Welcome to the realm of foreign exchange market example problems, where we’ll delve into the intricacies of currency fluctuations and equip you with strategies to navigate the ever-changing financial landscape. From economic events to political shifts, we’ll explore the factors that shape exchange rates and guide you through the complexities of risk management, trading strategies, and market analysis.

Join us on this enlightening journey as we uncover the secrets of the foreign exchange market and empower you to make informed decisions in your financial endeavors.

Market Dynamics

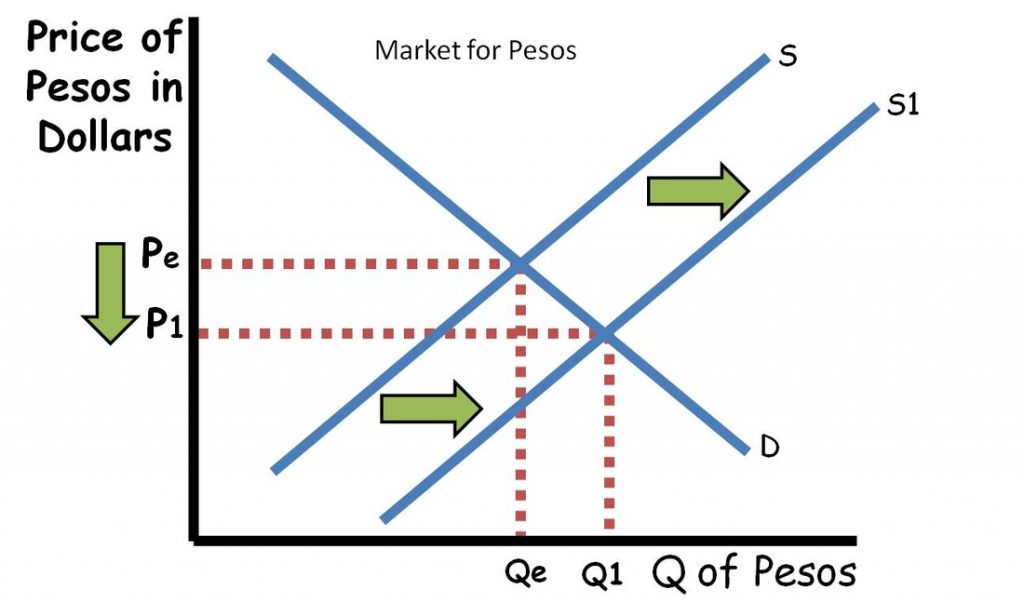

The foreign exchange market is a dynamic and complex environment, where currency values are constantly fluctuating. These fluctuations are driven by a wide range of factors, including economic, political, and psychological forces.

Economic Factors, Foreign exchange market example problems

- Interest rates: Changes in interest rates can have a significant impact on currency values. Higher interest rates tend to attract foreign capital, which can lead to an appreciation of the currency. Conversely, lower interest rates can lead to a depreciation of the currency.

- Inflation: Inflation is a measure of the rate at which prices are rising. High inflation can erode the value of a currency, making it less attractive to foreign investors. Conversely, low inflation can make a currency more attractive to foreign investors.

- Economic growth: Economic growth can lead to an appreciation of a currency, as it indicates that the economy is strong and stable. Conversely, economic contraction can lead to a depreciation of the currency.

Political Factors

- Political stability: Political instability can lead to a depreciation of a currency, as it creates uncertainty for foreign investors. Conversely, political stability can lead to an appreciation of a currency.

- Government policies: Government policies can have a significant impact on currency values. For example, changes in fiscal policy or monetary policy can lead to changes in interest rates or inflation, which can in turn affect currency values.

Psychological Factors

- Market sentiment: Market sentiment can play a role in currency fluctuations. When investors are optimistic about the future of a currency, they are more likely to buy it, which can lead to an appreciation. Conversely, when investors are pessimistic about the future of a currency, they are more likely to sell it, which can lead to a depreciation.

- Speculation: Speculation can also play a role in currency fluctuations. Speculators often buy or sell currencies based on their expectations of future movements in the market. This can lead to short-term fluctuations in currency values.

Risk Management

Foreign exchange trading involves various risks that need to be managed effectively. These risks include:

- Currency Risk: The risk of loss due to fluctuations in currency exchange rates.

- Interest Rate Risk: The risk of loss due to changes in interest rates, which can affect the value of currency pairs.

- Political Risk: The risk of loss due to political events or instability in a country, which can impact its currency value.

