Examples of foreign exchange market in economics – Delving into the realm of foreign exchange markets, we embark on a captivating journey to explore their profound influence on international trade and finance. These markets, where currencies are bought and sold, play a pivotal role in facilitating global commerce, shaping economic policies, and impacting businesses and individuals worldwide.

From multinational corporations seeking to optimize their cross-border transactions to central banks managing their monetary reserves, a diverse array of participants actively engage in foreign exchange markets. Understanding the dynamics of these markets and the factors that influence currency exchange rates is crucial for navigating the ever-changing global economic landscape.

Introduction to the Foreign Exchange Market: Examples Of Foreign Exchange Market In Economics

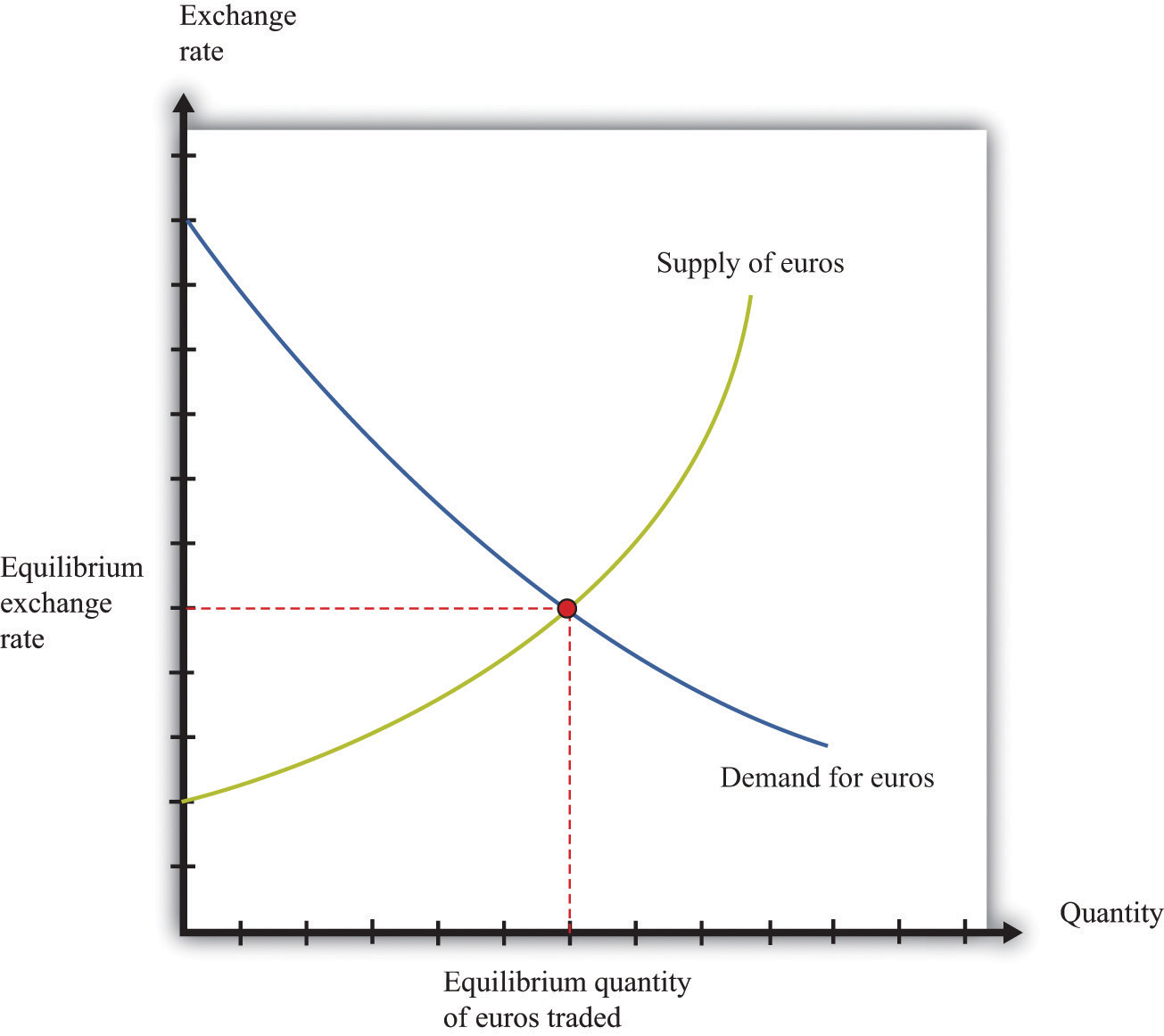

The foreign exchange market, also known as the forex market, is a global marketplace where currencies are traded. It plays a vital role in international trade and finance, facilitating the exchange of goods and services between countries with different currencies.

