The foreign exchange market in derivatives is a complex and dynamic global marketplace where participants trade financial instruments to manage currency risk and speculate on exchange rate movements. This market plays a crucial role in facilitating international trade, investment, and economic growth.

Derivatives, such as forwards, futures, options, and swaps, are financial contracts that derive their value from an underlying asset, in this case, foreign currencies. These instruments allow market participants to hedge against currency fluctuations, lock in exchange rates, and speculate on future currency movements.

Introduction to the Foreign Exchange Market

The foreign exchange market (Forex or FX market) is a global marketplace where currencies are traded. It is the largest financial market in the world, with a daily trading volume exceeding $5 trillion.

The Forex market was established in the late 19th century to facilitate international trade and investment. It allows businesses and individuals to exchange currencies at market-determined rates. The market is open 24 hours a day, five days a week, and trades currencies from all over the world.

Key Participants in the Forex Market

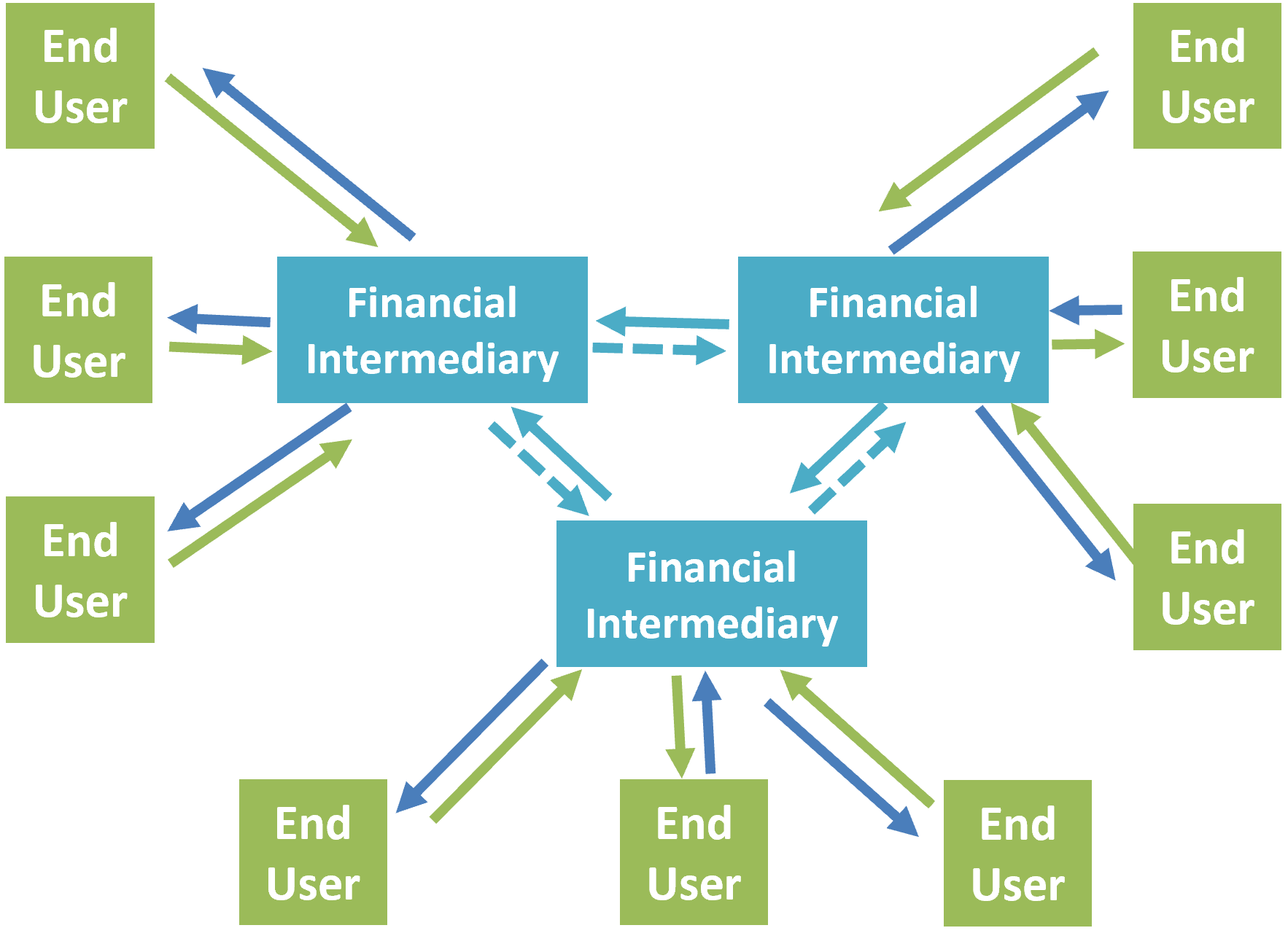

The key participants in the Forex market include:

- Banks: Banks are the largest participants in the Forex market. They provide liquidity to the market and facilitate currency exchange for their customers.

- Hedge funds: Hedge funds are investment funds that use sophisticated trading strategies to generate profits from currency fluctuations.

- Corporations: Corporations use the Forex market to hedge against currency risks and to facilitate international trade.

Factors Influencing Currency Exchange Rates

The exchange rate between two currencies is determined by a number of factors, including:

- Economic growth: The economic growth rate of a country can affect the value of its currency. A country with a strong economy will typically have a stronger currency.

- Interest rates: The interest rate differential between two countries can also affect currency exchange rates. A country with higher interest rates will typically have a stronger currency.

- Political stability: Political stability can also affect currency exchange rates. A country with a stable political environment will typically have a stronger currency.

Types of Derivatives in the Foreign Exchange Market

Derivatives play a crucial role in the foreign exchange market, providing tools for managing risk and speculating on currency fluctuations. Various types of derivatives are employed, each with unique characteristics and applications.

Do not overlook explore the latest data about foreign exchange market ap macro graph.

Forwards