- Liquidity Risk: The risk of not being able to buy or sell a currency pair at a desired price due to low liquidity.

Strategies for Mitigating Currency Risk

To mitigate currency risk, traders can employ various strategies:

- Hedging: Using financial instruments like forwards, futures, or options to offset potential losses from currency fluctuations.

- Diversification: Investing in a portfolio of currencies to reduce the impact of any single currency’s performance.

- Hedging with Real Assets: Using physical assets like commodities or real estate as a hedge against currency fluctuations.

- Monitoring Economic Indicators: Staying informed about economic indicators that can influence currency movements and making informed trading decisions accordingly.

Trading Strategies

The foreign exchange market offers a plethora of trading strategies, each tailored to different risk appetites, time horizons, and market conditions. Understanding the nuances of these strategies is crucial for successful navigation of the forex market.

Traders can broadly categorize trading strategies into three main types: scalping, day trading, and swing trading. Each strategy employs distinct techniques and time frames, catering to specific trading goals and preferences.

Scalping

Scalping involves executing numerous short-term trades within a single trading session, capitalizing on minor price fluctuations. Scalpers aim to generate small profits from each trade, relying on high volume and quick execution to accumulate gains. This strategy requires a deep understanding of market dynamics and lightning-fast reflexes.

Pros:

- Potential for high returns in a short period.

- Lower risk compared to other strategies due to small position sizes.

Cons:

Obtain a comprehensive document about the application of definition of foreign exchange market by authors that is effective.

- Requires intense focus and constant monitoring.

- Transaction costs can eat into profits.

Day Trading

Day trading involves opening and closing positions within the same trading day, avoiding overnight risk. Day traders capitalize on intraday price movements, utilizing technical analysis to identify trading opportunities. This strategy demands a thorough understanding of market trends and a disciplined approach to risk management.

Learn about more about the process of foreign exchange market ppt in the field.

Pros:

- Eliminates overnight risk.

- Offers the potential for consistent profits.

Cons:

- Requires significant time commitment and market expertise.

- Can be stressful due to the fast-paced nature.

Swing Trading

Swing trading involves holding positions for multiple days or even weeks, capturing larger price swings. Swing traders analyze longer-term trends and market fundamentals to identify potential trading opportunities. This strategy is less time-consuming than scalping or day trading and can be suitable for traders with less market experience.

Pros:

- Less time commitment required.

- Potential for larger profits due to longer position holding periods.

Cons:

- Overnight risk can be a concern.

- Requires patience and discipline to hold positions for extended periods.

Technical Analysis

Technical analysis is a widely used method in foreign exchange trading, as it helps traders identify trading opportunities by analyzing past price movements and patterns.

Technical indicators are mathematical calculations based on historical price data that help traders identify trends, support and resistance levels, and potential trading opportunities. Some commonly used technical indicators include:

Moving Averages

Moving averages smooth out price fluctuations and help identify trends. They are calculated by averaging the closing prices over a specific period.

Relative Strength Index (RSI)

The RSI measures the magnitude of recent price changes to evaluate whether a currency is overbought or oversold.

Bollinger Bands

Bollinger Bands are a volatility indicator that helps identify potential trend reversals. They consist of a moving average and two standard deviation bands.