Participants in the foreign exchange market include banks, investment firms, corporations, governments, and individual traders. Banks are the largest participants, acting as intermediaries between buyers and sellers of currencies.

Types of Foreign Exchange Market Participants

- Banks: Commercial banks, investment banks, and central banks are major participants in the forex market. They provide liquidity, facilitate currency exchange, and manage risk for their clients.

- Investment firms: Hedge funds, mutual funds, and other investment firms trade currencies for profit or to hedge against risk in their investment portfolios.

- Corporations: Multinational corporations engage in foreign exchange transactions to facilitate international trade, manage currency risk, and optimize their financial positions.

- Governments: Central banks intervene in the forex market to influence exchange rates, manage their foreign exchange reserves, and maintain economic stability.

- Individual traders: Retail traders participate in the forex market through online trading platforms, speculating on currency movements for potential profits.

Major Players in the Foreign Exchange Market

The foreign exchange market is a vast and complex global network where currencies are traded. Various key players participate in this market, each with distinct roles and functions.

Banks

Banks are the largest players in the foreign exchange market, facilitating a significant portion of global currency transactions. They provide a range of services, including currency exchange, trade finance, and hedging solutions, to businesses and individuals.

Enhance your insight with the methods and methods of function of foreign exchange market ppt.

Financial Institutions

Financial institutions, such as investment banks, hedge funds, and asset management companies, actively trade currencies to generate profits or manage risk. They often engage in speculative trading strategies, utilizing advanced financial instruments.

Corporations

Corporations with international operations engage in foreign exchange transactions to facilitate cross-border trade, investments, and payments. They manage currency risks through hedging strategies to minimize potential losses from exchange rate fluctuations.

Central Banks

Central banks, such as the Federal Reserve or the European Central Bank, play a crucial role in regulating the foreign exchange market and managing exchange rate stability. They intervene in the market to influence currency values, often through monetary policy tools.

Factors Influencing Foreign Exchange Rates

Foreign exchange rates are constantly fluctuating due to a complex interplay of economic, political, and social factors. Understanding these factors is crucial for businesses and individuals engaging in international transactions.

Economic Factors

- Interest rates: Changes in interest rates affect the relative attractiveness of different currencies. Higher interest rates tend to strengthen a currency, as investors seek higher returns.

- Inflation: Inflation erodes the purchasing power of a currency, making it less valuable relative to others.

- Economic growth: Strong economic growth indicates a healthy economy and can lead to a stronger currency.

- Balance of payments: A country’s balance of payments measures the difference between its imports and exports. A trade deficit can weaken a currency, while a trade surplus can strengthen it.

Political Factors

- Political stability: Political instability and uncertainty can lead to currency depreciation.

- Government policies: Government policies, such as monetary and fiscal policies, can affect foreign exchange rates.

- International relations: Diplomatic tensions or conflicts can impact currency values.

Social Factors

- Cultural events: Major cultural events, such as the Olympics or World Cup, can affect demand for a country’s currency.

- Natural disasters: Natural disasters can weaken a currency by damaging infrastructure and disrupting economic activity.

Methods of Foreign Exchange Trading

Foreign exchange trading involves various methods, each catering to different needs and risk appetites. Understanding these methods is crucial for participants in the forex market.

Do not overlook the opportunity to discover more about the subject of foreign exchange market features.

Spot Trading

Spot trading is the most straightforward method, involving the immediate exchange of currencies at the prevailing market rate. Transactions are settled within two business days, making it suitable for short-term trading or immediate settlement of obligations.