- Contracts that lock in the exchange rate for a future date, with no obligation to buy or sell the underlying currency.

- Used to hedge against currency risk or speculate on future exchange rate movements.

Futures

- Standardized contracts traded on an exchange, obligating the parties to buy or sell the underlying currency at a specified price on a future date.

- Provide a more liquid and standardized market compared to forwards.

Options

- Contracts that give the buyer the right, but not the obligation, to buy or sell the underlying currency at a specified price on or before a certain date.

- Used to manage risk, speculate on exchange rate movements, or create complex trading strategies.

Swaps

- Contracts that involve exchanging one stream of cash flows for another, based on different interest rates or currencies.

- Used for hedging interest rate or currency risk, or for speculating on future interest rate or currency movements.

Uses of Derivatives in the Foreign Exchange Market

Derivatives play a significant role in the foreign exchange market, providing various opportunities for risk management and profit-making.

Hedging Currency Risk

Derivatives offer effective tools for businesses and individuals to mitigate currency risk. By using forward contracts, options, or other derivative instruments, they can lock in exchange rates in advance, protecting themselves from potential losses due to currency fluctuations. For example, a company importing goods from Japan can use a forward contract to fix the yen-dollar exchange rate, ensuring a predictable cost for their imports.

Speculation and Profit-Making

Derivatives also present opportunities for speculation and profit-making in the foreign exchange market. Traders can use derivatives to bet on future currency movements and potentially profit from exchange rate fluctuations. For instance, a trader who believes the euro will appreciate against the dollar can buy euro call options, giving them the right to buy euros at a fixed price in the future. If the euro does appreciate, the trader can exercise the options and sell the euros at a higher price, making a profit.

Obtain direct knowledge about the efficiency of foreign exchange market in nigeria today through case studies.

Real-World Examples

Here are some real-world examples of how derivatives are used in the foreign exchange market:

- Hedging Currency Risk: A multinational company with operations in multiple countries uses forward contracts to hedge its exposure to foreign currency fluctuations, ensuring stable cash flows and protecting against potential losses.

- Speculation and Profit-Making: A currency trader uses options to speculate on the direction of the euro-dollar exchange rate. If their prediction is correct, they can profit from the currency movement.