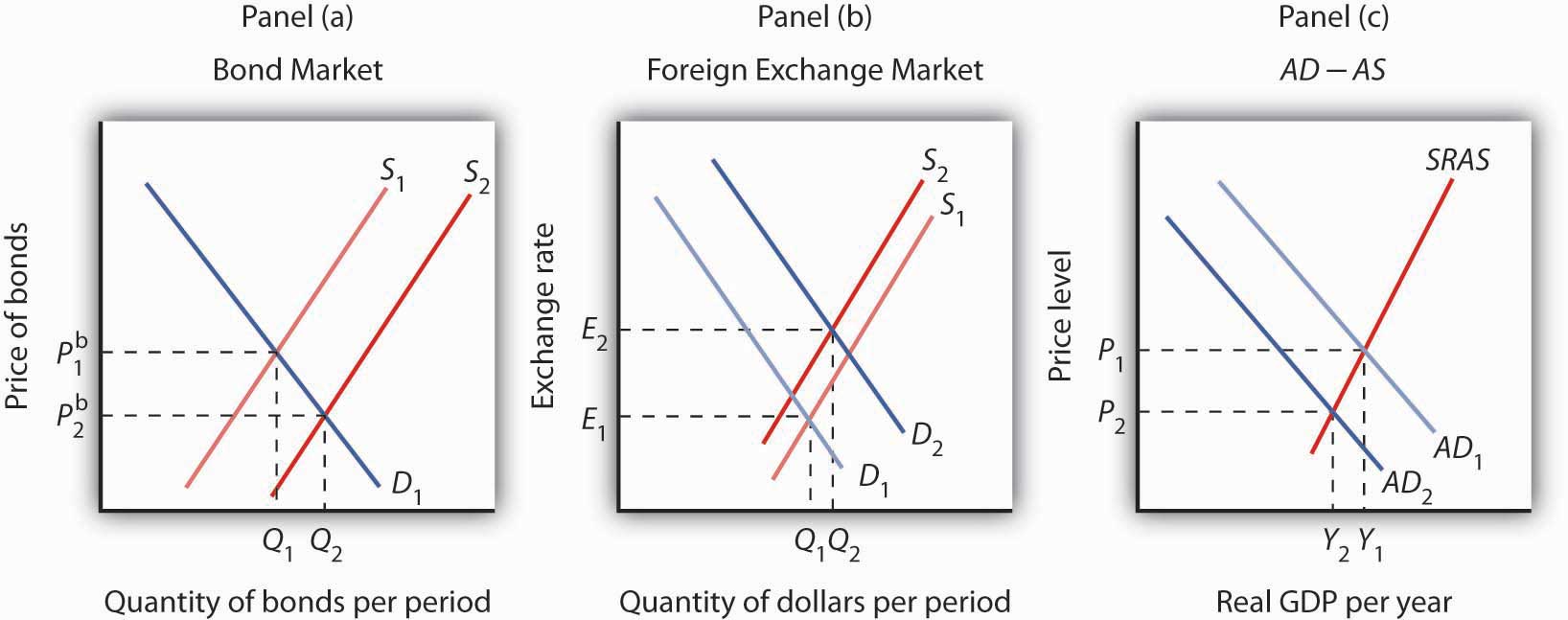

Fundamental Analysis

Fundamental analysis is a method of evaluating currencies by examining economic and political factors that influence their value. It involves studying macroeconomic indicators, such as GDP growth, inflation, unemployment rates, and interest rates, as well as political stability, fiscal policies, and international trade.

Key Economic and Political Factors

- Economic Growth: A country with a strong and growing economy tends to have a stronger currency, as it indicates a healthy economy and increased demand for its goods and services.

- Inflation: High inflation can erode the value of a currency, as it reduces the purchasing power of consumers and businesses.

- Unemployment: High unemployment can indicate economic weakness and reduced demand for the country’s currency.

- Interest Rates: Higher interest rates make a currency more attractive to investors, as it offers higher returns on investments.

- Political Stability: Political instability, such as wars, revolutions, or government changes, can negatively impact the value of a currency.

- Fiscal Policies: Government spending, taxation, and debt levels can influence the value of a currency by affecting the economy’s overall health.

- International Trade: A country with a positive trade balance (exports exceeding imports) tends to have a stronger currency, as it indicates increased demand for its goods and services.