Forward Trading

Forward trading involves an agreement to exchange currencies at a predetermined rate on a future date. This method is often used to hedge against exchange rate fluctuations or to lock in a favorable rate for future transactions.

Currency Swaps

Currency swaps are agreements between two parties to exchange principal and interest payments in different currencies over a specified period. These swaps are used for hedging, speculation, or altering the currency composition of a portfolio.

When investigating detailed guidance, check out foreign exchange market moneycontrol now.

Market Structure and Regulation

The foreign exchange market operates through various markets and trading platforms. The two main types of markets are:

- Interbank Market: The largest and most liquid market, where banks and other financial institutions trade currencies directly with each other.

- Retail Market: Smaller and less liquid, where individuals and small businesses trade currencies through brokers or retail platforms.

The foreign exchange market is regulated by various national and international organizations, including:

- Central Banks: Responsible for setting monetary policy and managing the exchange rate of their respective currencies.

- International Monetary Fund (IMF): Monitors global economic and financial stability and provides financial assistance to member countries.

- Bank for International Settlements (BIS): Promotes international cooperation among central banks and serves as a forum for discussing foreign exchange market issues.

These regulations aim to ensure the stability and integrity of the foreign exchange market, protect investors, and prevent market manipulation.

Impact of Foreign Exchange Market on the Economy

The foreign exchange market plays a crucial role in facilitating international trade and investment, thereby influencing economic growth and stability.

The exchange rate between currencies affects the competitiveness of exports and imports, impacting trade flows and economic activity. A favorable exchange rate can boost exports, while an unfavorable rate can make imports cheaper, potentially leading to trade imbalances.

Impact on Investment

The foreign exchange market also influences investment decisions. A stable and predictable exchange rate environment encourages foreign direct investment (FDI) by reducing currency risks. Conversely, volatile exchange rates can deter investment, as investors seek to minimize the potential impact of currency fluctuations on their returns.

Impact on Economic Growth

Exchange rate fluctuations can have a significant impact on economic growth. A depreciating currency can make exports cheaper and boost economic activity, while an appreciating currency can reduce exports and slow growth. Additionally, currency fluctuations can affect inflation, as imported goods become more or less expensive.

Risks and Benefits of Foreign Exchange Market Activity

The foreign exchange market offers both risks and benefits to the economy.

- Risks: Currency volatility, speculative trading, and potential for financial instability.

- Benefits: Facilitation of international trade and investment, economic growth, and diversification of financial portfolios.

Examples of Foreign Exchange Market in Economics

The foreign exchange market plays a pivotal role in influencing economic events, impacting businesses, governments, and individuals alike. Here are a few real-world examples that demonstrate the market’s significance:

Impact on Businesses, Examples of foreign exchange market in economics

- Currency Fluctuations: Companies with international operations are exposed to currency fluctuations, which can affect their profitability and financial performance. For instance, a strengthening dollar can make exports from the US more expensive, potentially reducing demand and revenue.

- Hedging Strategies: Businesses use foreign exchange hedging to mitigate currency risks and stabilize their earnings. By entering into contracts that offset potential losses from exchange rate movements, they can protect their cash flows and maintain financial stability.

Impact on Governments

- Monetary Policy: Central banks use foreign exchange intervention as a tool to influence the value of their currencies. By buying or selling foreign currencies, they can stabilize exchange rates and manage inflation.

- Balance of Payments: The foreign exchange market plays a crucial role in managing a country’s balance of payments, which records the flow of goods, services, and capital between the country and the rest of the world.

Impact on Individuals

- Travel and Tourism: Exchange rate fluctuations can significantly impact the cost of travel and tourism. A stronger currency in the destination country makes it more expensive for tourists to visit, while a weaker currency can make it more affordable.

- Remittances: Migrants often send remittances to their home countries, and exchange rates play a vital role in determining the value of these remittances. A stronger currency in the home country can increase the purchasing power of these funds.

Summary

In conclusion, foreign exchange markets serve as a vital conduit for international trade and investment, while also posing potential risks and opportunities for businesses and economies alike. By examining real-world examples, we gain invaluable insights into the intricate workings of these markets and their far-reaching implications. As the global economy continues to evolve, the foreign exchange market will undoubtedly remain a central force shaping its trajectory.