leverage: While leverage can amplify profits, it can also magnify losses if market movements are unfavorable.

- Market Manipulation: The foreign exchange market is susceptible to manipulation by large market participants, which can lead to unexpected price movements.

- Regulatory Changes: Regulatory changes can impact the foreign exchange market, affecting trading conditions and risk profiles.

Wrap-Up

In conclusion, the foreign exchange market is a dynamic and ever-evolving landscape, where the interplay of economic forces, geopolitical events, and market sentiment shapes the value of currencies and influences the global economy. Understanding the intricacies of this market empowers individuals and businesses to navigate its complexities, mitigate risks, and capitalize on opportunities.

As the world becomes increasingly interconnected, the foreign exchange market will continue to play a pivotal role in facilitating global trade, investment, and economic growth.