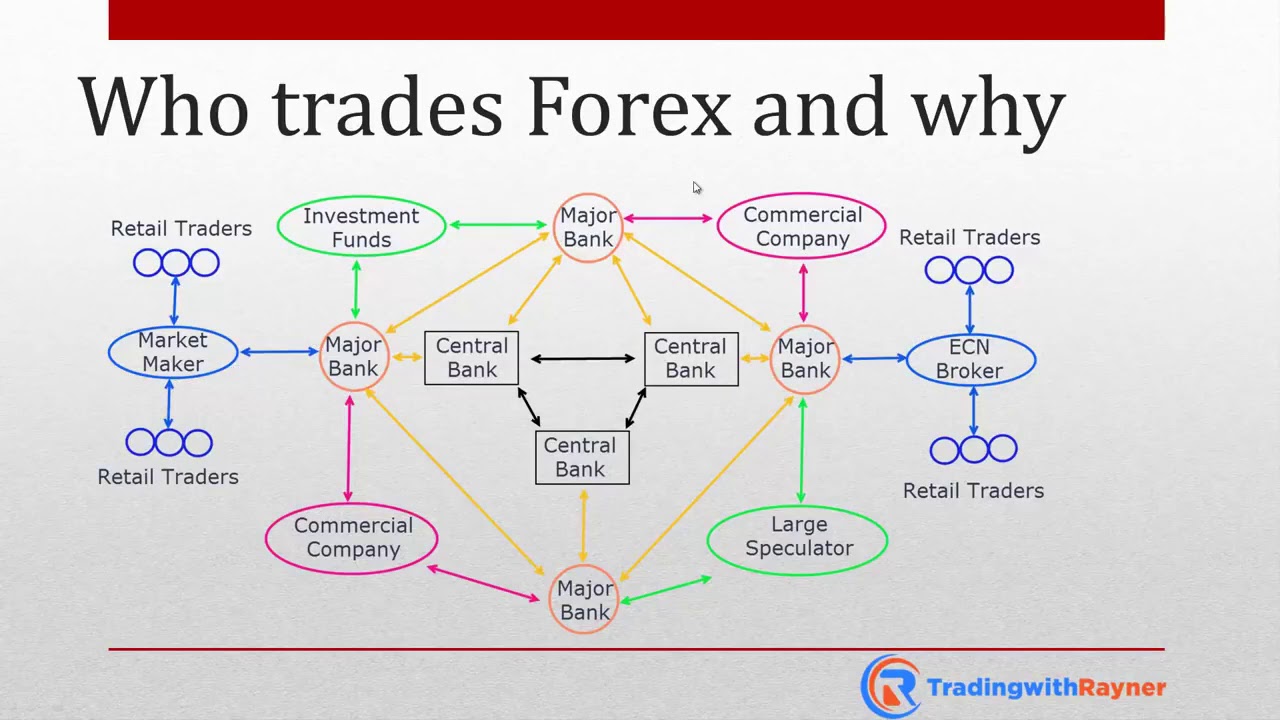

Market Participants

The foreign exchange market involves a diverse range of participants, each playing distinct roles and driven by specific motivations. Understanding the different types of market participants is crucial for grasping the dynamics and complexity of the forex market.

Find out further about the benefits of the foreign exchange market course hero that can provide significant benefits.

Central Banks

- Role: Regulate monetary policy, manage foreign exchange reserves, and maintain currency stability.

- Motivations: Ensure economic stability, control inflation, and influence exchange rates.

Commercial Banks

- Role: Facilitate foreign exchange transactions for their customers, including individuals, businesses, and other financial institutions.

li>Motivations: Profit from bid-ask spreads, earn interest on foreign currency holdings, and provide liquidity to the market.

Retail Traders

- Role: Speculate on currency price movements, seeking to profit from fluctuations.

- Motivations: Potential for high returns, access to a global market, and 24/7 trading availability.

Market Structure

The foreign exchange market is a global, decentralized market for the trading of currencies. It is the largest and most liquid financial market in the world, with a daily trading volume of over $5 trillion. The foreign exchange market is divided into several different types of markets, each with its own unique features and uses.

The three main types of foreign exchange markets are the spot market, the forward market, and the swap market.

Spot Market

- The spot market is the market for the immediate delivery of currencies.

- When you buy or sell a currency in the spot market, you are agreeing to exchange currencies at the current spot rate.

- The spot rate is the price of one currency in terms of another currency at a specific point in time.

Forward Market

- The forward market is the market for the future delivery of currencies.

- When you buy or sell a currency in the forward market, you are agreeing to exchange currencies at a specified future date and rate.

- The forward rate is the price of one currency in terms of another currency at a specific future date.

Swap Market

- The swap market is the market for the exchange of currencies for different periods of time.

- When you enter into a currency swap, you are agreeing to exchange one currency for another currency at a specified future date and rate, and then to exchange the currencies back at a later date and rate.

- Currency swaps are often used to hedge against foreign exchange risk.

The table below summarizes the key features and uses of each type of foreign exchange market:

| Market Type | Features | Uses |

|---|---|---|

| Spot Market | Immediate delivery of currencies | Trading currencies for immediate needs |

| Forward Market | Future delivery of currencies | Hedging against foreign exchange risk |

| Swap Market | Exchange of currencies for different periods of time | Hedging against foreign exchange risk |

Market Regulations

The foreign exchange market, being a decentralized and globalized market, requires a robust regulatory framework to ensure its integrity and stability. Regulatory bodies play a crucial role in overseeing the market, enforcing rules, and protecting participants.

Various regulatory bodies, such as central banks, financial authorities, and international organizations, are responsible for regulating the foreign exchange market. They establish guidelines, monitor market activities, and take enforcement actions against any violations or misconduct.

Role of Regulatory Bodies

- Establish and enforce regulations to maintain market integrity and prevent fraud.

- Monitor market activities to detect and prevent any illegal or manipulative practices.

