Efficiency of the foreign exchange market – The foreign exchange market, the heart of global finance, boasts remarkable efficiency that facilitates seamless currency exchange. Dive into the intricacies of this dynamic marketplace, where liquidity, technology, and regulation intertwine to ensure swift and cost-effective transactions.

Market participants, from central banks to retail traders, play diverse roles, contributing to the smooth functioning of the market. Electronic trading platforms and real-time data empower traders with instant access and precise execution.

Market Structure and Participants: Efficiency Of The Foreign Exchange Market

:max_bytes(150000):strip_icc()/vdotdash_INV_final-The-Foreign-Exchange-Interbank-Market_Feb_2021-01-bb2f378cd30b4e52903c2dc382c1121d.jpg)

The foreign exchange (forex) market is a global, decentralized market where currencies are traded. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion.

The forex market is composed of a diverse range of participants, including banks, corporations, investment funds, and individual traders. Each type of participant plays a different role in the market, contributing to its efficiency and liquidity.

Banks, Efficiency of the foreign exchange market

- Banks are the largest participants in the forex market, accounting for over 50% of all trading volume.

- Banks provide liquidity to the market by buying and selling currencies on behalf of their clients.

- Banks also provide a range of other services, such as foreign exchange advisory services and currency hedging.

Corporations

- Corporations are another major participant in the forex market, using it to facilitate international trade and investment.

- Corporations buy and sell currencies to pay for imports and exports, and to invest in foreign markets.

- Corporations also use the forex market to hedge against currency risk.

Investment Funds

- Investment funds are also active participants in the forex market, using it to generate profits for their investors.

- Investment funds trade currencies using a variety of strategies, including carry trade, momentum trading, and arbitrage.

- Investment funds play an important role in providing liquidity to the market and helping to determine exchange rates.

Individual Traders

- Individual traders are a relatively small but growing segment of the forex market.

- Individual traders use the forex market to speculate on currency movements and to generate profits.

- Individual traders can trade currencies using a variety of platforms, including online brokers and retail forex dealers.

Market Structure

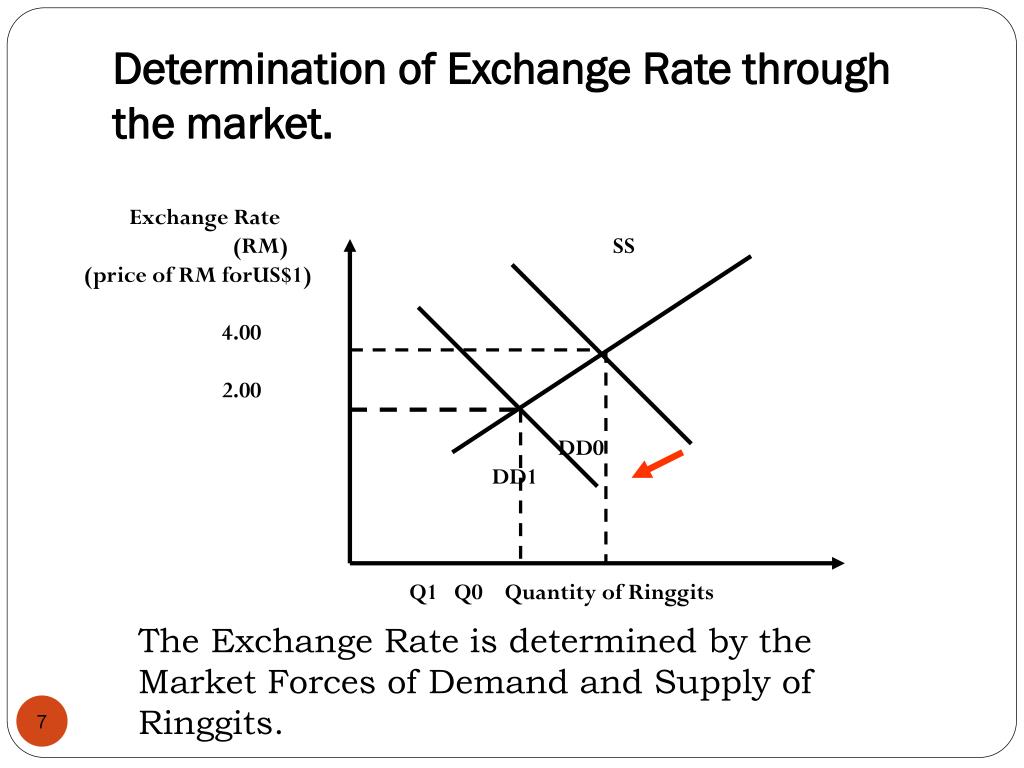

The forex market is a decentralized market, meaning that there is no central exchange where all trades are executed.