Pricing and Valuation of Derivatives in the Foreign Exchange Market

Pricing and valuing derivatives in the foreign exchange market involves determining their fair market value. This process considers various factors that influence their worth and utilizes specific methods to calculate their prices. Understanding these methods is crucial for market participants to make informed decisions and manage risk effectively.

Methods for Pricing and Valuation

- Black-Scholes Model: Widely used for pricing options, this model considers factors like underlying asset price, strike price, time to maturity, risk-free interest rate, and volatility.

- Monte Carlo Simulation: A stochastic method that simulates multiple scenarios to estimate the probability distribution of a derivative’s value.

- Binomial Tree Model: A discrete-time model that constructs a binomial tree to calculate option prices, considering factors such as risk-neutral probabilities and the number of time steps.

- Historical Simulation: Utilizes historical data to simulate future price movements and estimate the distribution of a derivative’s value.

Factors Affecting Derivative Pricing

- Underlying Asset Price: The price of the underlying asset, such as a currency pair, directly influences the value of the derivative.

- Strike Price: For options, the strike price determines the exercise price at which the option can be bought or sold.

- Time to Maturity: The time remaining until the derivative’s expiration date affects its value, with longer-term derivatives generally being more valuable.

- Risk-Free Interest Rate: The prevailing risk-free interest rate influences the cost of carry and the value of derivatives.

- Volatility: The volatility of the underlying asset’s price impacts the pricing of derivatives, with higher volatility leading to higher derivative prices.

Examples of Derivative Valuation, Foreign exchange market in derivatives

- Call Option Valuation: Using the Black-Scholes model, the value of a call option can be calculated considering factors such as the current stock price, strike price, time to maturity, risk-free interest rate, and volatility.

- Forward Contract Valuation: The value of a forward contract is determined by the difference between the spot price and the forward price, adjusted for the time value of money.

- Currency Swap Valuation: The value of a currency swap is calculated based on the difference in interest rates between the two currencies involved, the swap period, and the notional amount.

Risks and Challenges in the Foreign Exchange Market

The foreign exchange market, while offering immense opportunities for profit, also carries inherent risks and challenges. Understanding these risks and developing strategies to mitigate them is crucial for successful participation in the market.

Risks Associated with Trading Derivatives in the Foreign Exchange Market

- Currency Risk: Fluctuations in exchange rates can lead to significant losses if the underlying currency pair moves against the trader’s position.

- Interest Rate Risk: Changes in interest rates can affect the value of derivatives, especially those with longer maturities.

- Volatility Risk: The foreign exchange market is highly volatile, with rapid price fluctuations that can result in substantial losses.

- Counterparty Risk: The risk that the other party to a derivative contract may default on its obligations.

- Liquidity Risk: The risk that a trader may not be able to buy or sell a derivative at a fair price when desired.

Challenges Faced by Participants in the Market

- Complexity: The foreign exchange market is a complex and dynamic environment that requires a deep understanding of economic fundamentals, market dynamics, and derivative instruments.

- Regulation: Participants must adhere to strict regulations and compliance requirements set by financial authorities.

- Competition: The foreign exchange market is highly competitive, with a large number of sophisticated participants.

- Information Asymmetry: Traders may not have access to the same level of information, which can create a competitive disadvantage.

- Technology: The market is heavily reliant on technology, and participants must invest in robust systems and infrastructure.

Strategies for Mitigating Risks and Overcoming Challenges

- Risk Management: Implementing comprehensive risk management strategies, such as hedging, diversification, and position sizing, can help mitigate risks.

- Education and Research: Continuous learning and staying abreast of market trends, economic data, and regulatory changes are essential.

- Due Diligence: Conducting thorough due diligence on counterparties and understanding the terms and conditions of derivative contracts can reduce counterparty and liquidity risks.

- Technology: Investing in advanced trading platforms, risk management tools, and data analytics can enhance efficiency and decision-making.

- Collaboration: Seeking professional advice from brokers, financial advisors, or other experts can provide valuable insights and support.