- Investigate and prosecute cases of misconduct, such as insider trading or market manipulation.

- Cooperate with international organizations to harmonize regulations and combat cross-border financial crimes.

Measures to Ensure Market Integrity

- Licensing and Registration: Regulators require market participants, such as banks and brokers, to obtain licenses or register with the relevant authorities. This ensures that only reputable and qualified entities operate in the market.

- Capital Requirements: Regulatory bodies impose capital requirements on market participants to ensure they have sufficient financial resources to cover potential losses and maintain market stability.

- Risk Management: Regulators require market participants to implement robust risk management practices to identify, assess, and mitigate potential risks.

- Transparency and Disclosure: Regulatory bodies promote transparency and disclosure in the market to reduce information asymmetry and prevent insider trading.

Trading Platforms

The foreign exchange market offers a diverse range of trading platforms to cater to the needs of traders with varying experience levels, trading styles, and capital. These platforms provide a secure and efficient environment for executing trades, accessing market data, and managing risk.

Types of Trading Platforms

- Retail Trading Platforms: Designed for individual traders, these platforms are user-friendly, offering intuitive interfaces and a wide range of features. They typically provide basic order types, charting tools, and news feeds.

- Institutional Trading Platforms: Tailored for professional traders and institutions, these platforms offer advanced functionality, such as algorithmic trading, direct market access (DMA), and sophisticated risk management tools. They provide real-time market data, customizable interfaces, and high-speed order execution.

- Web-Based Trading Platforms: Accessed through a web browser, these platforms offer convenience and flexibility. They require no software installation and can be used from any device with an internet connection. However, they may have limited functionality compared to desktop-based platforms.

- Mobile Trading Platforms: Designed for on-the-go trading, these platforms allow traders to access the market and execute trades from their smartphones or tablets. They offer basic trading features and real-time market updates.

Comparison of Trading Platforms

| Feature | Retail Trading Platforms | Institutional Trading Platforms | Web-Based Trading Platforms | Mobile Trading Platforms |

|---|---|---|---|---|

| User Interface | Intuitive and user-friendly | Advanced and customizable | Simple and accessible | Optimized for mobile devices |

| Order Types | Basic order types | Advanced order types (e.g., limit, stop, trailing stop) | Limited order types | Basic order types |

| Charting Tools | Basic charting tools | Advanced charting tools with technical indicators | Limited charting tools | Basic charting tools |

| Risk Management Tools | Basic risk management tools (e.g., stop-loss orders) | Sophisticated risk management tools (e.g., position sizing, trailing stops) | Limited risk management tools | Basic risk management tools |

| Market Data | Real-time market data | Real-time market data with advanced analytics | Limited real-time market data | Limited real-time market data |

| Speed of Execution | Average execution speed | High-speed execution | Variable execution speed | Average execution speed |

| Fees and Commissions | Typically low fees | Higher fees for advanced features | Variable fees depending on platform | Typically low fees |

The choice of trading platform depends on the individual trader’s needs and preferences. Retail traders with limited experience may prefer user-friendly retail platforms, while professional traders may require the advanced features offered by institutional platforms.

Historical Case Studies: Foreign Exchange Market Example Problems

Historical events can significantly impact the foreign exchange market, shaping its dynamics and influencing currency valuations. By examining past events, we gain insights into the causes and consequences of market fluctuations, helping us better understand and navigate the complexities of the forex market.

2008 Financial Crisis

The 2008 financial crisis, triggered by the collapse of the US housing market, had a profound impact on the global economy and financial markets, including the forex market. The crisis led to a loss of confidence in the financial system, causing a flight to safety and a surge in demand for safe-haven currencies such as the US dollar and Swiss franc. As a result, the value of the dollar and franc rose sharply against other currencies, while riskier currencies, such as the British pound and euro, experienced significant declines.

Brexit Referendum

The 2016 Brexit referendum, in which the UK voted to leave the European Union, created uncertainty and volatility in the forex market. The pound sterling initially fell sharply following the vote, as investors worried about the economic and political implications of Brexit. The pound’s value continued to fluctuate in the months and years following the referendum, as negotiations between the UK and EU progressed.

Ending Remarks

Through this exploration of foreign exchange market example problems, we’ve gained a deeper understanding of the forces that drive currency values and the strategies employed to manage risk and capitalize on market opportunities. Whether you’re a seasoned trader or just starting your journey in the world of finance, we hope this guide has provided you with valuable insights and practical tools to navigate the ever-evolving foreign exchange market.