Instead, trades are executed over-the-counter (OTC), between two parties who agree on an exchange rate.

This decentralized structure makes the forex market very efficient, as it allows for trades to be executed quickly and easily.

Get the entire information you require about foreign exchange market noun on this page.

Trading Mechanisms and Execution

The foreign exchange market utilizes various trading mechanisms to facilitate the exchange of currencies. These mechanisms play a crucial role in ensuring the efficient execution and matching of orders.

Discover the crucial elements that make foreign exchange market equilibrium the top choice.

One of the primary trading mechanisms is the interbank market, where banks and other financial institutions trade currencies directly with each other. This market is characterized by high liquidity and competitive pricing, as participants seek to balance their currency positions.

Electronic Trading Platforms

Electronic trading platforms have revolutionized the foreign exchange market by providing a centralized venue for traders to execute orders. These platforms offer real-time pricing, access to a wide range of liquidity providers, and advanced order management tools.

- Reuters Dealing 3000 Xtra (FXall): A leading electronic trading platform that connects banks, brokers, and other market participants.

- EBS (Electronic Broking Services): A platform specializing in spot foreign exchange trading, known for its deep liquidity and innovative trading tools.

Over-the-Counter (OTC) Trading

OTC trading occurs directly between two parties, without the involvement of an exchange or central marketplace. This method is often used for large transactions or customized currency contracts.

Order Execution and Matching

When an order is placed in the foreign exchange market, it is matched against existing orders in the order book. The order book is a real-time record of all buy and sell orders, ranked by price and quantity.

The speed and efficiency of trade execution are influenced by several factors, including:

- Liquidity: The availability of buyers and sellers in the market for a particular currency pair.

- Market Depth: The number of orders at different price levels in the order book.

- Order Type: Market orders are executed immediately at the best available price, while limit orders are executed only when the desired price is reached.

Liquidity and Spreads

The foreign exchange market is renowned for its exceptional liquidity, which plays a crucial role in enhancing its efficiency. Liquidity refers to the ease and speed with which currencies can be bought and sold without significantly impacting market prices. This high liquidity stems from the participation of numerous market participants, including banks, investment firms, corporations, and individual traders, who constantly engage in currency transactions.

Liquidity is pivotal for market efficiency as it allows for smoother execution of trades at competitive prices. When liquidity is abundant, market participants can quickly enter and exit positions without encountering substantial price movements. This reduces transaction costs and enhances the overall efficiency of the market.

Bid-Ask Spreads

Bid-ask spreads, the difference between the bid price (the price at which a market maker is willing to buy) and the ask price (the price at which a market maker is willing to sell), are a key determinant of transaction costs. Tighter spreads indicate lower transaction costs and, consequently, greater market efficiency. Conversely, wider spreads result in higher transaction costs and reduced efficiency.

Learn about more about the process of foreign exchange market definition english in the field.

Factors contributing to liquidity and narrow spreads include:

- High Trading Volume: Substantial trading volume attracts more participants, enhancing liquidity and reducing spreads.

- Market Depth: A deep market, characterized by numerous orders at various price levels, provides liquidity and minimizes price volatility.

- Competition: Intense competition among market makers leads to tighter spreads as they strive to attract clients.

- Technology: Electronic trading platforms and algorithms facilitate faster and more efficient order execution, contributing to liquidity.

Technology and Infrastructure

Technology plays a crucial role in enhancing the efficiency of the foreign exchange market. It has revolutionized the way currencies are traded, making the market more accessible, transparent, and cost-effective.

Electronic Trading Platforms

Electronic trading platforms have transformed market access, allowing traders to execute orders from anywhere in the world with just an internet connection. These platforms provide a centralized marketplace where buyers and sellers can interact directly, reducing the need for intermediaries and lowering transaction costs.

Real-Time Data and Analytics

Real-time data and analytics have significantly improved market efficiency. Traders now have access to a wealth of information, including live quotes, market depth, and historical data. This data enables them to make informed decisions and react quickly to changing market conditions.

Regulation and Oversight

The foreign exchange market, being the largest and most liquid financial market globally, necessitates a robust regulatory framework to ensure its integrity and protect participants. This framework varies across jurisdictions, but it typically includes measures to:

– Prevent market manipulation and insider trading

– Ensure transparency and fair competition

– Protect consumer interests

– Mitigate systemic risk

Regulatory Framework

The regulatory framework governing the foreign exchange market typically comprises a combination of laws, regulations, and guidelines issued by central banks, financial regulators, and international organizations. These include:

– The Bank for International Settlements (BIS)

– The International Monetary Fund (IMF)

– The Financial Stability Board (FSB)

– National central banks and financial regulators

Impact on Market Efficiency

Regulation can have both positive and negative impacts on market efficiency. On the one hand, it can reduce uncertainty and promote confidence, leading to increased participation and liquidity. On the other hand, it can also introduce additional costs and complexities, which may hinder innovation and reduce market flexibility.