Regulation of the Foreign Exchange Market

The foreign exchange market, due to its global nature and the enormous volume of transactions, requires robust regulation to ensure stability, transparency, and fairness. This regulation is typically undertaken by central banks and other regulatory bodies, which establish rules and guidelines to govern the conduct of participants in the market.

Check what professionals state about foreign exchange market meaning and functions and its benefits for the industry.

Central banks play a crucial role in regulating the foreign exchange market. They are responsible for managing monetary policy, which includes setting interest rates and intervening in the foreign exchange market to influence the value of their currency. Central banks also supervise and regulate financial institutions involved in foreign exchange trading, ensuring they adhere to prudential standards and risk management practices.

Role of Other Regulatory Bodies

In addition to central banks, other regulatory bodies also play a significant role in regulating the foreign exchange market. These bodies may include government agencies, self-regulatory organizations (SROs), and international organizations.

- Government Agencies: Government agencies, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, have the authority to enforce securities laws and regulations related to foreign exchange trading. They may also have specific regulations governing the conduct of foreign exchange brokers and dealers.

- Self-Regulatory Organizations (SROs): SROs are industry-led organizations that establish and enforce rules and standards for their members. In the foreign exchange market, SROs such as the Foreign Exchange Committee (FXC) and the International Swaps and Derivatives Association (ISDA) play a significant role in promoting market integrity and self-regulation.

- International Organizations: International organizations, such as the Bank for International Settlements (BIS) and the International Monetary Fund (IMF), provide guidance and recommendations on best practices for regulating the foreign exchange market. They also facilitate cooperation and information sharing among regulatory authorities worldwide.

Regulatory Requirements for Trading Derivatives

The regulatory requirements for trading derivatives in the foreign exchange market vary depending on the jurisdiction and the type of derivative being traded. However, there are some general requirements that apply to most jurisdictions.

- Registration and Licensing: Entities involved in trading foreign exchange derivatives must typically register with and obtain a license from the relevant regulatory authority. This process involves meeting certain criteria related to financial stability, risk management, and compliance with regulations.

- Capital and Risk Management Requirements: Regulatory authorities may impose capital and risk management requirements on entities trading foreign exchange derivatives. These requirements aim to ensure that firms have sufficient financial resources and risk management systems to mitigate potential losses.

- Reporting and Disclosure: Entities trading foreign exchange derivatives are typically required to report their activities and positions to the relevant regulatory authority. This information is used to monitor market trends, identify potential risks, and enforce compliance with regulations.

- Market Conduct Rules: Regulatory authorities also establish market conduct rules to prevent fraud, manipulation, and other unethical practices in the foreign exchange market. These rules may include requirements for fair dealing, transparency, and disclosure of conflicts of interest.

Emerging Trends and Future Outlook of the Foreign Exchange Market

The foreign exchange market is constantly evolving, driven by technological advancements, regulatory changes, and global economic shifts. Understanding the latest trends and emerging technologies shaping the market is crucial for staying competitive and adapting to the future landscape.

Digitalization and Automation

- Artificial intelligence (AI) and machine learning (ML) algorithms are increasingly used for currency forecasting, trade execution, and risk management.

- Automated trading platforms facilitate faster and more efficient order execution, reducing transaction costs and latency.

Blockchain Technology

- Distributed ledger technology (DLT) enables secure and transparent cross-border payments, reducing settlement times and transaction fees.

- Cryptocurrencies are gaining acceptance as alternative investment and payment options, influencing FX market dynamics.

Regulatory Landscape

- Increased regulatory scrutiny is expected to enhance market transparency and reduce systemic risks.

- Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations is becoming more stringent.

Outlook for the Future

The foreign exchange market is expected to continue its growth trajectory, driven by increasing global trade and investment. Emerging technologies will reshape the market, enhancing efficiency, reducing costs, and providing new opportunities. However, regulatory changes and geopolitical uncertainties will continue to impact market dynamics.

Final Conclusion: Foreign Exchange Market In Derivatives

The foreign exchange market in derivatives is a sophisticated and ever-evolving marketplace that offers opportunities for risk management and profit-making. Understanding the intricacies of this market is essential for businesses, investors, and anyone involved in international transactions.