Impact on Market Innovation

Regulation can also impact market innovation. While it is essential to ensure market integrity and protect participants, overly restrictive regulations can stifle innovation and limit the development of new products and services. Regulators must strike a balance between protecting the market and fostering innovation.

Market Efficiency Metrics

The foreign exchange market’s efficiency is gauged using several important metrics that evaluate its ability to allocate resources, execute transactions smoothly, and respond to new information.

These metrics include:

Spread

- The difference between the bid and ask prices of a currency pair is known as the spread. A tight spread indicates high liquidity and low transaction costs, while a wide spread suggests the opposite.

Volume

- The total value or number of currency units traded in a given period measures market volume. High volume indicates a liquid market with many participants, while low volume can indicate a less active market.

Volatility

- Volatility measures the rate at which currency prices change over time. High volatility can indicate a market with high risk and uncertainty, while low volatility suggests a more stable market.

Execution Speed

- The time it takes for a trade to be executed from order placement to completion is known as execution speed. Fast execution speeds are crucial for traders who need to enter or exit positions quickly.

These metrics are calculated using real-time data and historical analysis. They are used by traders, investors, and policymakers to assess market conditions, make informed decisions, and measure the overall health and efficiency of the foreign exchange market.

Factors that influence market efficiency over time include economic conditions, geopolitical events, technological advancements, and regulatory changes. A well-functioning foreign exchange market is essential for facilitating international trade, investment, and economic growth.

Comparative Analysis with Other Markets

The foreign exchange market is widely regarded as one of the most efficient financial markets globally, surpassing many other financial markets in terms of liquidity, low transaction costs, and operational efficiency. Several factors contribute to this high level of efficiency.

Liquidity

The foreign exchange market boasts unparalleled liquidity, with an average daily trading volume exceeding $5 trillion. This immense liquidity ensures that market participants can execute trades quickly and efficiently at competitive prices. In contrast, other financial markets, such as the stock market, may experience periods of lower liquidity, leading to price volatility and execution delays.

Transparency

The foreign exchange market is characterized by a high level of transparency, with real-time market data widely accessible to participants. This transparency fosters price discovery and reduces information asymmetry, allowing market participants to make informed trading decisions. In contrast, other financial markets may suffer from limited transparency, hindering efficient price formation.

Technology

The foreign exchange market has embraced advanced technology, including electronic trading platforms and algorithmic trading systems. These technological advancements have significantly improved market efficiency by automating order execution, reducing processing times, and enhancing risk management capabilities. In contrast, other financial markets may rely on more manual or less sophisticated trading processes, leading to inefficiencies and delays.

Implications for Market Participants

The high efficiency of the foreign exchange market has several implications for market participants:

– Reduced transaction costs: The low transaction costs associated with the foreign exchange market allow participants to trade currencies more frequently and in smaller sizes, enabling them to capitalize on market opportunities without incurring significant expenses.

– Improved execution: The liquidity and efficiency of the foreign exchange market ensure that orders are executed quickly and efficiently, reducing the risk of slippage and execution delays.

– Enhanced risk management: The transparency and technological advancements in the foreign exchange market provide participants with the tools and information necessary to manage their risk effectively.

In summary, the foreign exchange market’s efficiency stems from its high liquidity, transparency, and technology adoption. This efficiency translates into reduced transaction costs, improved execution, and enhanced risk management capabilities for market participants.

Future Trends and Developments

The foreign exchange market is constantly evolving, and several emerging trends are likely to impact its efficiency in the coming years. These trends include the increasing use of technology, the rise of new market participants, and the growing importance of regulation.

Technology

Technology is playing an increasingly important role in the foreign exchange market. The use of electronic trading platforms has made it easier for market participants to trade currencies, and the development of new technologies, such as artificial intelligence and machine learning, is likely to further increase the efficiency of the market.

New Market Participants

The foreign exchange market is also seeing the rise of new market participants, such as hedge funds and retail investors. These new participants are bringing new sources of liquidity to the market, which is likely to make it more efficient.

Regulation

Regulation is also playing an increasingly important role in the foreign exchange market. The introduction of new regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act, has made the market more transparent and has helped to reduce systemic risk.

The Potential Future of the Foreign Exchange Market

The foreign exchange market is likely to continue to evolve in the coming years. The increasing use of technology, the rise of new market participants, and the growing importance of regulation are all likely to make the market more efficient and more transparent.

Summary

The efficiency of the foreign exchange market is a testament to the continuous evolution of financial infrastructure. As technology advances and regulatory frameworks adapt, the market remains poised to meet the ever-changing demands of global commerce.